Ataraxia Financial Newsletter - January 2022, 1st Issue

2021 What a Year! Big-Picture Review of 2021

“Excellence is never an accident. It is always the result of high intention, sincere effort, and intelligent execution; it represents the wise choice of many alternatives – choice, not chance, determines your destiny.”

—Aristotle

Athens, January 16th.

Welcome everyone to the first issue of my newsletter.

I had the idea of starting this newsletter for quite some time, so as one of my new year resolutions, I finally sat down and did it.

The main purpose of this newsletter is connecting the dots and making some sense of these crazy financial markets and their implications. I want to provide some knowledge to everyone who is interested in reading. And I also want to improve my own grasp on issues, by practicing to capsualize and formulate my thoughts and ideas.

Readers might wonder about the meaning of Ataraxia… just bear with me, I’ll elaborate on why I chose this name another time.

Many news reporters and newsletter writers try hard to pretend that they are taking neutral positions on whatever topic they are covering. In reality though, they are rarely neutral to it and instead tend to deliver their opinions in a sneaky way between the lines. As for me, whatever I write will be my opinion. Clear and obvious. Without any pretense of neutrality. You can agree or disagree with my opinions and I am always open and curious about other viewpoints. So feel free to comment.

For the first issue, I decided to do some broad review about the main events that have occurred and developed over the last year, as well as linking it all to how it can be viewed from an investment perspective.

In future issues, I am attempting to go deeper into more specific finance issues, that are of particular interest for the month.

Big-Picture Review of 2021

Let’s take a look at some of the main events that have taken place in 2021 and how they might shape the upcoming year(s).

Here is a quick overview of the contents that I am going to cover:

Inflation

Covid

Energy

Bitcoin

El Salvador

Stablecoins, DeFi and NFTs

Year of Records

China

Supply Chain Issues

Stock Markets

The sequence is somewhat of importance, since I sometimes refer to something that I previously wrote, but it is quite a long review, so if there are some topics in which you are not interested, feel free to skip them.

1. Inflation

The raise of inflation might have been for many the most surprising and worrying development in the past months. For many years, the narrative by central bankers and mainstream economists has been, that inflation is nothing to worry about and that it is in fact too low. And that the potential of deflation is actually way more dangerous.

The main reason for this kind of believe is, that a constant monetary growth is necessary so that people keep spending and not just ‘hoard’ money while waiting for prices to decline. A second argument is, that a deflationary economy would require wages to also decline over time, but since wages are described as ‘sticky’, this might be difficult to actually implement and therefore cause problems. This view is shared by both the Keynesian, as well as the monetarist economic philosophies, which make up the bulk of mainstream economists today. Furthermore, for some never really fundamentally explained reason, 2% — not 1.5% or 1.9%, nor 2.1% — no, exactly 2% has become the holy grail for an inflation target globally. To me this is total nonsense.

Since this a bit beside the topic, I don’t want to get too deep into this general economic discussion here, but I think it is important to grasp and understand, so I’ll elaborate my viewpoint a bit.

In general my opinion is that, contrary to modern economic theory, falling prices is a great ideal!

First, given a money with a hard supply means that the participants can reap the rewards of a growing economy.

Moreover, in today's world we also see sectors in which the growth outpaces the inflation, leading to falling prices. But it does not seem to hinder these sectors to flourish, so that the most valuable 5 companies are all technology companies, which are mainly selling “deflationary” products.

Lastly, historical evidence clearly indicates that deflationary periods in history did not result in stagnation or dwindling economies, but in contrast led to rampant development and flourishment: For instance, during the late 18th century and all throughout the 19th century - except for the war times (in which the government tremendously increased the money supply) - America actually experienced a deflationary period in which prices were constantly falling. Therefore, to me it is no coincidence at all, that this is exactly the time-frame in which America happened to become the most prosperous nation.

Just think about the encouraging experience of waking up in the morning and going through the day knowing that the purchasing power of the money you earn and save will allow you a greater living standard in the future? I think this has a tremendous implication for general life-satisfaction, well-being and motivation for living. On the other side, today’s inflation makes people worried where they should put their savings in order to preserve their wealth. And what it really comes down to is a hidden tax!

This brings us back to 2021. Essentially, governments have two ways to spend money: Either they tax their population, or they go into debt. Taxing is the honest way, because the population immediately feels the cost of what the government does, while increasing debt is more fraudulent, because it means that the burden is pushed towards future generations who eventually are expected to pay back the debt. And in addition to paying the debt burden, there are also interest rates that need to be paid on top of it.

Furthermore, in a free market prices are determined by supply and demand. However, the price of money (expressed in interest rates), which is arguably the most important price in the economy, is not determined by the market, but by central banks. We have increasingly witnessed, that the desired interest rates are not supplied by the market. Instead, it requires central banks to rush in and buy increasing amounts of government debts in order to keep the rates at a low level.

Here is a chart that shows the expansion of central banks balance sheets over the last years. It has absolutely skyrocketed, especially due to the “help-packages” that were rolled out in response to the market interventions throughout the Covid epidemic.

Chart Source: Yardeni.com

Watching financial news, people can easily get the impression that inflation is something mystical. That it is hard to pinpoint where it actually comes from. While the economy is a complex system and there are many factors, which have an influence on it, there are some very clear basics that can be examined in order to determine whether the environment is ripe for inflation.

As can be seen in the chart, in particular the FED and the EZB did ramp-up their purchases since Covid started. If central banks purchase assets, it mainly means that they are monetizing government debts. This directly translates into an increase in the broad money supply. Hence, it is also no wonder that these are the countries where we are now witnessing increasing inflation numbers, with the U.S. CPI inflation at 6.8% and the Eurozone at 4.9%.

Central bank money printing alone does not necessarily lead to higher inflation, but it is a key ingredient. Combined with other inflationary factors, it works like fuel for a fire. Some other reasons why we are seeing these increasing inflation numbers are:

The money is not only used to provide liquidity for banks (like the bailouts during the 2008 financial crisis), but a lot of it is going out in the form of stimulus checks directly to consumers. It therefore leads to a direct increase in gross demand.

The low interest rates lead to the easy access of cheap money, fostering bank lending, whereby they provide debt-financed purchasing power.

The Covid measurements have decreased overall production and massively distorted the supply chains leading to bottleneck issues and reduced supply.

There seems to be a general trend and push for de-globalization, which is also inflationary.

For me, it has actually been rather surprising how long it has taken for inflation to finally also show in the Consumer Price Inflation Indexes (CPI).

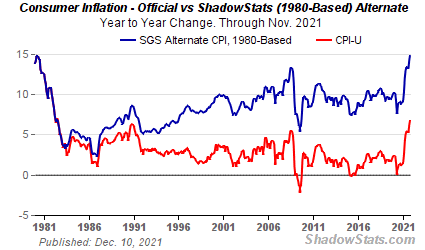

Whether the CPI is actually giving a somewhat reliable inflation number is another highly debated topic. What can be said is that the way of calculating has gone through various changes over the years. Prior to 1980, it used to be a fixed basket of goods which price was measured over time. Nowadays the calculation is much more complex. For instance, so called hedonic adjustments try to adjust for technological improvements of products. In addition, if a product increases a lot in price, it is presumed that consumers will shift to buy a cheaper substitute product. Thus, many argue that these changes have made it possible for government institutions to understate the real level of inflation. ShadowStats tracks the CPI in the old fashioned methodology and comes up with U.S. inflation numbers approaching 15%.

Chart Source: ShadowStats.com

Moreover, the CPI does’t include real rents or investment items. These are for most people important parts of their budget and have gone up way more than the CPI over recent years.

If inflation keeps rising then one thing to watch out for are price controls. When prices are starting to rise, people have the misinformed suspicion that it is because of price gouging by greedy sellers who take advantage of the distressed situation. Even though history provides sufficient evidence that price controls have the adverse effects of making the situation even more dreadful, politicians nonetheless often feel tempted to impose controls to gain popularity from their constituency.

A currently unfolding case study is Turkey, where the inflation level has crossed 30% in December. There are news that governors across the country are expected to impose price controls. And there are already videos on YouTube in which police officers go into supermarkets telling the operators to lower the prices.

I would not be surprised to also see arguments for price controls in developed countries if the inflation trend continues in the coming year.

Finally, inflation is a very individually dependent phenomena. Every person has a very different basket and therefore it is hard to pinpoint a general number. The real inflation that each person experiences will always be very unique to the location, the circumstances in life and the spending habits.

What to make out of it?

The key problem is that governments and central banks around the world have put themselves in a corner where it is almost impossible to get out. In my opinion from just observing and playing around with the numbers, they have passed the trigger-point of no return out of the debt spiral. Here is some basic math:

The total global debt (including government, household, corporate and bank debt) is now at about 300 trillion USD.

This debt is supported by a global GDP which is slightly less than 100 trillion USD. This is the underlying economy that can potentially be taxed or employed to service the overall debt.

Since debt is more than three times as much as GDP, this means that in order for every 1% growth in debt, the GDP would need to grow at least 3% just to keep up with it.

Considering the rate at which debt is rising at the moment this would require an enormous spike in GDP. Unless there is some major technological breakthrough, leading to a massive global productivity improvement, I think it is impossible.

Additionally, in order to fight inflation governments and central banks would need to let interest rates rise. However, this would make the burden of debt rising even faster since the increased interest rates would require to add additional debt even faster. Additionally, a rise in interest rates would trigger great economic distress, crashing stock-markets and housing prices and probably lead to a severe recession, hence a decrease in GDP.

I am pretty sure that central banks are pretty aware of the position they are in… they just can’t admit it. Admitting it would lead to a financial crisis right away.

The way out

The way for governments to get out of this debt spiral is actually inflation itself.

In other words, “Inflate or die!”

And therefore I think that while central banks will deny it, and will keep paying lip service that they are going to fight inflation and keep it at a “manageable level”, the real goal is to debase the money over the next decade, or even longer, through a persistently high inflation. High inflation is good for everyone who has debt, because it means that the value of the outstanding debt is being decreased. It is bad for all those who save money, their savings are constantly being devalued.

If this is the case, then what can investors do to preserve their wealth? I think the first important implication is not to hold bonds or large amounts of cash. If you invest in 10-year bonds with a coupon of 1.5% while inflation is at 5% or more, you are guaranteed to loose money. Basically, those who hold these assets will be the ones finally paying for fiscally irresponsible governments. The only reason for holding some cash or bonds is to use them as liquid ‘dry powder’ for investment opportunities, to take advantage of sudden market developments and fluctuations.

Assets that might work well against a long inflationary period are scarce assets, which cannot easily be increased. Such assets would include:

Bitcoin

Gold

Other industrial commodities such as silver, copper, nickel etc.

Real estate

To some extend stocks, particularly the ones involved in the production or transportation of scarce resources (e.g gold miners, pipeline operators, oil producers, uranium producers etc.)

More on some of those assets later.

2. Covid

Unfortunately 2021 has been another year in which leaders didn’t stop to fuel the whole Covid-charade, but are instead going on to engage in more and more nonsensical theater around it. I don’t want to get too deep into it here since the whole thing has unfortunately become more a political issue than a honest health issue. Even people like me, who think that given the current knowledge, most people should probably vaccinate, but mention some concerns and don’t fully subscribe to the given official narrative of the particular authorities of the country in question, arguments like:

it might not be the best choice for everyone

certainly nobody should be forced to take a shot into their own body

the government measurements might do more harm than good

…are quickly labeled as “Anti-vaxxers”, or “Covid-deniers”. Both of which I am clearly not.

In general, the main problem is that it has become such a public issue. Instead of focusing on the people who are actually in danger, everyone is put in the same box and whole societies are held captive under restrictions that seem to have little effects on the actual death-rates. Everyone allowed to speak on public media channels is concerned with infection numbers, masks, social distancing, lockdowns and vaccination rates, but nobody seems to actually care about real health.

Real health should be the cornerstone for any consideration — not only against Covid.

El Salvador’s president Bukele tweeted a campaign add, which gives by far the best Covid suggestions I have heard from any official government source about the issue:

But El Salvador is my country of the year for another reason. More on that and Bukele’s tweets later.

When it comes to the financial implications of the whole epidemic, it is obvious that it has not only led to governments engaging into financial stimulus spending as mentioned above, but also triggered many people to think more clearly about what is going on. For instance I believe that the rise of Bitcoin over the last two years is also to a huge extend due to people actually questioning the financial system and doing their own diligent research. It made them realize what potential such an incorruptible asset might hold, and how it will most likely be a safer asset to hold in a world where printing presses around the globe are just keep printing fiat money into oblivion.

Another aspect in which Covid keeps influencing the market is that companies find themselves in passive positions where they are dependent on whatever policies governments decide to apply and which businesses they decide to support. Thereby they are directly interfering in businesses environments with specific Covid regulations & restrictions or right out shut downs. On the other hand, some businesses have gotten huge advantages throughout these market interventions. For instance pharmacy companies like Pfizer or Moderna had huge payoffs, as well as the companies supporting home-office workers, or just making the live at home more convenient.

Lastly, back to the political aspects of Covid. We have seen that it is another ingredient to separate people and pushing them into camps, who are becoming more and more radical on both ends. It even goes so far that there are families which are being separated and friends who have become enemies over this issue. It is quite disturbing and it might lead to increased risk of civil unrest in the coming years. It is quite a dangerous development.

As for 2022, unfortunately currently there is no sign of any change of perception when it comes to the political environment around Covid. Will more lockdowns and more vaccination do more good than bad? Will people be incentivized to live more healthy (which is by far the best protection)? Unfortunately I doubt it. There is always some hope though.

3. Energy

Another topic that has been a big topic during the year is climate change. Apart from the discussion on the topic and its different viewpoints about it, there is a general consensus that we should try to be more conscientious and act more responsible in order to reduce our human footprint on the planet.

In the corporate world this has been manifested in the ESG awareness that investors increasingly take into consideration. ESG stands for Environmental, Social, and Governance. The idea is that when investing in stocks, investors should evaluate how these companies are striving to improve on those aspects and the year has shown that there is a huge trend for this and that companies increasingly comply in putting out goals that they are aiming to achieve by a certain year.

Interestingly, the discussion seems to mainly focus on the “E” part, everyone is mainly talking about the energy aspects, while the “S” and the “G” appear to be mostly neglected. Another issue is that to me it seems that a huge part of it is driven by value-signaling and greenwashing, rather than actually seriously comprehending the issue and improving things in a way that makes sense.

Part of it is probably due to the political meddling in the market. Politicians are setting goals that are foremost for gaining popularity among voters, but are not logically thought through and often not even possible to achieve. However, regulations and guidelines are put into place, forcing companies to adapt and adjust their goals accordingly. For instance, in the Sustainable Finance Disclosure Regulation which came into force in march, requires companies listed on the stock markets to report their sustainability characteristics. And currently there is a debate in the EU whether natural gas and nuclear energy should be labeled as “green”. There are some countries producing it (e.g. France) in support, while other countries (e.g. Germany) are against it. The whole debate is a complete political circus and has little to do with serious thinking about the real implications. However, the decision will have effects on the companies and investors that are involved. Such central planning approaches usually result in negative unintended consequences later on.

Germany’s energy fiasco

When it comes to energy policies, my home country Germany is actually a perfect — although embarrassing — example to illustrate how “feeling good” and “virtue signalling” policies, imposed by the government, lead to disastrous outcomes.

Germans for some reason have a huge dislike for nuclear energy. Part of it is due to the confusion of distinguishing the concepts of atomic weapons and using nuclear power as a source of energy. But mainly I think it is driven by the largely exaggerated coverage of the nuclear disasters in the media.

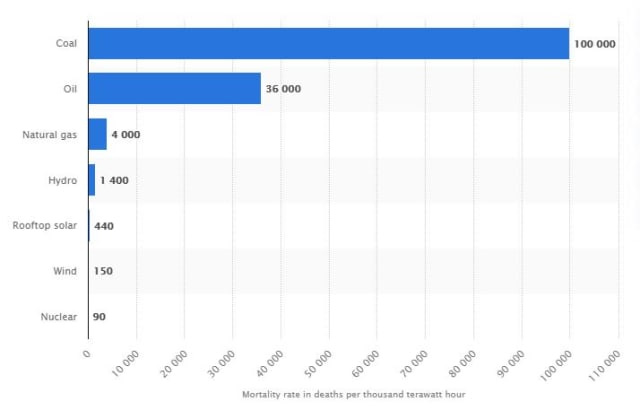

While a nuclear disaster is a terrible thing to happen, it is a bit like comparing the danger of a plane crash to car accidents. Flying in an airplane is by a huge magnitude more safe than driving a car. Nonetheless, if there is a aircraft accident there is a huge media coverage and most people have more fear of boarding a plane than driving their car. Likewise, the production of nuclear energy is far more safe than all the health issues that are caused by the production of coal. As a side-note: There have been three main nuclear power accidents: The Three Mile Island accident (1979), the Chernobyl disaster (1986), and Fukushima (2011). The total amount of deaths attributed directly to these disasters is 32 people. Which makes it in comparison the safest way of producing energy.

Chart Source: Statistica

Sana Kazilbash, editor at engineering.com summarizes it as follows:

Since 1951, 667 nuclear power plants have been built across the world. Today, 440 nuclear power plants are operating across 32 countries, and account for more than 10 percent of total electricity produced. To put these numbers into perspective, in 70 years and with a total of 667 nuclear power plants that have ever operated, only three major accidents have taken place. Using the official internationally-recognized death statistics for Three Mile Island, Chernobyl and Fukushima, the combined loss of lives from the three major nuclear accidents is 32 people. In fact, estimates on the number of deaths caused by the nuclear energy sector overall is 90 per 1000TWh —the least of any energy sector!

In addition it should be mentioned that all of the 3 power plants causing the accidents were build during the 50s and 60s. Since then the technology and security of plants have gone through a series of updates in technology and security measures.

The really beautiful part about nuclear energy is that it is not only safe, but clean, reliable and in comparison to renewable energies also much more affordable.

Nonetheless, back to Germany’s lunatic top-down energy approach. After Fukushima, Germany decided to get out of nuclear energy all together. So they started a decommission program of the (at the time) 17 nuclear plants. At the same time they provided huge stimulus spending to ramp-up the solar and wind energy facilities to make up for the lost energy. And yes, driving through Germany these wind turbines are visible everywhere blemishing the landscapes. And many households have put solar panels on their rooftops. Many of them, if not most of them, would not be economically viable by themselves, if it were not subsidized by taxpayers money.

I wanna quickly mention that I am generally not against renewable energy. I am mainly against coal production. I think it is good if we can add more renewable energy to our grids. The crucial aspect is that this should occur naturally through technological progress and developments and not as a forced top-down approach that picks “winners” and “losers”. This approach is distorting the market and leads to a constant misallocation of capital.

What actually happened in Germany is that even though the additional added amount of renewable energy has been enormous, it is still by far not sufficient to support Germany’s economy sufficiently. Furthermore, one key problem with these renewable energy sources is that they require wind and sun in order to produce energy, and are therefore not always reliable to produce the adequate amount of energy that is needed at any given moment. This not only has the potential danger of shortcomings during spike times, but there is also quite a gap of the renewable energy that is produced and the actual amount that is finally consumed. A lot of it gets wasted.

The end results for Germany are:

That it has become the most expensive energy market on the planet.

As consequence to closing nuclear plants, Germany still needs to produce a lot of coal, which is the most polluting and health concerning form of energy. Moreover, due to available reservoirs, a lot of the produced coal form in Germany is lignite, which creates a particularly high level of air pollution.

Germany still uses a lot of nuclear energy, its just imported now, mainly from France and the Czech Republic.

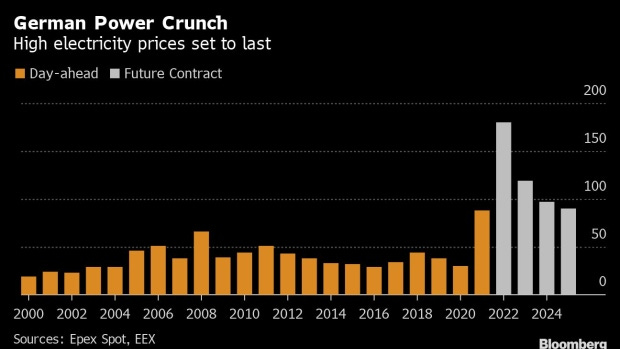

The last nuclear power plants are scheduled to be closed down by the end of this year. And according to futures markets, German electricity prices are about to get even more expensive in the coming years.

Chart Source: Bloomberg

Unfortunately, instead of having to eventually pay for economic mistakes (like it is supposed to happen in a market economy), governments are not restrained by these checks and often even double down on foolish policies.

Here is Germany’s new chancellor Olaf Scholz in his new year’s address:

In nicht einmal 25 Jahren soll Deutschland klimaneutral sein. Dafür werden wir den größten Umbau unserer Wirtschaft seit mehr als 100 Jahren voranbringen. Wir werden uns in diesem Zeitraum unabhängig machen von Kohle, Öl und Gas, und gleichzeitig doppelt so viel Strom aus Wind, Sonne und anderen erneuerbaren Energien erzeugen.

English:

Germany should be climate neutral in less than 25 years. To do this, we will advance the biggest restructuring of our economy in more than 100 years. During this period we will make ourselves independent of coal, oil and gas, and at the same time generate twice as much electricity from wind, sun and other renewable energies.

Back from Germany’s fantasyland into the energy reality

To understand the global dilemma that we are facing in the energy industry, it is crucial to understand just how important oil, gas and coal are for the well-being and flourishing of mankind.

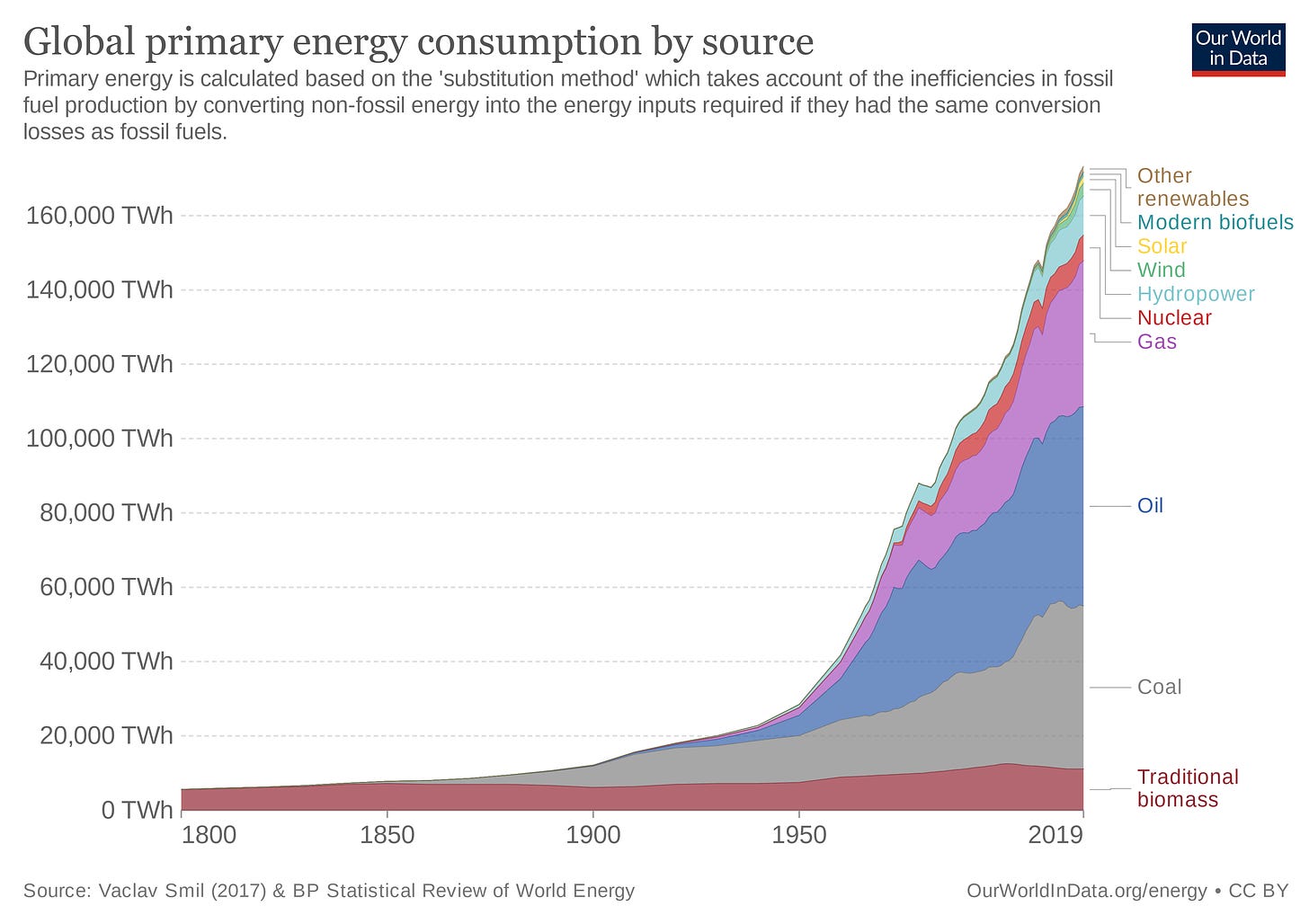

Chart Source: Our World in Data

Energy is what drives human flourishing. Whenever we had an increases in living standards, this was accompanied by bursts in energy consumption. The chart above shows the tremendous importance that gas, oil and coal play in today’s economy. Further, the trend indicates that the energy consumption is gonna continue to increase in the future. This should be no surprise considering that the amount of energy used by developed countries outweighs the per capita consumption of emerging markets by magnitudes. If we assume that people in China and India want to obtain a similar living standard as developed countries, then we have to acknowledge that this will require a massive increase in energy production. Even if it becomes more feasible to increasingly rely on renewable energy sources, this will by no means be sufficient in the foreseeable future. Even German “feeling righteous” politicians won’t be able to change that.

However, given that the current narrative is to go away from traditional energy sources and many policies have been enacted to foster this trend, it has become a publicly held believe that the future energy mix will be largely renewable.

I am sure that most people a) put too much trust into public institutions, b) don’t actually take the time to do any serious research about the topic, and c) lack the impulse to critically think through any complex topic.

A contrarian investment strategy is to take advantage of such public misconceptions. Fueled by the ESG trend, wrongheaded policies and the overall public “feeling righteous” spirit, most of the energy sector is out of favor and there has been little capital expenditure in recent years. Hence, increasing demand is gonna face insufficient supply. And in the end, the price is not determined by any “feeling righteous” spirit, but by supply and demand.

Thus, I think investments in oil and gas production and exploration, as well as companies involved in transportation or other aspects of the energy supply chain, might do quite well over the coming years. Especially in the inflationary environment that I expect.

4. Bitcoin

Bitcoin had a very interesting 2021. It had a great start in the year. It was driven by a bunch of favorable news, such as notable corporations like Tesla and Square announcing their purchase of Bitcoin, Microstrategy selling convertible notes to acquire additional BTC and the IPO of Coinbase (the largest Bitcoin exchange). During the first quarter, prices were constantly reaching new all-time highs. It peaked at around 64,000 in April, before going through a contraction of over 50% over the following months. It is always hard to exactly single out reasons for such movements, but the drawback was surely influenced by the complete banning of mining in China, in combination with negative tweets by Elon Musk (just a few months after putting Bitcoin on Tesla’s balance sheet), and the whole recurrence of energy fuss that went along with it. In the fall the price recovered and fueled by positive announcements like the ETF approval, it went for a new all-time high of almost $69,000 in November. The last few weeks marked another pullback and it finished the year at about $46,000.

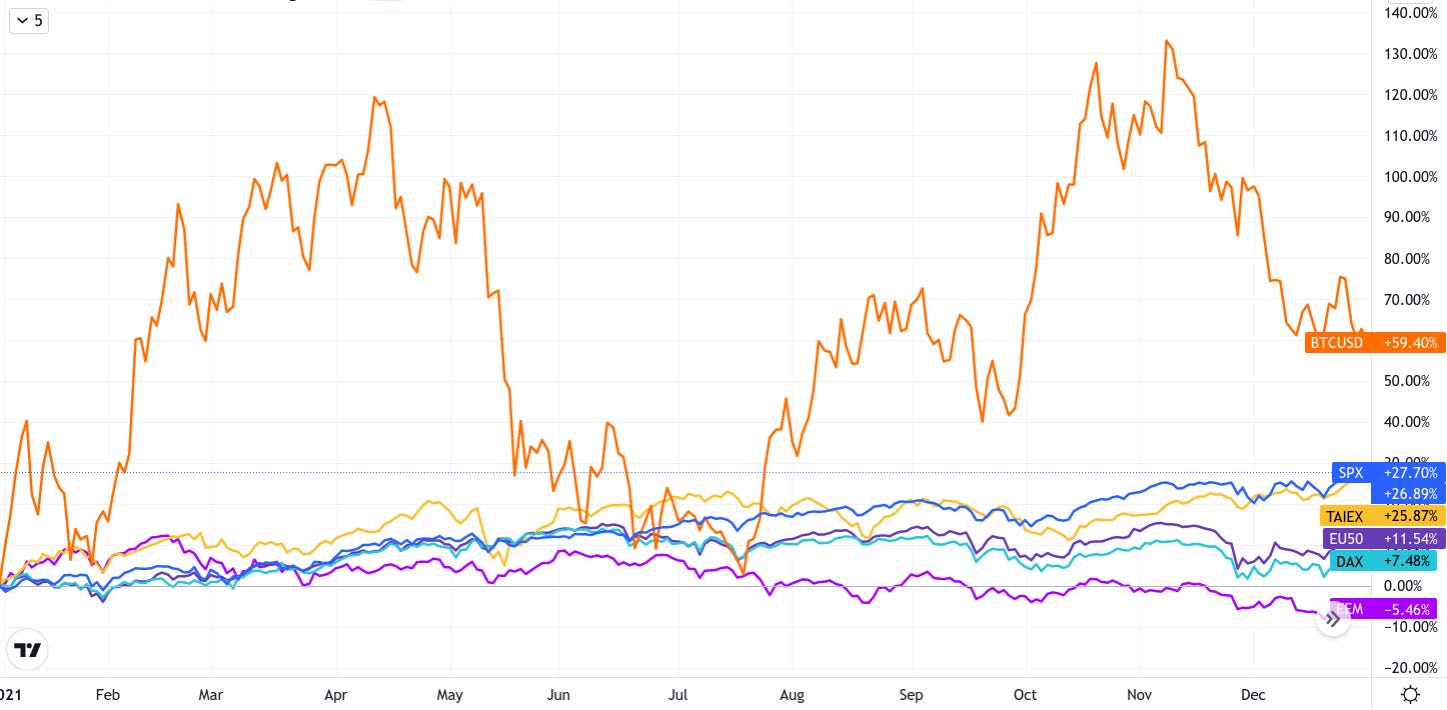

Overall, Bitcoin had a price increase of 59% in 2021, thereby once more beating the S&P 500, which had a return of 27%. Actually, for 8 out of the last 10 years, Bitcoin has been the best performing asset class.

Here is Bitcoin’s price performance throughout the year:

Chart Source: Blockchain.com

It is exciting to watch, how it is slowly but surely weaving its way not only in the mainstream media and financial coverage, but also into the consciousness of the general population. More and more people seem to grasp the merits of such a decentralized asset and that it is not just a bubble that will just pop and go away. Contrary, its historic action seems more like a hydra than a financial bubble. Like a hydra that grows two heads for every head that is chopped off, the Bitcoin ecosystem improves and becomes more antifragile after every drawback.

One outstanding event in this regard, was the complete banning of mining in China. Over the years there have been several attempts by the Chinese government to restrict and outlaw different aspects around the Bitcoin industry. This year they finally did a serious step by outlawing all bitcoin mining. It was sudden and quick, without any warnings in advance. Bitcoin mining is the process of providing computing power (measured in hash-rate) to find new blocks and add them to the blockchain. It is also the process that secures the network from attackers. At the time around 2/3 of the hash-rate came from China. To some people this was also a concern, worrying that China could simply overtake these miners and make a state-attack on the network. For various reasons such an attack would be almost impossible to implement in reality. However, this has been one of the long-term critic points.

When the ban happened, the hash-rate was cut in half over a few weeks, as can be seen in the chart below:

Chart Source: Blockchain.com

Imagine if half of the Amazon, or Google servers would go down in a short period of time. This would certainly cause some severe disruptions and downtime. But the Bitcoin network just shrug it off and went along as if nothing had happened. Sure, the average block time was for some time a bit above the usual 10 minutes, but due to the difficulty adjustments that are programmed into the protocol, the network adjusted adequately. Someone who didn’t know about it, wouldn’t have noticed anything.

In the following weeks there was a huge shift in the mining distribution. Chinese miners shut down their operations and shipped the Bitcoin miners to other destinations, to plug them in again. At the end of the year, the hash-rate was almost back to its all-time high level and well above the level it had started the year.

It is another showcase how reliably resistent the Bitcoin network is. And China has lost a huge advantage. A bit more on that topic later.

Another milestone has been that finally a Bitcoin ETF was officially approved by the SEC. While Canada and Europe already had Bitcoin ETFs approved, the SEC had previously rejected all of the applications.

It immediately set a new record by accumulating over 1 billion USD faster than any ETF ever did before. And just a few days later, a second ETF was approved as well.

The two approved ETFs are based on futures contracts, meaning that the ETF actually doesn’t hold any actual Bitcoins, but instead engages in buying Bitcoin futures contracts. The head of the SEC, Gary Gensler had previously stated that a futures ETF would be more likely to be approved, since they have lower volatility risks for investors than a spot-price ETF. Many observers, including me, think that from an investor’s perspective the spot-price ETF, that directly holds the underlying asset, would provide more security.

The main reason is that the futures ETF needs to roll over the existing ETFs before they expire. Since the Bitcoin futures exist, they have constantly be trading above the spot price. This phenomenon is known as contango. The contango phenomenon can be explained by the risks coming along with self-custody, or just by the general expectation that the asset will rise in the future. In any case, it means that the futures ETF constantly is required to sell the futures contracts at a price lower than the future contracts that it needs to buy. Therefore, investors incur an additional fee in holding the ETF. These fees would disappear if the ETF would simply buy and sell Bitcoin.

I have no idea about how exactly the SEC makes these decisions, to me the reasonings for rejecting and approving them so far seem quite arbitrary. However, the general consensus seems to be that they will also approve a spot-price ETF sometime in 2022.

In any event, the best way to invest in Bitcoin is to just learn how to securely store it in self-custody and then buy them. It is the most secure and cheapest way to invest in this asset.

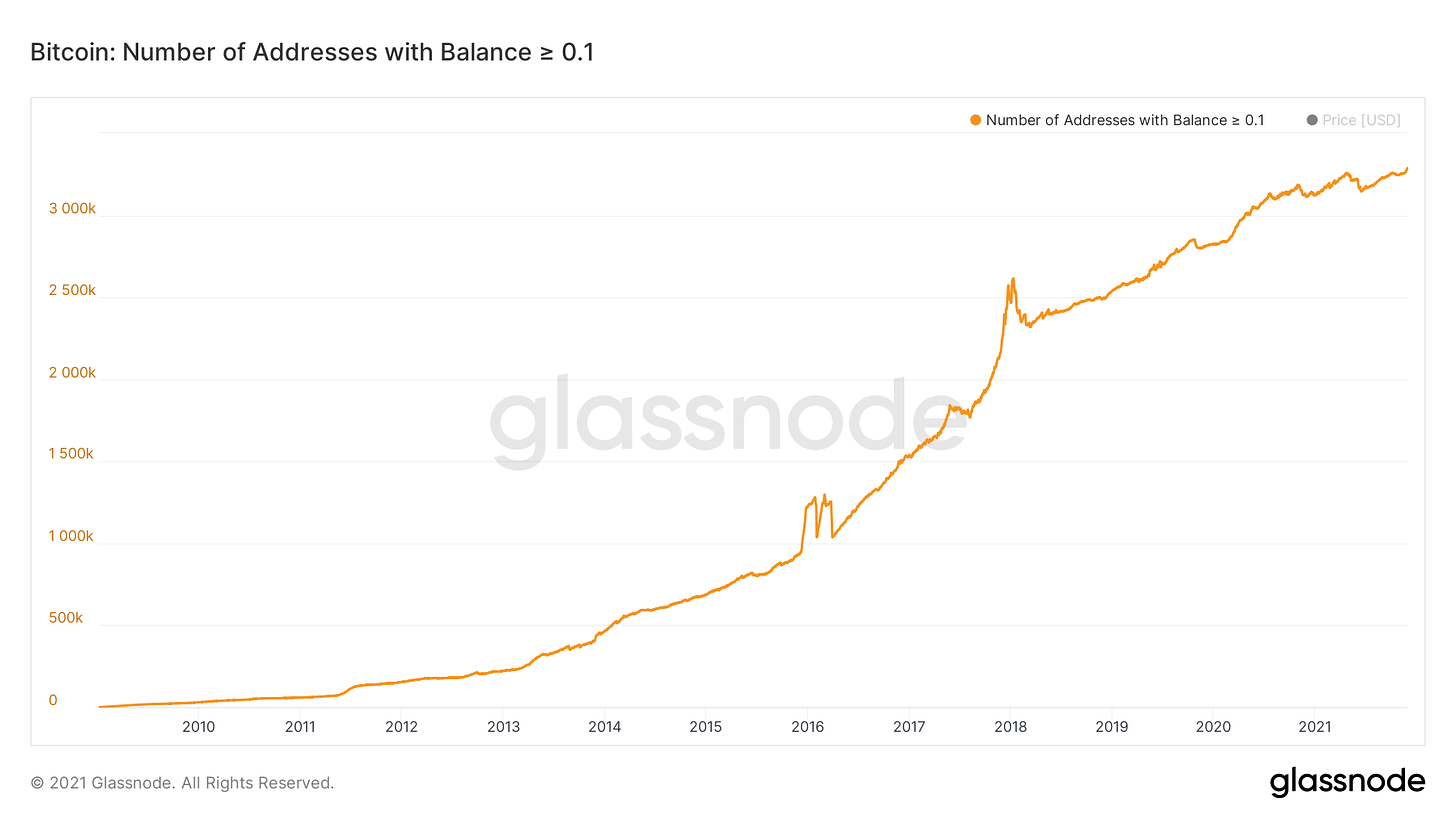

The spread of Bitcoin adaption has also continued to look favorable over the year, while the addresses holding high amounts of Bitcoin have been flat, or even slightly go down, we continuously see the number of addresses with small holdings increase. Since one person can have multiple Bitcoin addresses, it cannot be precisely tracked how many people hold Bitcoin, but a growth in addresses with low quantities is still a good indication that there is a continuous trend of Bitcoin adaption.

The below chart shows the increase of addresses holding more than 0.1 BTC (about 4,500 USD):

Chart Source: Glassnode.com

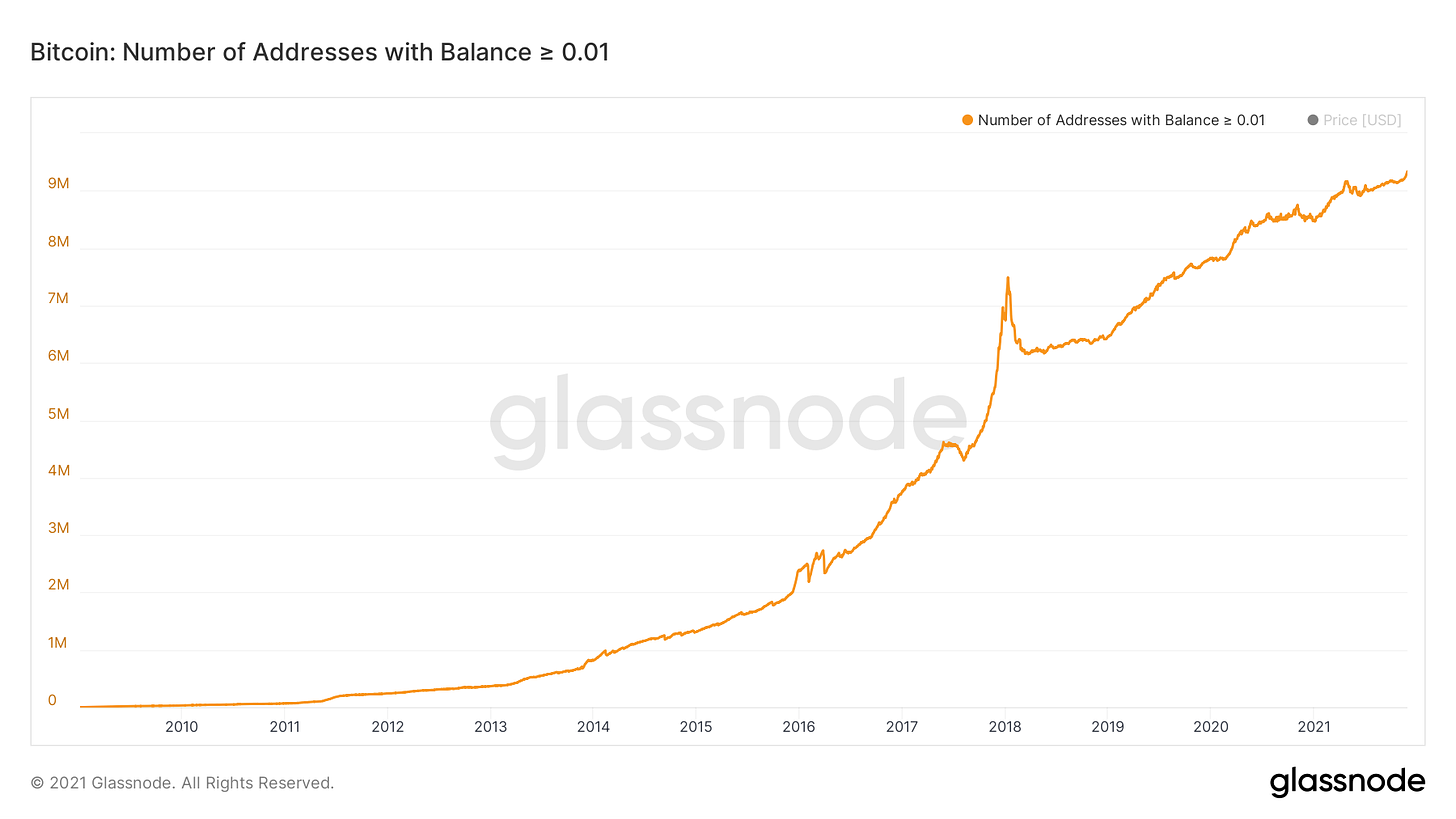

And here is the chart for addresses holding more than 0.01 BTC (About 450 USD):

Chart Source: Glassnode.com

Even though the adaption is constantly rising, the true understanding of Bitcoin’s value proposition is still quite low. Most people acquiring Bitcoin are not knowledgeable on the real fundamentals of it. They rather buy it because they become aware that despite its volatility, the price continues to go up over time, or because it keeps getting more and more media attention. I think especially during the last year many have also started to realize the precarious situation of skyrocketing debts and therefore have started to look for alternative assets that can hedge against ongoing inflation. With rising awareness there are also more and more good sources to read and learn about this asset and get a better understanding of it.

Bitcoin’s value proposition

Having been engaged in learning and investing in this asset for many years, I hope I can also provide some valuable educational insights. In my opinion there are three essential features that make up Bitcoin’s fundamental value proposition:

A hard cap (of 21 million Bitcoin).

Pier-to-pier transactions without a middleman, hence enabling uncensorable transfers of value.

The ability to store and secure it just with a string of letters and numbers (private key), making it not only globally accessible, but also enabling to hide and obscure its possession, which makes it basically unconfiscatable.

To capsulize it, Bitcoin is the first asset in history that has a predetermined supply which cannot be diluted, it furthermore can be transferred without requiring permission by anyone, and finally can be “transported” around the world without the knowledge of anyone else. In short: it is the perfect conceivable configuration for a store of value.

While it is possible for individuals to obscure their footprints, Bitcoin’s distributed blockchain is inherently super transparent. Everyone can validate any transaction that ever happened and can exactly see the flows of funds. The implications of this feature are amazing.

Consider a government operating on a Bitcoin standard. Citizens can follow exactly where their taxes go and how the government spends these funds.

Almost every week there is some scandal reviled in which some politician made some favorable deal with some corporation. In Germany alone a lot of shady deals around masks, fake tests, or hugely overpriced emergency beds have become public over the past two years. And I bet that most of such activities are never uncovered. A Bitcoin standard would allow to keep track when and where the government money is going.

Another example that comes to mind are non-profit organizations that operate on donations. A lot of these companies are currently very in-transparent on how they are using their funds and a lot of people have huge distrust in these organizations — for good reasons.

Operating on a Bitcoin standard would allow for transparency, eliminate a lot of fraudulent behavior and potentially also provide trust in institutions, potentially encouraging more people to donate for good causes.

Bitcoin is also the first monetary unit where the supply is ultimately not a variable, but a constant. A constant that is programmed into it and can’t be changed by political will. Many economists see that as a flaw, but I see it as one of the most important attributes. A hard monetary unit has the tendency to be deflationary (at least as long as there is economic growth and a growing population). As I explained in the inflation part, I see deflation caused by a hard currency as a net benefit for human flourishment. Monetary systems that are controlled by humans inherently have the tendency to decay. History shows us a never ending succession of events, in which people in control of the money supply always abuse their power and destroy the monetary unit over time. There is not a single exception where this didn’t happen. Once you can increase the money supply, the desire — and sometimes the pressure — of doing so is just too much to resist. Remember the chart of the central bank balance sheets? We are witnessing it right now. Bitcoin is the first monetary unit where this abusive power over money has been totally stripped away from humans.

The Lightning Network

In addition to the fundamental values of Bitcoin, we are currently seeing how second layer solutions can be build on top of it and solve many of the issues that critics have had in the past and other cryptocurrencies tried to address by sacrificing decentralization (which is the cornerstone of the value proposition).

The Lightning Network for instance is build on top of Bitcoin. It allows fast transactions with low fees and immediate settlement, without sacrificing the decentralization and security of the underlying base layer.

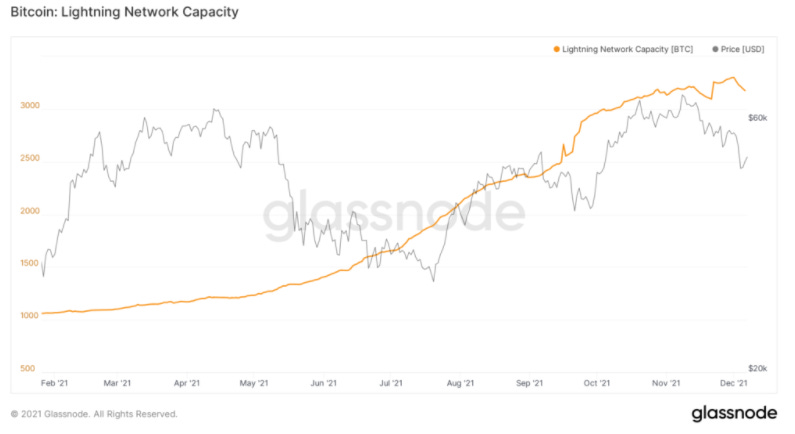

The White Paper for the Lightning Network was published in January 2016 and it was implemented shortly thereafter. It has been growing ever since, but the development that has happened throughout 2021 was breathtaking. The number of channels has more than doubled and while the amount of transaction value is restrained by the channel capacities, this capacity has tripled in 2021:

Chart Source: Glassnode.com

In a nutshell, the Lightning Network allows to open a payment channel between two entities (generally referred to as “nodes”) by using some Bitcoin to fund the channel. Once a channel is opened, there can be unlimited transactions back and forth on this channel. These transactions are not recorded on the Bitcoin blockchain. This allows these transactions to happen instantly and cheap. Once a channel gets closed, the outstanding funds are transferred back to the associated Bitcoin addresses. Hence, the only times when transactions are recorded on the base layer is when a channel is opened and when it is closed.

The network comes into effect when node A has a channel to node B, and node B has also a channel with node C. This allows node A to also transact with node C, even tough there is no direct channel between A and C (by going through B). Every channel added to an already existing node increases the strength of the network effect. What happens is the emergence of so termed “node hubs”. These are nodes with high capacity and open channels to other important node hubs. This development has already reached a state in which is it possible to send funds basically everywhere in the network.

While it is still complicated to open, operate and close channels individually, it has become increasingly easy to make use of it through a 3rd party. These provide lightning wallets with connected channels. It enables to download a lightning wallet (e.g. the Muun Wallet), fund it with some BTC and then send transactions to everyone accepting lightning payments — everywhere on the globe, instantly and with negligible fees. It is still early, but just imagine what implications this might hold for global finance.

Compare all these features that Bitcoin offers to all the problems, intransparency and political risks that our current financial system is prone to. Bitcoin would definitely provide a better base layer to build on in the future. Further consider the implications of a monetary unit that is constantly decreasing in value in competition with a monetary unit that is ultimately deflationary, hence increasing in value. The outcome is almost inevitable.

Getting off zero

I believe that Bitcoin is by far the best available asymmetric investment opportunity.

An asymmetric risk-reward profile means that the potential upside by far outweighs the potential downside.

While the upside potential is less than it was 1, 3, 5 or 10 years ago, it still has the potential of going up more than 100x (yes, that’s about 5 million USD per Bitcoin). What’s more, the probability of becoming the fundamental monetary settlement system in the future is way higher than it was a few years ago. On top of that, the small risk of a total failure and going to zero has become exceedingly small, and it further decreases with every blog added.

Thus, I believe that every portfolio should hold a non-zero position in Bitcoin.

5. El Salvador

El Salvador is the country of the year 2021.

Without any question, for me the most crucial financial event of 2021 has been El Salvadors courageous step to be the first country to adapt Bitcoin as legal tender.

To me it came as a total surprise. My expectation was that we would see more and more companies, especially those with free cash flows, following the example set by Microstrategy in putting Bitcoins as substitutes for cash and bonds on their balance sheets. But I did definitely not believe that any government would adapt it as legal currency. Especially not a small country without any geopolitical complications and a population of merely 6.5 million people.

I was actually watching the live-stream of the Bitcoin 2021 Conference in Miami when they broadcasted president Bukele’s announcement. I got goosebumps. Almost couldn’t believe what I was seeing and hearing.

In retrospect it makes a lot of sense for El Salvador to do this step.

First, El Salvador pegged it’s currency to the USD in 1993 and completely adapted the dollar as legal tender in 2001. Using the dollar had the advantage of a more stable currency as well as more trust of the population who had been used to a continually strong devaluation of their currency. The huge disadvantage for relying on a currency that another government controls, is that you get all the disadvantages, but none of the advantages of money creation. For instance, when the U.S Government approved to spend 4.5 trillion USD on Covid relieve programs, all of this money went to US companies and citizens, but non of it went to El Salvador. However, this debt-financed newly created money is a debasement of the dollar and therefore hurts the purchasing power for everyone using it.

The second reason why it makes perfect sense for El Salvador is that a staggering 22% of its GDP are remittances. These are mostly El Salvadorians who are working in the U.S. and send money back to El Salvador to support their families. The ugly part of it is that companies like Western Union who are transmitting these dollar remittances across the boarder charge incredibly high fees. The adaption of Bitcoin enables it through various ways to bring the costs of these remittances down to nearly zero. Moreover, apps like Strike even enable the conversion to USD, so that people can send and receive USD and only the app uses the bitcoin rails in order to make cheap cross-boarder transactions possible (Strike buys BTC for USD in the U.S. and sells BTC for USD in El Salvador, the users just see that they sent dollars from the U.S. to El Salvador with negligible fees).

The third major reason is that El Salvador is a poor country where about 70% of the population has no access to a basic bank account. This poses some tremendous challenges and disadvantages in transacting, doing business and being part of the economy. Even saving and accumulating money becomes difficult without the access of banking. Bitcoin allows the immediate financial inclusion only requiring internet and a smartphone. El Salvadorians can now be their own bank, save money and transact easily by just walking into a McDonalds and scanning an QR code.

Finally, this step has put El Salvador on the global map. Not only has it helped Bukele to gain a lot of international fame (I’m actually not sure whether that’s a good thing), but many bitcoiners have been attracted to visit and potentially even move to El Salvador. The tourism sector has already witnessed a huge boost — even in Covid times. Further, an additional law actually allows that investing 3 Bitcoin in El Salvador is a possibility to get a permanent residence. Which can be a very tempting offer for many bitcoiners who are looking for a jurisdiction diversification, also for tax reasons (legal tender means there are no taxes on capital gains on Bitcoin). Even more importantly, it opens up the opportunity for all kind of crypto related start-ups to move there. I think that we gonna see a massive influx of capital, as well as smart and young people over the coming years.

It is also astonishing how quick this all happened. The law was enacted in September, just three months after it was announced. Within these three months they rolled out an own app, usable for merchants and customers with functions for dollars, as well as bitcoin holdings, and feeless transactions between them. They constructed Bitcoin ATMs all around the country and even some in the U.S. And they managed to provide all the necessarily assistance to the extend that as the roll-out happened, at least all larger companies were perfectly capable of implementing the payment procedures from day one.

I usually make fun of government inefficiencies and how unable they are to role out anything, especially if it evolves technological aspects (just think about the Obamacare debacle, or all the failed attempts to roll-out Covid tracking apps over the past 2 years). El Salvador proved that focusing on a good objective, even a government can efficiently do something. Soon after the announcement it was also discussed how El Salvador’s volcanoes provide a source for thermal energy that could potentially also be used for bitcoin mining.

And sure enough, El Salvador bought a bunch of containers and miners and are now actively engaged in volcano mining. Quite impressive.

It has been amusing to read Bukele’s tweets along these developments. For instance, another tweet came out when Bitcoin experienced a huge price drop:

What other president in the world texts on twitter about “buying the dip”. Even though there are a lot of negative things to say about him, but these tweets bring some needed freshness in the otherwise dull world of politicians.

Some entity that has not been happy at all about these developments is the International Monetary Fund (IMF). They criticized the decision to adapt Bitcoin from the very first minute and ever since have been pushing against El Salvador. The IMF can be seen as something like an international central bank, providing access of financing for countries that otherwise find it difficult to finance their debt expenditures. It claims to be an important institution for helping poor countries to facilitate trade, financing and stability. However, it’s track record is very poor to say the least.

Instead of backing off, El Salvador went one step further, announcing the issuance of a 1 billion USD “Volcano Bond” that is publicly offered and investors can choose to subscribe for it with Bitcoin or dollars. Half of it will be invested in Bitcoin and half of it will fund a construction program called “Bitcoin city”. Part of the Bitcoin holdings is in case of appreciation supposed to be payed back to the bond holders starting 5 years after the issuance and in case that the Bitcoin price has appreciated. Interestingly, different from usual bonds, the bond will also be tradeable 24/7 by using the Liquid Network (a second layer protocol that enables the trade of securities and runs on top of Bitcoin). It is a 10-year bond with a coupon of 6.5% and therefore well below the 13.5% at which El Salvador’s 10-year bonds are currently trading at. By doing this, El Salvador not only gets access to cheaper financing, but they are also circumventing the usual way of going through the IMF to receive financing.

I personally would not recommend people to invest in this bond. It’s success is pretty much in line with Bitcoin’s success and buying Bitcoin directly has way more upside. But it can be an interesting investment for someone who holds a lot of Bitcoin already, is bullish on it, but wants to diversify the risk structure a bit. Also, it might be interesting for someone thinking about getting the permanent residence in El Salvador, which can be obtained by investing 3 Bitcoin.

There are a couple of other reasons why I think this is going to have huge impacts for El Salvadors future. In any way, it is gonna be tremendously entertaining to see all these developments unfold.

Will other countries follow?

Well, that depends on how it turns out for El Salvador over the coming months, or years. I am sure that many countries watch pretty closely what is happening in El Salvador now.

If my thesis turns out right and Bitcoin continues to become more valuable, then I am quite sure there will be more countries jumping on the train. By seeing all of the benefits that come along with it, they will be driven to follow El Salvador’s example. In this scenario, the adaption by El Salvador might become the cascading even that results in a domino effect. The game theory here is that, likewise personal bitcoin adaption, the countries which adapt earlier, will be the ones that reap the most upside. Hence, once the event is set into motion, those dominoes could topple over rapidly.

Another Bukele tweet puts the potential outcome perfectly into perspective:

6. Stablecoins, DeFi and NFTs

Leaving the world of Bitcoin, let’s take a brief look at what else has happened in the crypto-sphere. Coinmarketcap has now listed almost 16,500 cryptocurrencies. As the year started there were exactly 8150. They more than doubled.

During the last Cryptocycle back in 2017 the main topic were Initial Coin Offerings (I actually wrote my master thesis about this topic back in 2018). Since then the regulatory framework has become more strict, and crypto start-ups have become more careful in how exactly they describe and issue the coins in order to not face the danger of being classified as security (which requires a lot more scrutiny and compliance with security regulations).

Thus, this time around the ICO craze has been replaced by different phenomena.

Stablecoins

Stablecoins are cryptocurrencies that are pegged to fiat currencies and (at least the regulated ones) are also backed by fiat currencies and sometimes other liquid assets.

The rise in the amount of stablecoins is staggering. According to Fitch Ratings, the total market capitalization of stablecoins rose around 450% to approximately $156 billion in 2021.

Stablecoins were first developed with the aim of facilitating trading between cryptocurrencies without requiring to go through the banking system. While the regulatory environment has become more clarified recently and it has become easier to on-ramp and off-ramp between cryptocurrencies and fiat currencies, it is still somewhat cumbersome.

In earlier days, when going on a crypto exchange platform to engage in trading altcoins, it was usually done by exchanging one altcoin for another. Only funding an account, or cashing out was done using wire transfers. Nowadays, almost all trading on exchanges is done using stablecoins. Users can hold stablecoins and then buy and sell the desired cryptocurrencies. It allows traders to hold the desired amount in a cryptocurrency that is not prone to the price volatility. Thus, they can avoid, or bet on, volatility swings in the overall crypto-market.

Apart of avoiding some of the regulatory burdens, stablecoins offer another important advantage compared to the financial legacy system: Immediate settlement. Implications of this is more interesting from a broader perspective for financial institutions. Settlements between financial institutions within a country usually take 24 or 48 hours, internationally those settlements may even take weeks. We have seen financial institutions starting to get interested in using stablecoins for international transfers. Governments fear that a widespread use of stablecoins might lead to money laundering, avoiding taxes, circumventing sanctions, or funding of illegal activities. It will be interesting to observe how this will develop and how regulators are going to react.

Another interesting story that just recently came out, is the announcement by Myanmar’s shadow government to declare Tether (currently the largest stablecoin) as legal tender and try to get funding through it. The National Unity Government (NUG) was overthrown by a military coup early last year and since then they are shut off from any access to government funding.

From an investors perspective, stablecoins are interesting because there are some lending platforms and exchanges which are offering interest rates. These rates are currently ranging between 8% and 10% and are therefore way more attractive than the rates on a checking or savings account in a bank. These yields are supposedly generated from lending, providing liquidity and market making.

These higher yields come of course also with some additional risks. First, there is no deposit insurance by the government. Therefore, there is a third party risk of the company that takes custody of the stablecoins. In addition, there is another third party risk with the company that issues the stablecoin.

I am not sure how high I would evaluate the risk of holding a stablecoin. But I think that even if the risks are low, 8% interest is not worth holding a meaningful amount in it, given the current inflation.

Decentralized Finance

One of the words that gets a lot of attention and is thrown around a lot is DeFi. Decentralized finance means that instead of going through financial institutions (centralized finance), financial transactions are determined through so called smart contracts. A smart contract simply is a predetermined succession of events. Once the involved parties agree about the terms and enter into the contract, it cannot be changed and will happen as determined.

One example that I have heard several times by DeFi proponents is lending money. The smart contract would provide a person with the loan and at the same time some of his coins are put into escrow by a third party, which ensures that the loan is paid back according to the predetermined schedule. The question is, why would you lend money if you at the same time need to put money away into escrow? I sometimes have the feelings that a lot of DeFi proponents actually have no real idea what they are actually talking about. They just try to sound smart by throwing around fancy and popular words.

It also remains quite interesting how regulations will deal with such contracts, since they by definition circumvent all the financial entities that are currently implementing the regulations. At the moment most regulators don’t even seem to have any clue how to look at this, let alone how regulations could even be applied.

A popular use case of DeFi are decentralized exchanges. The most famous decentralized exchange is UniSwap. You can trade between different cryptocurrencies and all the trades happen through smart contracts which determine the way in which buyers and sellers are matched. People can invest in it by providing liquidity to facilitate those exchanges. As a compensation they get payed in UNI (the UniSwap token). It’s complicated, highly speculative and risky. However, I find it interesting to watch how it evolves and how regulations are going to deal with it.

An interesting aspect that has been around quite some time and finally seems to mature a bit is the concept of Decentralized Autonomous Organizations (DAOs). The concept here is that instead of one person or entity making decisions, a community bound by smart contracts is put in charge. For example you could have a crypto hedge fund governed by a DAO. All investors get DAO tokens according to the amount of their investment into the fund. Any investment decision is made with the DAO tokens determining the voting rights on it. A lot of money actually went in such kind of funds last year and then invested into various other cryptocurrencies. In essence, the success of such an investment is determined by how good the other participants are at making investment decisions. I personally would’t put any of my money into a DAO.

The DAO concept can of course be applied to all kinds of organizational decision making processes and I am excited to watch it develop.

Most DeFi is build on platforms that specialize in enabling all sorts and possibilities for creating smart contracts, such as Ethereum, Solana, or Cardano. However, my favorite example for DeFi and smart contracts is something that has been made possible with “Taproot”, the latest Bitcoin update, which came into effect recently.

It makes it possible to create multisignature addresses (a bitcoin address requiring more than one private key to make a transaction), for which the number of required private keys can change at a predetermined time and the nature of the address cannot be distinguished from other addresses by anyone. There are multiple ways in which this feature can be used for all different kinds of settings and security considerations.

One of the challenging parts of Bitcoin ownership is how to deal with inheritance. If you are the only person that has access to private keys and you die, these Bitcoins are lost. Taproot enables a way to implement inheritance measures for Bitcoins held in self-custody. For instance, you can create a MultiSig address requiring 2 out of 3 keys with a smart contract that changes the requirement to only 1 out of 3 keys if 5 years go by without any 2-key signature. You can then entrust one of the private keys to the person that you wanna give the Bitcoin in case of death. In case of death that person would be able to have access to the Bitcoin after 5 years.

I have not yet fully wrapped my head around all the possible implications, but my current position is that there is way more hype than actual value. I think some smart contracts do make sense and might add value, but I think they will be rather easy to implement by any entity who can take advantage of it and therefore I don’t see any big gains that a particular company would reap from it in the long run. I personally wouldn’t invest.

Non-Fungible Tokens

If the developments in stablecoins and DeFi sound crazy to some people, NFTs bring the craziness level to the stratosphere.

An NFT is a unique unit of data stored on a blockchain, that cannot be interchanged. The idea is that an artist, or anyone, can put a unique piece of art on a blockchain. Even if someone else makes a copy of it, it is provable who is the “real” creator, or owner of it.

Here is a picture of the so far most expensive NFT that changed ownership for a staggering $69.3 million. Totally crazy!

Here is a picture of the so far most expensive NFT that changed ownership for a staggering $69.3 million. Totally crazy!

Picture: Everydays: the First 5000 Days by Mike Winkelmann (a.k.a. Beeple)

Picture Source: Wikipedia under fair-use

Well, I personally would’t even spend $10 on it for being the true owner of the original. But value is subjective and — as it is generally the case with art — different folks have very different value scales.

My base case on NFT is that it is just a craze gone viral as part of the entire bubble economy and the easy money environment we are living in. I honestly just don’t see any huge value for owning some digital piece of art. And while I also have a hard time to comprehend the valuation of some physical works of art I can at least understand while other people might value it highly. Having a real Picasso painting in your living room that you can see every day — and brag about it in front of guests — yeah, I get why other people might spend a lot on it. But a digital one? I think the whole NFT space is a huge bubble.

Well, psychology is complex and maybe I really just don’t have the capacity to comprehend the way of how others might value it. So I concede that I could be totally wrong. But until proven wrong, I hold that the risk by far outweigh the potentials.

There are actually some NFT use cases that do make sense to me, such as selling tradeable scarce tickets for an event or membership. Or, some artistic items included in a game. Maybe even things like cute kittens that can be raised, fed and exchanged among a certain obsessed community.

However, in my opinion it is mainly a question of valuation. Can it be worth something? Sure. Are some of them gonna be worth millions of dollars? Maybe. Are the NFTs currently out worth the amount that they are trading at? I highly doubt it.

7. Year of Records

Not just the crypto assets have gone wild, but also the world of traditional finance is experiencing crazy times.

We have seen:

A record number in IPOs (Also a record in companies with negative cash-flows in the year of going public)

Record number in SPACs (a special purpose acquisition company is a company without any operation that privately raises funds, does an IPO and then acquires or merges with a private company that it takes public.)

Record number in share buybacks

68 all-time highs of the S&P 500 (only topped by 1995)

Record housing prices and record price-rise increases in many countries

In additions we have seen the emergence of meme-stocks. These are stocks that have acquired a cult-like following mainly through social media. The most prominent once were AMC and GameStop.

Fostered by a substantially increased usage of investment platforms, like Robinhood, allowing commission-free day trading for retail investors, these stocks have taken some adventurous rides.

Take a look at GameStop’s stock rollercoaster ride throughout 2021, especially the enormous spike in January:

Chart Source: Google Finance

And here is AMC:

Chart Soure: Google Finance

GameStop is a chain of video game retail retail stores and AMC Entertainment is a movie theater chain. With people generally spending more and more time online, the progression of technology, which allows for better online gaming experiences, as well as cheaper and better flat-screen TV sets, both of their business models are flawed in regards to our evolved daily lifestyle. This combined with upcoming companies, such as Steam and Netflix, who have been gaining increasing amounts of market shares in these industries, it is not difficult to see, why the revenues and share prices have been declining over the past years.

Being in this already precarious situation, the advent of shutdowns and other Covid restrictions was another drawback that made analysts wonder whether these companies would soon be facing bankruptcy. Accordingly, hedge funds started short-selling (betting against) these stocks.

The stories that unfolded was in both cases almost the same. The event for GameStop got triggered on “subreddit r/wallstreetbets”, a forum on Reddit, where participates exchange opinions about stock market bets. Somebody mentioned that there were way more short-positions than the public float of the stock and therefore a huge opportunity to create a short-squeeze by buying shares (if prices rise, short sellers need to buy shares in order to cover their short positions).

Taking a step back for a second, the broader picture here is, that many folks are angry about what is going on in Wall Street and especially when it comes to hedge funds. Thus, as the event started to unfold, a lot of retail traders saw this as the big chance to stick it to them.

In a way it is quite a funny coincidence, that the name of the most involved trading platform, where this was happening, is Robinhood, famously steeling from the rich and giving it back to the poor.

As the price shot up, some of the short sellers indeed incurred some major losses in this event. When those trading apps finally halted the purchase of GameStop in order to prevent major market turmoils, users got enraged, accusing the platforms for market manipulation and proclaiming that once again the rich prevent the poor from having a fair shot at equally participating in the financial market.

In the end, some people ended up with huge gains, some, starting to participate at the wrong time, with huge losses. Same goes for hedge funds, some had big losses, while others actually started participating and made money. Both stocks still have their meme-stock supporters and are probably highly overvalued.

Again, to me the whole event is all part of the general craziness that we see.

Same goes for all of the record numbers. When there is a lot of money supply coming into the market, this money must go somewhere. When money is easy, everything goes. It’s as simple as that.

Lets turn to a country that recently hasn’t been as easy with its money increase.

8. China

China was the first country I visited outside of Europe. I have a very clear memory of the day I arrived in Beijing back in April 2012. It was maybe the most memorable day in my life so far. Having grown up and traveled only in Europe before, the difference was just mind-blowing for me. I felt like I was entering a completely different world. The experience was probably also more strongly engraved in my memory by the circumstance that I was engaging on this 3-month adventure all by myself, just capable of basic English and at the time speaking no word of Chinese. The reason of bringing this up here is that the spirit that I experienced at the time in China, was one of openness, motivation and progression.

The growth rates were high, there was a rapidly growing middle class and the world generally looked at the developments in China with amazement. This general trend has totally changed since then — unfortunately for the worse.

Growth rates are still comparatively high, but have consistently been falling over the past decade. And since Xi Jinping has overtaken as president, China has been pushing less for international integration, but instead it’s approach has become more nationalistic and authoritarian.

The extreme growth rates over decades, combined with rising wealth and prices, have also led to a certain expectation that this trend will continue. For this reason there has been a continuous vast expenditure in infrastructure and construction, especially housing.

The home ownership rate in China is at 90%. Since there are capital restrictions, it is difficult for Chinese to park their money outside China, for instance, by investing in foreign stock markets. Therefore, they are more incentivized to put their savings into real estate. Real estate is seen as save and, of course, houses always go up in value. Many wealthy Chinese therefore have numerous houses and apartments in which they don’t even plan to live in, or make other use of. It is just seen as an asset.

There have been stories about ghost towns, rarely populated commute trains and empty shopping malls for quite some time. Such trends can obviously go on for a long time, as long as the times are good, nobody cares and the music keeps playing. But if the fundamental growth doesn’t support it, then at some point there will be problems. And it appears that the first cracks in this came apparent last year with Evergrande, which is one of the largest Chinese construction companies, not able to service its $300 billion in debts.

Looking at balance sheets and accounting data in China is always tricky since the rules are way more stretchable and it therefore hard to exactly examine a companies financial health from the outside, but it is to reason that other Chinese construction companies are likely not far away from being in a similarly unhealthy position.

One thing on the good end to say about China is that they seem to handle the situation more “capitalistic” than western economies deal with their debt-problems nowadays. So far their hasn’t been any talk about big government intervention in the form of bailouts (to keep the music playing and kick the ball down the road). Instead, the Chinese government appears to be aware of the bubble and wants to downsize the outgrowth in housing speculation. It seems that they are actually going to let Evergrande fail and the aim seems to be, to get restructuring of the debts, in order to let some air out of the balloon.

The potential danger is the size of the whole real estate bubble and the cascade effect, which such an event could possibly trigger. Another story that I am sure will be with us this year.

Other actions by the government have been less in line with capitalist guidelines. For instance, online tutoring companies were prohibited in one quick strike. With the justification that private teaching shouldn’t be done with a profit incentive, online teaching platforms had to immediately stop their businesses. Also, they are increasingly cracking down on the big technology companies. Alibaba suffered a huge decline in stock value, as it was reported that the government seeks to break up Alipay, which is the worlds largest mobile payment app, and hand over the user data. I think the motive for this action is part of the strive to completely centralize all lending and banking in China. More on that topic later.

Additionally, towards the end of the year, we saw energy shortages not only in Europe, but also China has difficulties sourcing its supplies, which brings us bag to the topic of energy.

When it comes to investing in China, there are different things to consider. On the one hand, I think the stocks have been punished a lot recently, are therefore comparatively cheap and a lot of them have promising potentials. But on the other hand, due to the way things are done in China there are additional risks that investors should be aware of. One risk is, that — as it happened several times last year — the government may come in with arbitrary decisions at any time, with the possibility of destroying a company, or whole industry, completely. An additional risk is, that the data provided by companies is not always trustable.

Banning Bitcoin mining

In my opinion this is probably the worst geopolitical mistake of 2021! I think China will regret this decision dearly in the future.

Historically, China has a record of hastily making political decisions on enormous scales, that later become painful self-inflicted wounds.

Around 500 years ago, China had the largest fleet. It was far greater, and according to some historians also technologically superior to the Spanish, Portuguese and other European fleets at the time. There are some different opinions on what exactly happened, but the main thesis is that the political elite in the Emperor's circle became afraid of the rising power of the merchant class, who kept increasing their trading activities and increased their wealth.

To ensure the maintenance of total political power, the whole fleet was either burned, or left to rot in their docks. So instead of participating in the discovery of the globe, as was done by the Europeans in the following centuries, China remained mainly closed towards the outside world.

In the 19th century, when China faced naval conflicts with western countries during the Opium Wars, their ships were vastly inferior to their European enemies. The consequences were not only the humiliating defeats, but they had to pay reparations and provide them with territory, as well as favorable tariffs and trade concessions.

I bring this historical anecdote up here because I think the banning of the Bitcoin mining is a very similar mistake. Similar to the size of the fleet 500 years, China had by far the majority in the mining industry. Roughly 70% of the hash-rate was coming from mining operations in China. Now it is down to just a few entities operating in a black market environment with the risk of being caught.

Most people who haven’t yet dug deeper into this area might wonder, why it is so important. The mining industry has been growing rapidly and it might well be one of the most important industries for future progress in the energy production. This is a huge topic by itself but here are some of the key points:

Miners can be plugged in anywhere anytime, hence they can help putting otherwise wasted energy outputs into productive use.

There are remote places providing natural energy sources which are economically unfeasible to develop because the costs of developing it and building out the infrastructure are too high and the potential demand too unstable (consider a small nearby mountain village that only has some hours of high demand). Bitcoin mining has the potential of making such projects feasible, since during the time that the demand is low, the energy producer can now engage in mining as additional revenue stream.

The ability for energy producers to employ their overcapacity might in general lead to a decline in energy prices.

Estimates are that 85-90% of the costs for mining companies is the energy price. No other industry is influenced to such an extend by energy prices. It follows, that there is a huge economic incentive structurel to find ways to improve the efficiency of energy production. This might lead to many technological improvements in the coming years.

Apart from that, there are many actual and potential jobs that have been lost due to this policy. And a lot of potential wealth that these companies might have created for Chinese citizens just by increasing the holdings of an asset that goes up in value over time and might become the fundamental base layer of the financial system at some point. Wealth that would have been generated in China, but is now generated somewhere else.

In addition, it is also a huge plunder! Think of all the Chinese entrepreneurs who invested lots of money and energy in planning and building theses mining facilities. They all took huge losses through this sudden decision and while most of the miners have been shipped to other locations, some of the Chinese operators probably went bankrupt. Just as the merchants 500 years ago, who had to watch their trading vessels being burned down.

Central Bank Digital Currency (CBDC)

One especially worrisome aspect about modern China is everything about the level of public surveillance. There is already a social credit system in place, making citizens into state robots, that follow all the ideals set by the government, in order to benefit from a good rating score.

The next step is to take away the access to cash or other independent forms of payments. Having access to cash (or digital cash), is a very crucial aspect of human freedom. In today’s world, money is the lifeblood for basically everything. If you have no direct control of your own money, but need to rely on the state granting you the permission to use it, then your freedom of choice is gone.

The use of the CBDC as the only currency would create exactly such a world, and China is on its way to try it. It will be interesting to see how exactly it is going to be implemented and also what role the banking industry is supposed to play in it, because they are basically completely disintermediated by it.

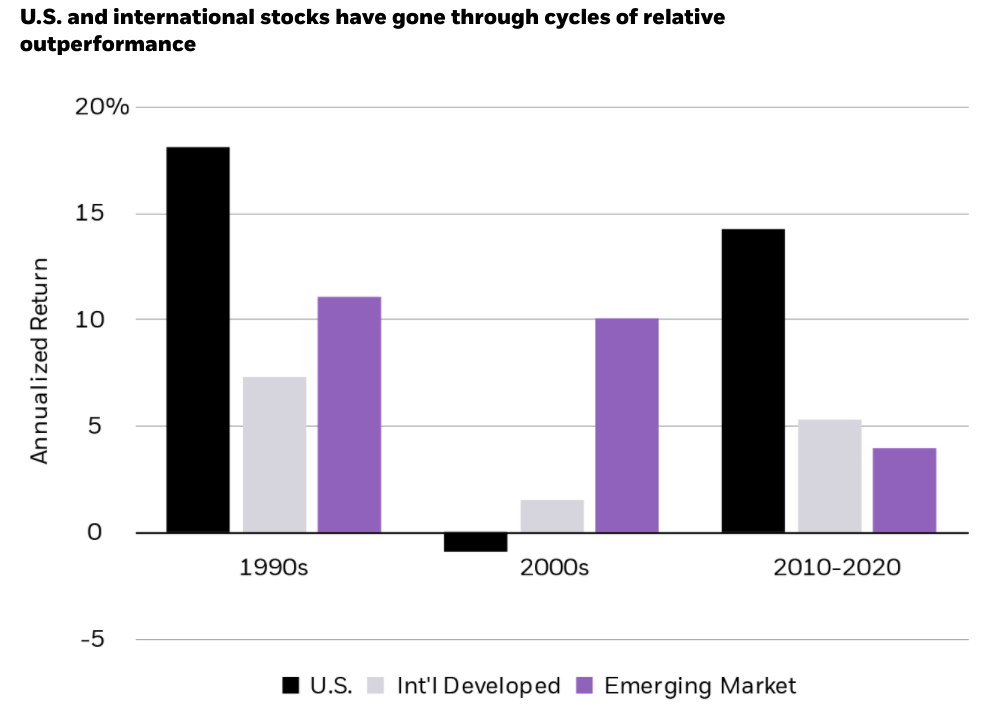

To state it clearly: I think a CBDC is a horrible and monstrous financial system.