Ataraxia Financial Newsletter - July 2022

All Markets in Turmoil - The Global Economy on the Verge of (or Already in) a Recession

“The market is like a large movie theater with a small door. And the best way to detect a sucker is to see if his focus is on the size of the theater rather than that of the door.”

— Nassim Nicholas Taleb (Skin in the Game)

July 9th, Kuala Lumpur.

First, whoever remembers my guesstimate of a 50 bps rate hike… well, I was wrong. Powell ended up taking the more hawkish approach of the 75 bps pint, notching up the turbulence in the markets to yet another level.

It is my first time in Malaysia and I am quite impressed: People are friendly and have a positive attitude. The economic activity seems to be coming back even though people here still seem concerned about the notorious bug 🦠. The food choices are broad and tasty and public transportation works smoothly and is convenient. Technologically, it actually feels more advanced than most European countries and so far I didn’t encounter any barriers by communicating in English. To top it off, the futuristic skyline of Kuala Lumpur is absolutely stunning!

Continuous readers — and sufferers 😅 — of this newsletter already know that I am generally bullish on the development of emerging markets over the next decade, especially with regards to South East Asia and Latin America. Spending some time here has definitely reinforced this viewpoint.

This month’s newsletter will cover the following topics:

Part l - Market Analysis:

Key Indicator Rundown

The Story About the Luna & Terra Implosion and the Ensuing Meltdown of the Entire Cryptoverse

Is Japan Gonna Be the Luna for the Sovereign Debt Collapse?

The Oil Price as Economic Indicator

Part ll - What is a Bear Market? And how to Define a Recession?

Definition of a Bear Market

Definition of a Recession

Are We in a Recession Right Now?

Are Bear Markets and Recessions Related?

Part l - Financial Analysis

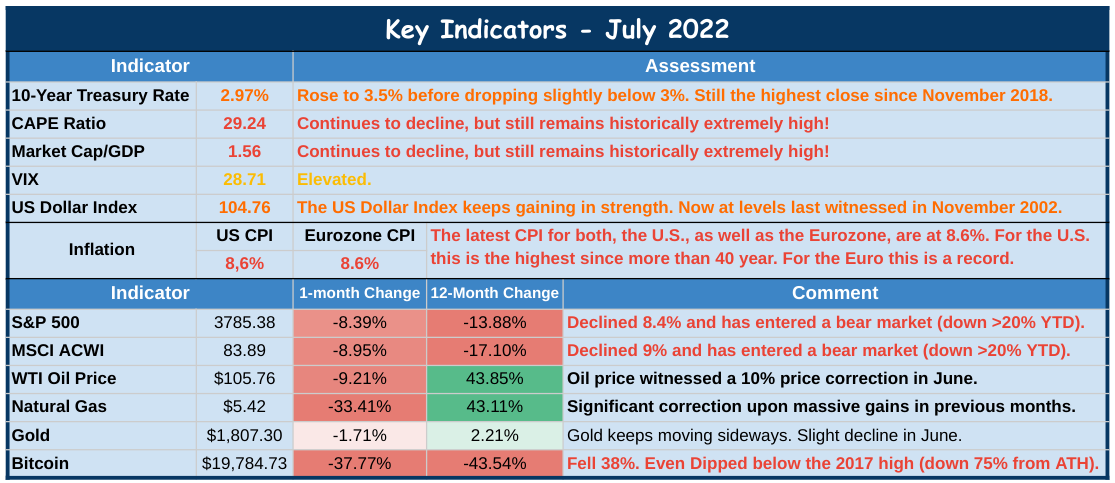

Yep, it’s quite a colorful table this month. And red is the predominant color.

The stock market has had its worst half year since more than 50 years.

Whatever number you look at, it’s not looking good.

Key Indicator Rundown

Inflation and interest rate hikes keep being the main story-line in the markets.

After the official CPI Inflation number for May came out at a new record level of 8.6%, the Fed answered with a 75 bps rate hike. According to Jerome Paul, the economy is strong and can withstand more tightening amidst the staggering inflation. Here is his comment:

"We are raising interest rates, and the aim of that is to slow growth down so that supply will have a chance to catch up. We hope that growth could still remain positive. But if you look at the strength of the economy, households are in very strong financial shape, they've still got a lot of excess savings - from forced saving of not being able to travel and things like that - and fiscal transfers. The same thing is true with business, with very low rates of default and lots of cash on the balance sheet. The labor market is also tremendously strong, still averaging very high job growth per month. Overall, the U.S. economy is in the position to withstand tighter monetary policy, we think."Not long afterwards, the CPI for the Eurozone also came out at 8.6%, marking another record point for the deterioration of the Euro. The ECB is now finally planning to start hiking its rates by 25 bps in July and another 25 bps in September. This will be the first rate hike in over a decade. Further, the ECB President Christine Lagarde stated that she does not believe that inflation will be going away anytime soon:

"I don't think we are going to go back to that environment of low inflation. There are forces that have been unleashed... that we're facing now that are going to change the picture and the landscape within which we operate. Certainly in this part of the world, the energy shock that we have suffered, are suffering, and will continue to suffer has had a major impact. I think this is not specific to Europe, but there is certainly a dependency of European countries and the euro area to external supply from foes. That is certainly a strong driving force of inflation on the price of energy and food... as well as supply shocks."

This is a new stance taken by the ECB. It is a further reason why the trust in the ability of central banks credibility seems to dwindle around the world. We saw the shift of the Fed from “deflationary pressures”, to “transitory inflation”, to “rampant inflation” over a year. Now the ECB performs a similar 180° turn. All their previous forecasts turn out to be at best erroneous and at worst totally wrong.Meanwhile, in response to the hawkish stance of the Fed, the Treasury yields increased substantially across the yield curve, with the 10-Year Treasury Rate moving all the way up to 3.5%, before falling back closing the month slightly below 3%.

Decreasing by 8.4% in June, the S&P 500 had its worst performance for the first half of any year since 1970. Since it reached its latest all-time high ($4,796), right at the start of the year, it closed June at $3,785, down 21%. This means that the leading global stock market benchmark has entered into a bear market. It further means that more than $9 trillion in market value has been lost over 6 months. For the American 6-month indices comparison:

The Dow Jones fell only 16%.

The NASDAQ plunged a staggering 30%.

International stock markets didn’t fare better. The MSCI ACWI also tumbled down almost 9% in June and is down 21% so far in 2022. In comparison:

EURO STOXX 50 is down 20% so far this year.

The German DAX is also down 20% at the end of June YTD.

The British stock market did better, with the FTSE 100 only down 4.5%.

Looking to Asian markets, Hong Kong’s Hang Seng is down 6%.

And the SSE Composite Index declined 6.4%.

Thailand’s SET 50 fell 4.8%.

The FTSE Bursa Malaysia KLCI, Malaysia’s leading index is down 10.7%.

The Nikkei 225 fell by 10% (More about the situation in Japan later).

Whereas Taiwan’s TAIEX did comparatively well, with a 3.75% decline.

Finally, the MSCI Emerging Markets Index also fell almost 19%.

The U.S. Dollar Index keeps rising higher, going above 105 for the first time since late 2002 and closing the month at 104.76. When thinking about the performance of global stock markets, it is important to remember that a rising dollar index means that price movements of stocks which are measured in other currencies result in a worse overall performance. Particularly, this is relevant for Japanese and European stocks, since both the Japanese Yen and the Euro have lost a lot of value compared to the USD. Hence, even though European stocks have declined by about the same amount over the recent year as the S&P 500, they still substantially underperformed the American stock market. For instance, measured in USD, the German DAX index is down 27% so far this year.

Both, the CAPE Ratio, as well as the Buffet Indicator continue their recent trend to decline. From a historical perspective, both indicators are still extremely high. This means that compared to the company's earnings and the overall economic output as measured by GDP, stocks are still quite expensive. Thus, even though the recent decline seems quite massive, it might not have been the end of this bear market.

We saw the VIX spiking up to over 34, just before the FOMC announcement (apparently there was a leak of the 75% bps hike, which spooked the markets). In general, we can see that the VIX remains at historically elevated levels (it stayed in the range of 25 - 35 throughout June). Anyway, given everything that is going on, it is actually surprising that it doesn’t move even higher.

Energy: The XOP Index, which tracks companies involved in oil and gas exploration and production, retreated 23.66% in June, giving at least some relief for the stressed economies around the globe. Oil prices fell by 9.21% in June and the price of natural gas even dropped 33.41% to $5.42. (Later in this newsletter, I will cover the importance of oil and how it can be used as an economic indicator).

Meanwhile, amidst the energy crisis, the European Union is doubling down on their strive to force its citizens to avoid using Russian energy sources: The sanctions will prohibit seaborne imports of Russian crude oil as of December 5, 2022, and ban petroleum product imports as of February 5, 2023. Only some Eastern European countries are partially excluded from applying these sanctions. This is happening while the EU still does not have a coherent plan, how to deal with potential gas shortages this winter. The Nord Stream 1 pipeline — which is currently the most important piece of European energy supply infrastructure — is scheduled to be shut down for a 10-day maintenance, starting on July 11th. Some worry, that Russia could prolong the maintenance, or keep the pipeline shut down altogether, by using their gas-leverage, to retaliate against European economic warfare. If this happens, it would have disastrous consequences for the European gas supply over the coming winter. European politics appears to be driven by career politicians who strive for votes. Their goal is to be on the ‘correct side’. Political correctness is the holy grail, while common sense and economic realities are thrown over board. They try to harm Russia economically as much as they possibly can, while hoping that Russia will be a nice economic actor. Not even talking about the moral flaws of their sanctions, economically it has totally backfired so far: Russia has seen higher energy income since the sanctions started, while Europeans are suffering the consequences of this lunatic economic warfare. But instead of questioning it, they are doubling down. Along those lines, Germany — the country famous for its goal to ‘save the planet’, by stopping fossil emissions — is now engaged in firing up its idle coal plants again as a consequence. And for doing this, it relies on the reactivation of lignite mines — the most environmentally harmful form of energy production!

Among all that is happening in the market, Gold seems to be the island in stormy oceans, slightly down in June (-1.7) and YTD (-1%), but slightly up over the last 12 months (2.2%). Nonetheless, given the high inflation over the last year, it is surprising that gold doesn’t seem to be able to live up to its expected quality as a reliable inflation hedge.

Moreover, it has been taken quite a downward step over the first few days of July. At the time of writing, gold futures traded at $1,739, down 3.61% over 4 trading days.The worst performer among the indicators was yet again Bitcoin. After its 17% decline in the prior month, Bitcoin fell another 38% in June. For the first time in its 14-year history, it dropped below the ATH of the previous 4-year cycle. It is now trading around the $20,000 mark.

In the following part, we will take a closer look at what happened and how things might be shaking out from here.

The Story About the Luna & Terra Implosion and the Ensuing Meltdown of the Entire Cryptoverse

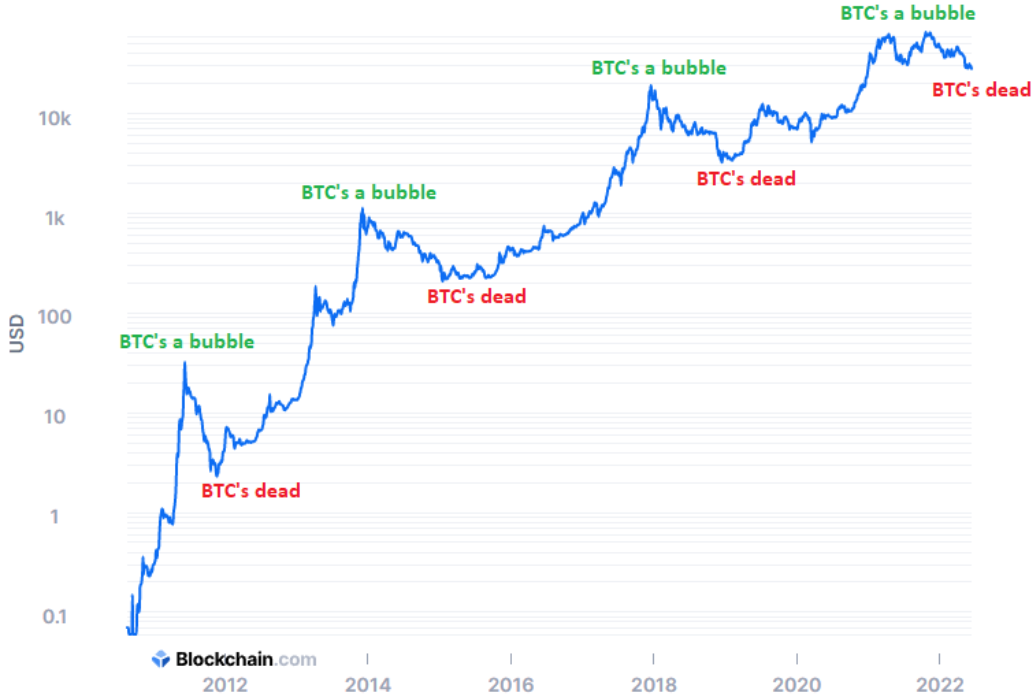

Over the past 2 months we have seen a massive decline in the price of Bitcoin and other crypto assets: Bitcoin declined about 18% in May, which was followed with a 38% decline in June. It is down more than 70% from its all-time high of November 2021.

Likewise, the total valuation of all cryptocurrencies saw a decline from almost $3 trillion to the current valuation of around $870 billion. Hence, over $2 trillion in valuation have been eclipsed and about $1 trillion over the past two months alone.

This begs the question: What the hell happened there?

A lot of critics have taken the opportunity, to dance victory laps and declare once again, that Bitcoin doesn’t work, will never succeed in the long-run and is finally dead.

Well… people following Bitcoin for some time are familiar with this narrative…

So far, there have been 8 times, in which Bitcoin pulled back more than 50%. It always came back and went to substantially higher valuations.

As stated in previous issues, I think that Bitcoin is the hardest and best form of money ever conceived. As its programmed attributes play out over time, this gets recognized by more and more people, who will sooner or later adapt it as their store of value. Moreover, due to its decentralized nature, it is basically impossible for any entity to prevent this process from happening. Therefore, in the long run, it is almost destined to become the main global settlement layer in the future.

As long as the fundamentals are intact, there is nothing that makes me divert from this belief. What are the key fundamentals?

Flawless operation of the ‘proof of work’ mechanism and its difficulty adjustment to produce stable and secure blocks every 10 minutes on average.

Decentralization (especially nodes, but also development and mining).

Network growth (a healthy growth of the user base).

Since all of these fundamental factors are well intact, there are other reasons which must have caused this massive decline in valuation.

From my perspective, there are 3 main factors, which — in combination — are the reason for this decline:

Bitcoin is generally in a bear market phase.

The bearish ‘risk-off’ macroeconomic environment.

Structural risks inherent to current ‘DeFi’ endeavors of crypto companies.

Historically, Bitcoin has moved in cycles, which to some extent can be tied to its halving events every 4 years. It is not totally clear whether this 4-year cycle is a perfect indicator to gauge price developments, or, whether these cycles will continue to follow previous patterns over the next years, but we are by all measures in an environment that is driven by bear market sentiment.

With high inflation, the stock market experiencing its worst first half year since more than half a century and the Fed putting pressure on the global debt markets by tightening the credit markets, people first and foremost sell the assets which they consider more risky. While I think that Bitcoin offers the best risk-off asset out there, most investors have’t grasped the asset’s features yet and still see it as a speculative risk-on asset. This can also be seen by the high correlation of Bitcoin to the NASDAQ over the recent months.

The third point is probably the most crucial one that is playing out at the moment and the one I want to focus on here.

A Brief Description of the Current Stablecoin Environment

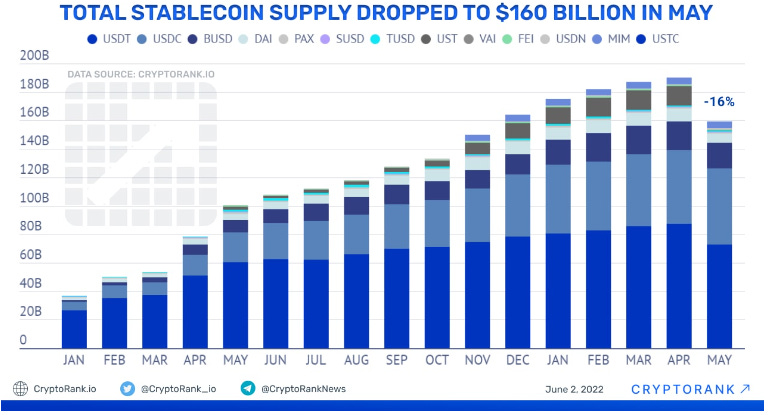

One angle of cryptocurrencies which has gained a lot of attention over the last year, are stablecoins. The event that pulled the trigger for all the recent deleveraging and liquidation events was, when the Terra USD stablecoin (UST) lost its peg to the USD and the subsequent collapse of both, the LUNA token and the UST itself.

I briefly introduced the inception and basics of stablecoins in the January issue, but I’ll elaborate on the relevant aspects of them here.

Stablecoins are crypto tokens which are pegged to fiat currencies or commodities. They allow easy movement of value between trading entities without going through the traditional banking sector. This brings several advantages:

Instant settlement of transactions.

Avoiding all the troubles and inconveniences related to the regulatory framework that underlies the banking sector.

Circumventing capital controls.

Avoiding high transaction fees for international payments.

A way to have exposure to more stable currencies (e.g. someone in Turkey who is experiencing >70% inflation of the Turkish Lira and cannot open a USD denominated bank account).

The majority of the current market capitalization of stablecoins are pegged to the USD. Most transfers and trading on and between exchanges, lending platforms and DeFi entities, are facilitated with stablecoins.

What is important to understand, is the way in which the peg is archived and secured. There are 3 ways in which this is done:

Collateralized

This is the most straight forward approach: A central entity holds the same amount of highly liquid assets (such as cash of the actual fiat currency to which it is pegged or Treasuries) as the stablecoins that it issues into circulation.

Examples are:

This is probably the most secure form of a stablecoin. But there are still some risks:

Market swings might lead to temporary de-pegging.

General counterparty risk (technical security, trustworthiness and collateralization strategy of the issuing entity).

Future government decisions might lead to freezing up the assets.

The major downside of this form is that it relies on centralized institutions. Thus, it is prone to arbitrary government decisions. Stablecoins are still quite new and just recently came on the radar of lawmakers. Hence, it is very uncertain how governments will react when the global use of stablecoins continues to expand and thereby lowers the level of control that the government can exert upon the market.

Crypto-over-collateralized

Another form to peg stablecoins, is through an over-collateralization with other cryptocurrencies. These cryptocurrencies are held in a vault and it relies on rules (ensured through smart contracts) that govern the level of over-collateralization required to mint new coins, or the penalties incurred when the value of the collateral drops under a certain level.

Example: (DAI)

The advantage of this form is, that it does not necessarily rely on a central institution which can easily be controlled by authorities.

The risk is, that the assets which are used for ensuring the peg, might tumble and lead to an under-collateralization. in such a scenario the pegging might break. If the backers are not quickly adding additional collateral to the vault, this could be detrimental.

Algorithmic

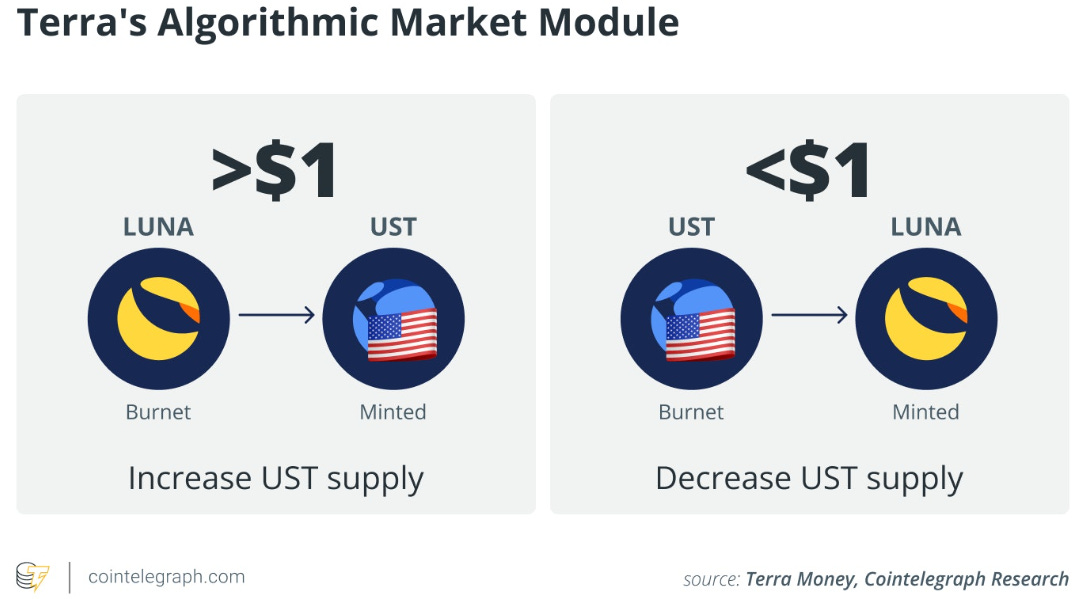

This is the most opaque and difficult to understand form of creating a peg. There is no determined collateral backing. Instead, algorithmic mechanisms enforced by smart contracts are employed to ensure the pegging. This mechanism is supposed to make sure that the supply is expanded when the peg is too high, and it contracts if the peg is too low.

Advantage: Potentially decentralized.

There is a good argument to be made that it is impossible to ensure the security of such a stablecoin, because, apart of its complexity, without real backing, it consequently always has to rely on an automatic pegging-mechanism, which can be exploited by market participants.

Here is a chart that shows how these constituents account for the stablecoin supply:

As can be seen, the total market capitalization of the stablecoin supply experienced a substantial expansion over the last year. It reached almost $200 billion before the Terra-event unfolded in May, causing a 16% reduction in the overall stablecoin supply.

For everyone interested in a great conversation about history, current state and potential future visions of the stablecoin adoption process, I highly recommend a recent podcast, in which Saifedeen Amous (author of “The Bitcoin Standard”) hosts Paolo Ardoino (CTO of Bitfinex and the above mentioned Tether stablecoin, USDT).

Luna Meets Terra

I actually didn’t pay any attention to the whole Luna & Terra story until Do Kwon and the Luna Foundation Guard started to buy massive quantities of bitcoin in the months preceding the collapse. I briefly mentioned the massive purchasing in the April and May issues of this newsletter. Here is an excerpt from April:

Another groundbreaking announcement has come from the Luna Foundation Guard (LFG). The foundation is implementing the algorithmic stablecoin TerraUSD (known as UST), which currently sits at more than $15 billion in market cap. Terra is described as “a public blockchain protocol deploying a suite of algorithmic decentralized stablecoins which underpin a thriving ecosystem that brings DeFi to the masses”. [now clicking on the link gives: “Terra 2.0 is Here” 🙈] There are now a whole bunch of stablecoins out there. The ones which currently have the widest range of use are regulated stablecoins, who are pegged to the dollar and mostly also backed by the dollar and/or commodities, such as Tether, USDC, and BinanceUSD. The problem with these stablecoins is, that the underlying assets are held by banks and therefore bear the risk of potentially being confiscated. Terra is currently the 4th largest stablecoin and its founder Do Kwon has announced the plan to back it in the future by a basket of other crypto-assets, primarily bitcoin. Consequently, over the last days the Luna foundation has started buying huge amounts of bitcoin on a daily basis, already holding more than $1.5 billion worth of bitcoin.

I was excited by the idea of having a decentralized stablecoin backed by the “most pristine” collateral asset, as Do Kwon framed it at the time. So I wrote:

Except for Microstrategy and Tesla, LFG has already acquired a higher bitcoin stack than any other publicly-listed company. Further, according to Do Kwon, Bitcoin is the “most pristine” collateral asset and with the declared goal of keeping acquiring another $1.5 billion with current reserves, this would amount to a total of about $3 billion in total (at the current BTC price). Additionally, it is planned to obtain another $7 billion in bitcoin through users wanting to get access to UST. This would promise the possibility of a stablecoin that is truly decentralized. While offering the benefit of low volatility and commercial usability, just as any other USD stablecoin, it would not rely on the granted permission by central authorities. In other words, this might be an enormous step in the direction of a more free financial system. The world is taking step after step, to slowly but surely realize the value that bitcoin offers. It is the most pristine monetary asset the world has ever seen.

However, to my own regret, I did not take the time to closely look into it and the way that the pegging is supposed to function, so I did not foresee the collapse. In retrospect, it seems quite obvious that it was destined to fail sooner or later.

The pegging mechanism was designed as follows:

Terraform Labs was the institution that founded the project. It was founded in January 2018 by Daniel Shin and Do Kwon.

LUNA was the governance token. It acted as the ‘collateral’ for the TerraUSD (UST).

The mechanism was designed so that one UST could always be exchanged for $1 worth of the LUNA token. And vice versa. The underlying structure was that UST would either be minted or burned, depending on supply and demand:

If there was high demand for UST, the price would rise slightly above the peg and market participants would be incentivized to immediately burn LUNA to mint new UST and hence bring the price back down to the peg.

On the other hand, if the price would fall below the peg, arbitrageurs would exchange their UST, to get $1 worth of LUNA and profit from the spread. Thus, the supply of UST would subtract and the price would rise back to the peg.

Further, Terraform Labs tried to bootstrap an entire Terra ecosystem around the LUNA token, as to incentivize people to invest in the project and hold the Luna token. These incentivization schemes included:

Luna holders would receive a percentage of the UST payment fees.

Listing LUNA on all popular exchanges to encourage trading frequency and liquidity.

They partnered up with the Korean fintech company CHAI, one of the largest eCommerce platforms in the country with 10 million users and $3.5 billion in GMV. (Note: The Founder and CEO of CHAI is Daniel Shin, the co-founder of Terraform Labs)

Another popular part of the ecosystem was the Mirror Protocol (MIR), a protocol that allows the mirroring of real assets, such as stocks.

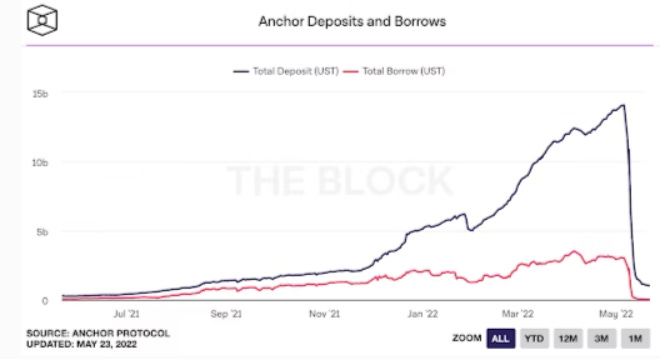

Probably the most crucial part in building the ecosystem, was the Anchor protocol. This money market platform primarily facilitated the borrowing and depositing of Terra stablecoins. The gist of it was, that depositors of the UST were offered with a yield of 20%!!!

The main goal was to generate mass adoption in order to create a large ecosystem with the decentralized Terra payment system at its core. Additionally, they wanted to win the competition of being the most used stablecoin.

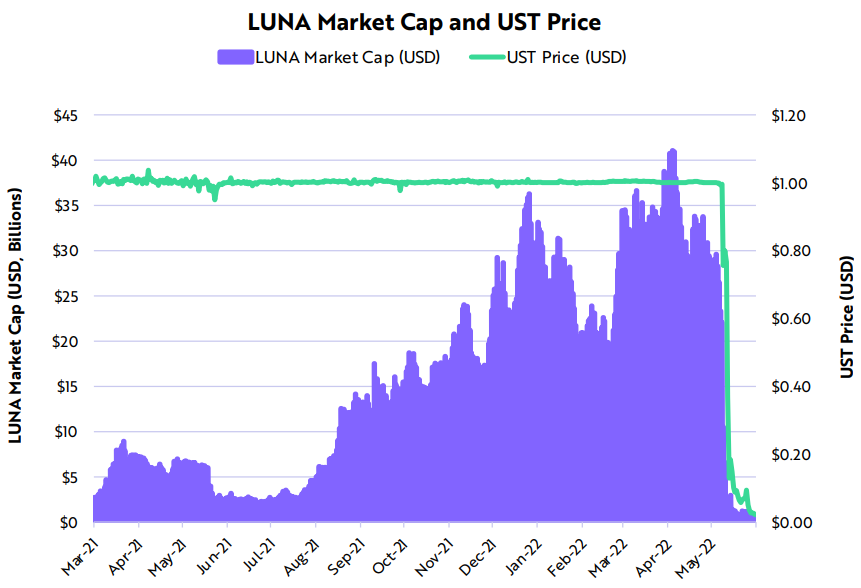

As a result of the incentives — primarily through the 20% yield from depositing UST on the Anchor protocol — the LUNA Token and the UST experienced a phase of rampant growth and expansion. The Anchor protocol was launched in March 2021 (by Daniel Shin and Do Kwon (the same founders of the Terraform Labs). Unsurprisingly, this marks exactly the point, when the ecosystem started to gain massive traction: LUNA went from a market cap of around $3 billion to a peak of $41 billion in April 2022.

In late 2021, Terra also overtook DAI in market cap, which was the main competitor as a decentralized stablecoin. The competition between these two protocols became quite a big discussion on social media and was colorfully commented by Do Kwon’s tweets:

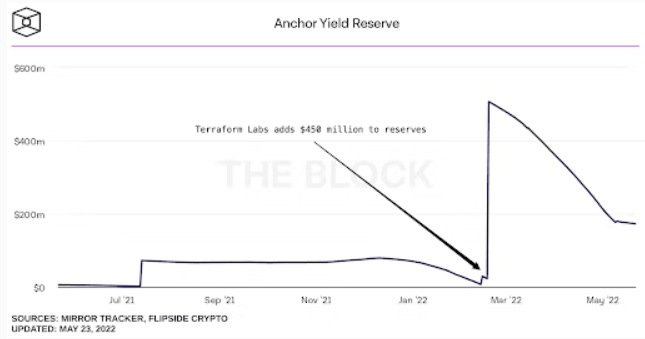

Important to note here is that the 20% yield of the Anchor platform was of course not sustainable. It was not generated by the lending activities on the platform, but rather subsidized by Terraform Labs.

Worries about the sustainability of the yield were always played down by Do Kwon:

In other words, Do Kwon was very aware that the offered yield was not sustainable, but it was provided with the goal of enticing investors to hold UST, by providing the highest yield in the DeFi landscape and thereby achieving massive growth with the accompanying network effects, to building up moats.

The crucial (negative) feature of the design is, that the market cap of Luna needs to keep up with the market cap of UST. Otherwise, in the case that the demand for UST outpaces the demand for LUNA, then the UST-peg becomes more vulnerable, since its backing reserve deteriorates in relation.

In a scenario where Luna declines in value and the peg breaks below $1, arbitrageurs would step in and burn the UST in order to mint more LUNA. However, this would increase the LUNA supply and lead to a further decrease in the price of LUNA. This in turn can create a negative feedback loop and finally lead to a hyper inflation of Luna.

Therefore, it was crucial for Terraform Labs to incentivize investors to hold their UST and not exchange them for real USD. Hence, the 20% yield offered on Anchor was really an essential part of keeping the whole charade going — unsustainable in the long run.

Due to its popularity, the yield reserves began to dwindle quickly in January and February, so that Terraform Labs needed to add additional funding to the Anchor yield reserve, which was financed by selling some of the LUNA token treasury:

Before the collapse started, the total value stored in the Anchor protocol was just over $14 billion and it was growing quickly. At a 20% yield, this would require a payout of $2.8 billion a year, not even considering the compounding effect.

To put it in perspective, the total market cap of LUNA at the time was around $30 billion (most of it not in control of Terraform Labs), so it was clear that they would run out of funding capacities soon. However, if they wouldn’t continuously provide this yield, it would be likely that people would withdraw their UST from Anchor and exchange them. This might set in motion the above described de-pegging spiral.

As a strategy against this looming disaster, the Luna Foundation Guard (LFG) was established. The goal was that the LFG would acquire and hold bitcoin as a reserve to secure the peg. In the event of a de-pegging, these funds could be used to buy UST and thereby defend the peg (similar to how developing countries use USD reserves to defend their currencies in crisis situations).

Do Kwon was also the leading figure of the LFG and the stated goal of the foundation was, to accumulate a total of $10 billion in bitcoin. (This was when I first got interested. It would make it the largest Bitcoin holding entity except for Satoshi Nakamoto).

Through ‘donations’ from Terraform Labs and also raising $1.5 billion from a deal with Genesis and Three Arrows Capital (3AC) (a hedge fund that will further be covered as a protagonist later in this story! 🙈), the LFG started buying massive amounts of bitcoin in late March and throughout April. By May 8th, they held a total of 80,394 BTC, worth $3.275 billion at the time, which made it the second largest institutional holder behind MicroStrategy (129,218 BTC) and in front of Tesla (43,200 BTC).

Besides BTC, the LFG also held some other assets before the events started to unfold. According to LFG, their reserves consisted of the following assets:

To get a better grasp of the event, it is crucial to understand the environment around it, to put it in the right frame:

The Fed had started raising the funds rate, by 25 bps in March and by 50 bps early in May, leading to havoc in the bond market and a significant decline in the stock market → general risk-off sentiment.

Bitcoin had declined by 21% over the previous 30 days → the BTC reserves of the LFG therefore were worth much less.

The LUNA token did even worse: Its price had declined by about 37.5% over the previous 30 days → This is the token which is supposed to ensure the peg.

Consequently, the rapidly increasing supply of UST (due to the 20% Anchor yield), was faced with a substantial decline in the market cap of LUNA.

→ This provided the perfect environment for speculative attackers to take advantage of the flaws in the pegging design.

It appears that some trader(s) started to attack the peg by systematically selling USD. A first de-pegging occurred on May 7th, but the pegging-mechanism still worked and the price got back to $1, however, the volatility around the peg had increased.

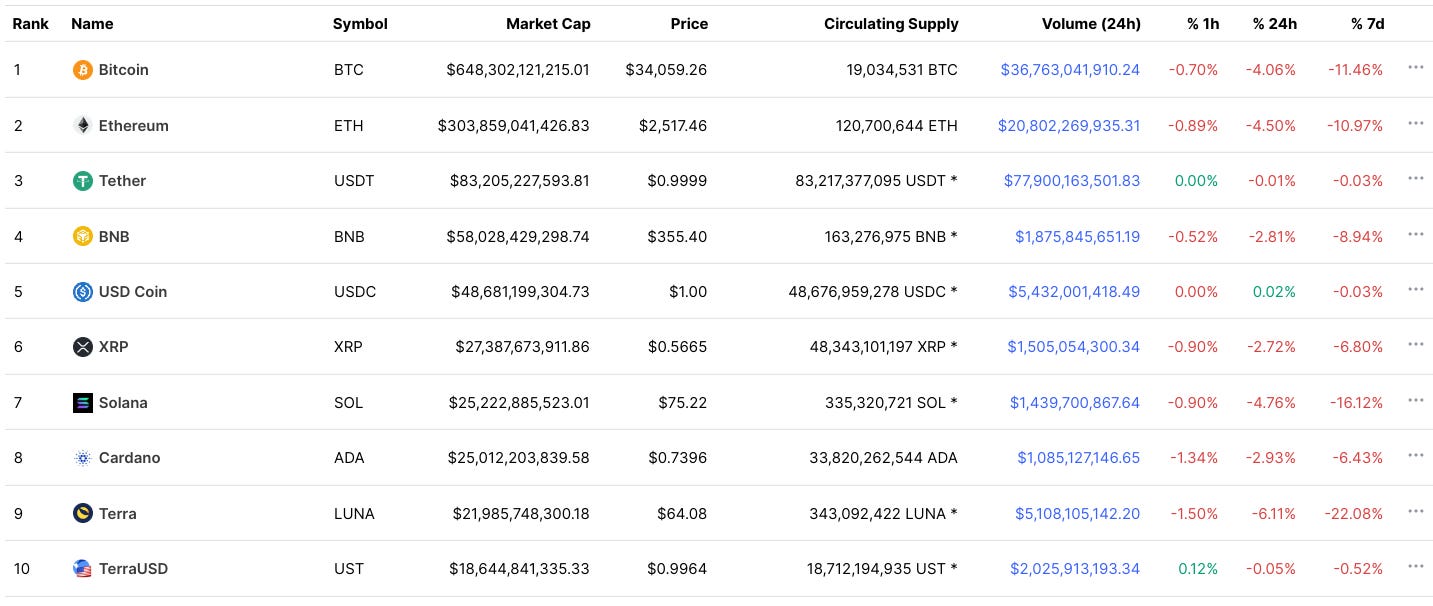

On May 8th, LUNA and UST were both in the top 10 (rank 9 and 10 respectively) cryptocurrencies in terms of market capitalization. Combined their market cap amounted to about $40 billion, which would put them at rank 6, right behind Bitcoin, Ethereum and the other major (centralized) stablecoins:

As the rumors and concerns about whether the peg could be maintained increased, the spreading panic led to a bank run-like situation starting on May 9th.

Over the following days, people rapidly started to withdraw their UST from the Anchor protocol and exchanged them for $1 worth of newly ‘minted’ LUNA.

Through this process, the LUNA supply massively increased. The LUNA token holders were therefore faced with the following two options:

Trust into the long-term viability of the Terra ecosystem and hold on to the LUNA tokens (whose supply was rapidly increasing while the price was rapidly falling).

Quickly sell it!

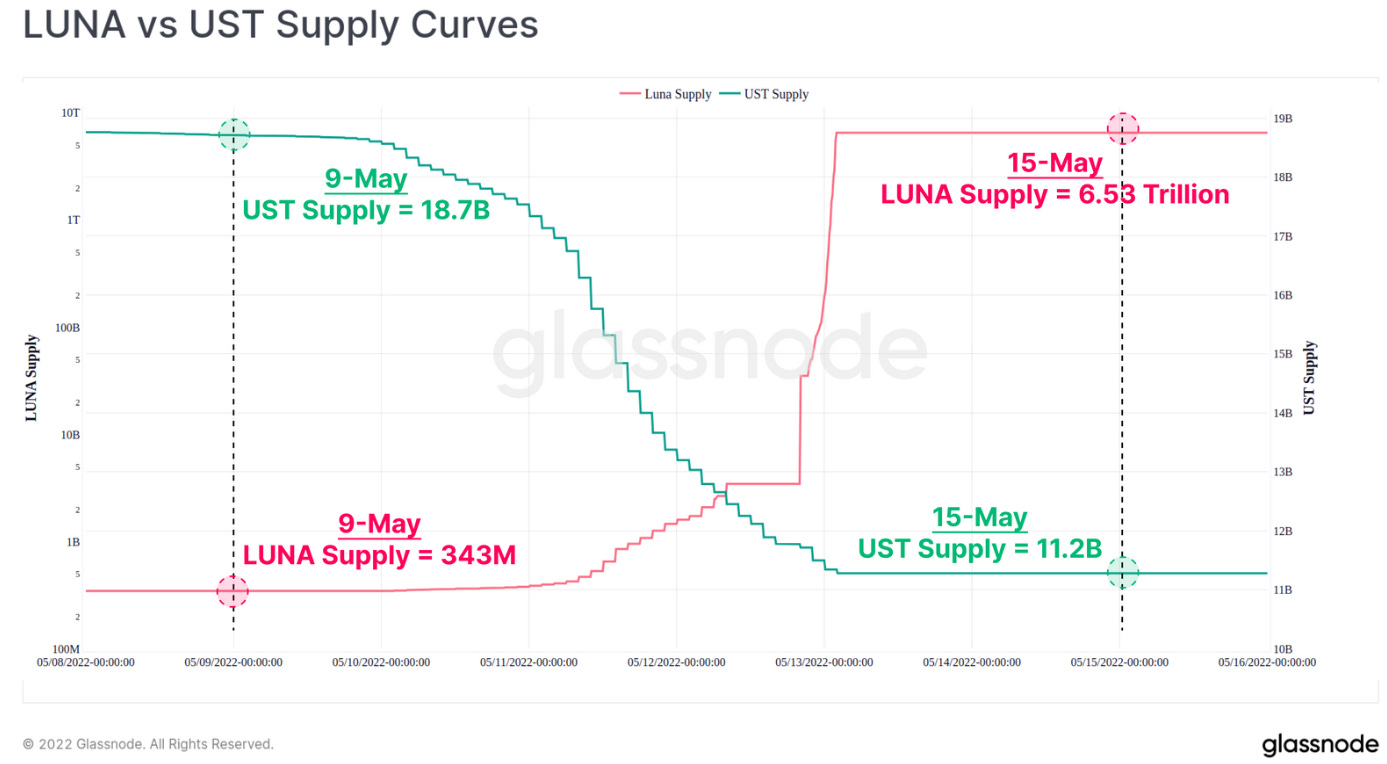

Obviously, most decided to sell and LUNA experienced a hyperinflation:

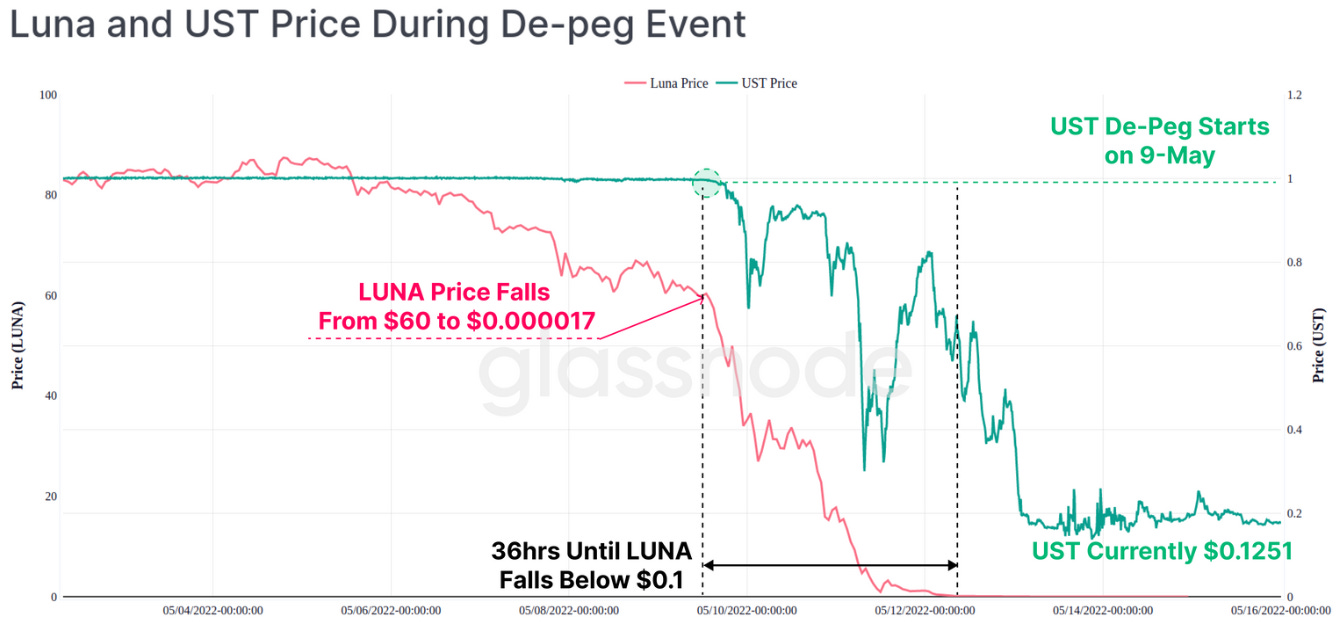

It actually took only 36 hours for the price of LUNA to decline from $60 to $0.1:

As can be seen in the above chart, the UST price (green line) still experienced some rally attempts to get back up to the $1 dollar peg. This is due to the attempts by the LFG to defend the peg by selling their BTC reserves. These reserves were all sold in three tranches within 24 hours — one of the largest Bitcoin sales that ever happened — but it was not enough to defend the peg.

“When you are right, you cultivate the delusion that you know something. When you are wrong the air goes out… the windbag flattens… and you see yourself for the idiot you really are.”

— Bill Bonner

Zooming out, the story can be summarized by looking at the market cap of LUNA and the price of Terra:

This is where the story of Luna and Terra ends. Actually, upon the collapse, many observers were quite optimistic, given how robust the bitcoin price reacted to the rapid sale of 80,394 bitcoin.

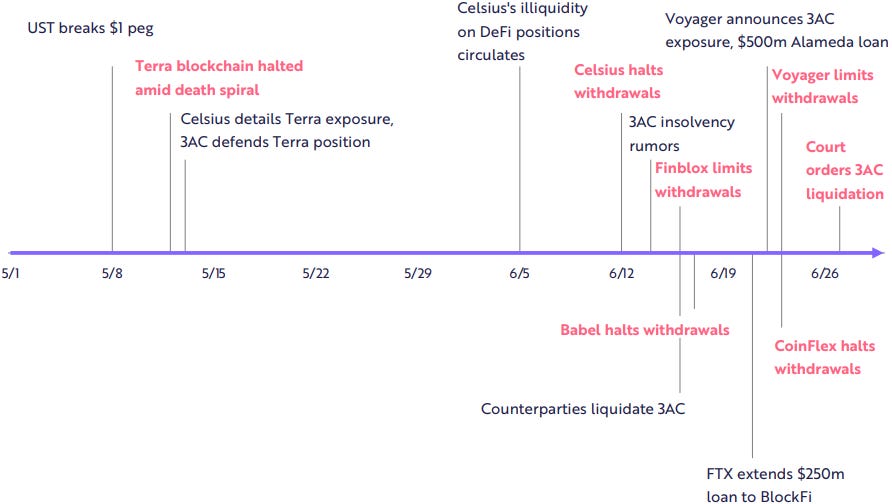

It dropped from around $34,000 to slightly below $30,000, before seemingly stabilizing around that price level over the following days. However, it triggered the start of a massive contagion effect throughout the whole cryptoverse.

The Contagious Effects Rippling Through the Crypto Industry

“Only when the tide goes out do you discover who's been swimming naked.”

— Warren Buffet

This famous investment quote perfectly describes what happened in succession of the Terra & Luna collapse.

In the ensuing days, markets calmed down a little, but it was clear that there would be some effects of this meltdown. If $40 billion of value just evaporates like that, there must be some contagion somewhere. Will Clemente tweeted out the relevant question:

It turned out that a lot of well renowned DeFi related companies, exchanges and lending platforms were involved in various yield-seeking schemes that were in one way or another exposed to the Terra ecosystem, but without applying the adequate risk-management procedures, to protect against scenarios such as a blow-up of Terra & Luna.

As it turned out, a lot of them were swimming naked.

There were several prominent people, such as Brad Mills, Nic Carter, Cory Klippsten and Lyn Alden, who looked into it and warned against the flaws of the Luna-Terra design and the likelihood of such an outcome. So it definitely cannot be framed as a black swan event.

A structural problem that has been building up throughout the crypto industry over the last few years, is the expanding construction of complicated products to generate yield.

The gist of it is, that some of the involved institutions took massive amounts of risks in order to grow their user base and generate higher yields, which was done through:

Unsecured lending: Lending out assets without requiring the lender to post a sufficient amount of collateral.

Rehypothecation of collateral: Using the collateral (posted on the platform to secure loans) to invest in other projects. Or, to use it on another platform as collateral to borrow other assets. And they might proceed doing the same. This leads to a situation in which a certain asset serves as collateral for many investment schemes.

A lot of leverage: Lending assets exceeding the value of the own assets to invest.

Moreover, the market structure in the world of Decentralized Finance (DeFi) is quite distinguished from what is going on in the traditional financial sector:

One aspect that separates the DeFi world from the TradFi world is, that it relies on transparent blockchains. The movements of assets can be followed and transactions settle immediately.

Some (the more prudent) entities engage in something called ‘Proof of Reserves’, in which it can be verified that the entity actually holds the assets that it claims to have.Another aspect is, that there is no government-guaranteed deposit insurance and no state-sponsored lender of last resort.

The problems with unsecured lending, insufficient collateral and rehypothecation became obvious when billions of value disappeared from the Terra & Luna collapse and the value of other (collateral) assets also lost substantially in value. This led to margin calls and forced selling of assets, which in turn triggered further margin calls, liquidations and value depreciation of assets.

In short, it unleashed a downward selling spiral and the contagion effects ensued and quickly rippled through the cryptocurrency ecosystem.

Lets look at some entities and in which way their exposure caused contagion:

3AC: As mentioned above, Three Arrows Capital, a hedge fund focused on DeFi investments and reportedly managing $18 billion at its peak, is the protagonist culprit:

Due to its reputation, it was able to borrow money unsecured from several counterparties. Including:

15,250 BTC from Voyager.

$350 million of USDC.

Due to its reputation as a large hede fund, it was also able to trade on Deribit (a trading platform for options and futures of cryptocurrencies) without posting collateral.

They had invested $1.3 billion and were the largest holder and therefore heavily exposed to the arbitrage trade in the GBTC fund, whose discount continuously widened up to 34%.

→ Fails to meet margin calls, facing insolvency.

Celcius: One of the largest lending platforms.

Suffered losses through hacks in DeFi projects in which they had exposure:

$22 million loss in the Badger DAO hack.

Like 3AC, they also had heavy exposure to the staked Ethereum (stETH) scheme.

Completely halted all withdrawals.

→ Potentially insolvent and on the verge of filing bankruptcy.

Blockfi: Maybe the largest retail lending platform.

Also heavily invested in the GBTC trust.

Announced to shed 20% of its workforce.

→ Gets a ‘bailout’ loan of $400 million from FTX including the option to be bought for up to $240 million.

Voyager: Cryptocurrency exchange platform.

paused withdrawals .

Finblox: A trading and lending platform.

Involved with 3AC to generate yields.

Limited its withdrawals to $500 a day and $1,500 a month.

Paused reward distribution.

Babel: Lending platform based in Hong Kong.

Reports liquidity issues and suspends withdrawals.

Genesis: Cryptocurrency lender and broker.

Exposure to 3AC.

Parent company Digital Currency Group, has “assumed some of Genesis’ liabilities related to 3AC”.

CoinFlex: Exchange platform.

Unsecured lending: Claim to have had special agreements with a large investor, preventing them from making a margin call.

Halts withdrawals.

Ark-Invest summarized some of the important events in a timeline:

Many risks taken by the above listed institutions, were unquantifiable and lacked transparency. A combination of DeFi hacks, leverage, rehypothecation of collateral, counterparty risks, duration risks such as GBTC and stETH and illiquidity, lead to these collapses.

It remains to be seen if the cryptocurrency ecosystem can take these events as a lesson to learn from and improve upon.

One way to get there, would be the proliferation of the “Proof of Reserves” standard among crypto institutions that provide custody based products.

To summarize it all, basically, the 17% decline in May and the 38% decline in June can be capsulized by the following 2 big developments playing out throughout the crypto market:

May → Terra & Luna collapse

June → Contagion effects

Have We Reached the Bottom? Or, Are Further Shock-waves to Be Expected? Might Bitcoin Be the Canary in the Coal Mine?

The question is whether we have seen the worst and are bottoming out, or whether there is more distress coming in the next few weeks. Some on-chain metrics appear to indicate that based on several historical floor models, we should be in the final capitulation phase, but given the macroeconomic environment, the viability of these models could be tested. In addition, there are still concerns about the financial condition of some companies in the space (e.g. some of the leveraged miners seem to be in a precarious situation). Therefore, it wouldn’t surprise me, if we haven’t seen the bottom yet.

Key Takeaways from these events:

Some due diligence and appropriate risk management considerations before investing in any yield seeking schemes are highly recommended.

Always keep in your mind: Not your keys, not your coins!

I will limit my price prediction to the hunch that once Powell pivots, rates get cut back to zero and the next rounds of QE and stimulus get injected (which I still believe is inevitable), the Bitcoin spaceship will skyrocket. 🚀

The final question is, whether what happened in the crypto hemisphere, is just a canary in the coal mine, for what is going to play out in traditional financial markets!?

When it comes to undercollateralization and overleveraged institutions, the crypto market is a small fish in comparison to what is going on in TradFi. During the Terra meltdown, the largest stablecoin issuer, Thether (USDT), also experienced a situation similar to a bank run: It redeemed $7 billion within 48 hours, which represents about 10% of their reserves. I am pretty sure that most financial institutions would not be able to do that within such a short time frame.

The difference is, that in the DeFi world, there is no central bank that can print the money to bail them out. Additionally, the naked swimmers are not as easily identifiable through the jungle of balance sheets and quarterly reports, as they are on transparent blockchains with immediate settlement.

Is Japan Gonna Be the Luna for the Sovereign Debt Collapse?

A financial system based on credit is just an exchange of money today for money later. I give you dollars today and temporarily lose the utility of my money in exchange for having more later. You have the inverse: the benefit of more money today and less tomorrow as you pay back the loan with interest.

This system works on trust - trust that you will pay back what you said you would pay. It is the same whether that trust is in a person, company, or government. Remove trust and it affects the credit-worthiness of an individual or company. Remove trust from a system and the entire system can unravel very quickly.

— Jeff Booth (The Price Of Tomorrow)

In the culmination of the Terra & Luna collapse, we saw the LUNA token hyper-inflate, by trying to keep the peg of the UST intact. But once the trust was gone, it was a failed attempt.

The Deterioration of the Yen

Historically, the Japanese Yen, has become known as a safe haven asset to hold in times of turbulence.

However, recently we have seen the reverse reaction, which is quite alarming:

The Japanese Yen has not only failed, to act as a safe haven, it has literally been obliterated over the recent months. Since the Ukraine invasion, it has given up about 20% against the USD. It seems like investors are losing their trust in Japan’s ability to service its debt.

Debt to GDP

This needs to be put into context to Japan’s immense debt problem:

An often mentioned study by Hirschman Capital pointed out, that out of 52 countries that reached government debt levels of over 130% of GDP, 51 ended up defaulting on the debt within the next 15 years in some way or another.

Japan is the only country which has defied this rule — so far.

Many analysts point to this as a prove that high government debt doesn’t necessarily lead to a default, but I would be cautious with that assessment. From my perspective, they first need to be able to somehow reduce their debt burden before they can claim any victory. So far, they have only shown that they were able to keep this high ratio going for more than 15 years, but the ratio keeps rising.

Lyn Alden describes the general phenomenon as follows:

To put it bluntly, when debt gets this high relative to GDP, the only way out is to default in some way. If the debt is denominated in a currency that the government can’t print (like for emerging markets with dollar-denominated debt), it eventually leads to nominal default. If the debt is denominated in a currency that they can print, it usually leads to significant devaluation of that debt via inflation, where inflation (and along with it, nominal GDP) runs much higher than interest rates for a while.

At that point, the ability to get out of inflation depends on private markets’ and policymakers’ ability to create new industrial capacity for goods and services and commodities. In other words, high levels of productivity must be re-established, or the pain continues in one form or another.

— Lyn Alden

Earlier in the year, we saw Sri Lanka unable to service its foreign debts and default. Many other developing countries also seem to be on the brink of a nominal default, as they are dealing with the aftermath effects of all the insane global Covid policies.

Japan is in a different position, since their debt is mainly denominated in Japanese Yen, which they can print.

Again, many tend to point out, that government debt is fine as long as it is owed to the own population. I think this is an erroneous way to look at it: “We owe it to ourselves” is the spirit of this thinking. But who are the “We” and who are the “ourselves”? There are either individuals or institutions behind the deal, who expect to be repaid. What difference does it make whether I lend money from my neighbor, or a friend who is living in another country? In the end, I need to pay the debt and if I don’t, the other party incurs a loss. It is the same when it comes to sovereign governments.

Furthermore, while the majority of the debt is owed to domestic investors and institutions, with 97.8% in 2021, it also has a high amount of external debt (denominated in other currencies, mainly USD), which has been rapidly rising over the past months with the falling yen.

Japan’s Budget and Fiscal Policy

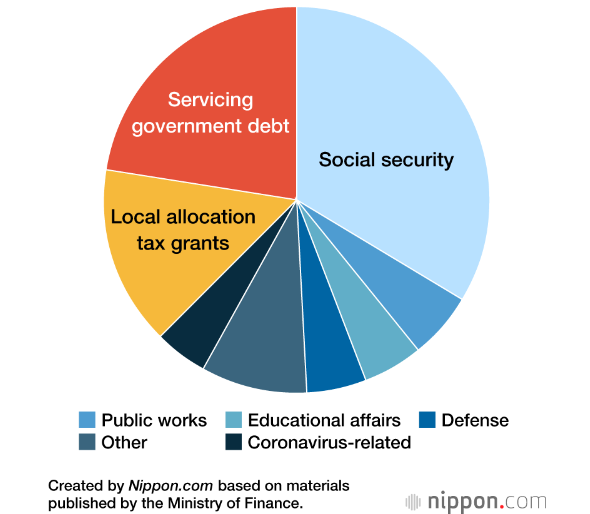

Japan’s 2021 budget amounted to ¥106.6 trillion and had the following budget composition:

Social Security is the largest component, but servicing the government debt is already the second largest component and makes up more than 20% of the expenditures.

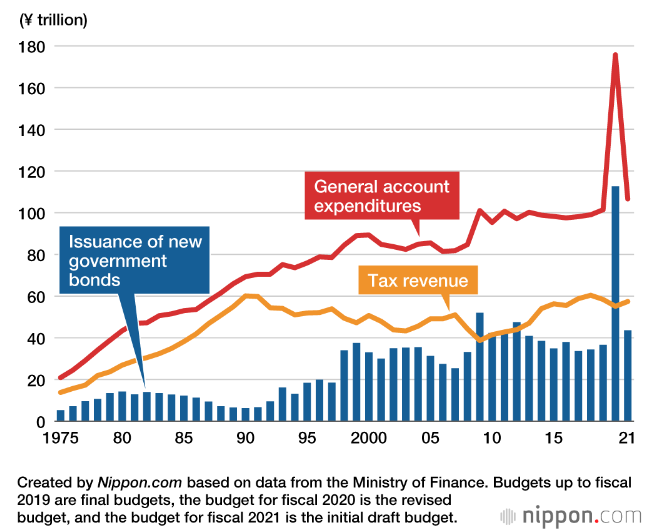

The next chart shows the government’s revenue (yellow), it’s expenditures (red) and the issuance of new debt (blue):

The trend of this chart shows the precarious position that Japan is facing. The yellow and the red line shifting further and further apart, implies that the government needs to run an increasing amount of newly issued debt. The fact that the blue bars almost touch the yellow line means that almost half of the budget is financed by new debt.

In my estimation, Japan has already entered into a debt spiral.

The total national debt is about $10,23 trillion, or ¥1,392 trillion.

At a tax revenue of about ¥60 trillion, this means that an interest rate of 4.3% would be sufficient to put the government in a position in which 100% of the tax revenue would be required to service the debt. Game over.

The JCB: Monetary Policy and Yield Curve Control

High debt is the fundamental reason why Japan has started to control the yield curve. The Japanese central bank offers to buy unlimited amounts of 10-year bonds, to cap the yield at 0.25%.

Recently, it was observable that the upper limit of the yield curve control was tested, putting the JCB’s credibility under pressure.

The question is, whether they are capable of keeping this insane monetary policy going. There are varying opinions about it:

Some believe they will pivot, follow the tightening of other central banks and let the rates go higher.

Others believe that they will feel the need and try their best to stick to it.

Another theory is, that the Fed and other central banks might step in and buy Japanese debt in order to prevent global turmoil.

In any event, it remains interesting to see, how this monetary adventure will play out over the coming months.

Other Economic Considerations

Apart from the monetary and fiscal issues which Japan is facing, its economy is also underpinned by some structural problems, which make the situation look even more dire:

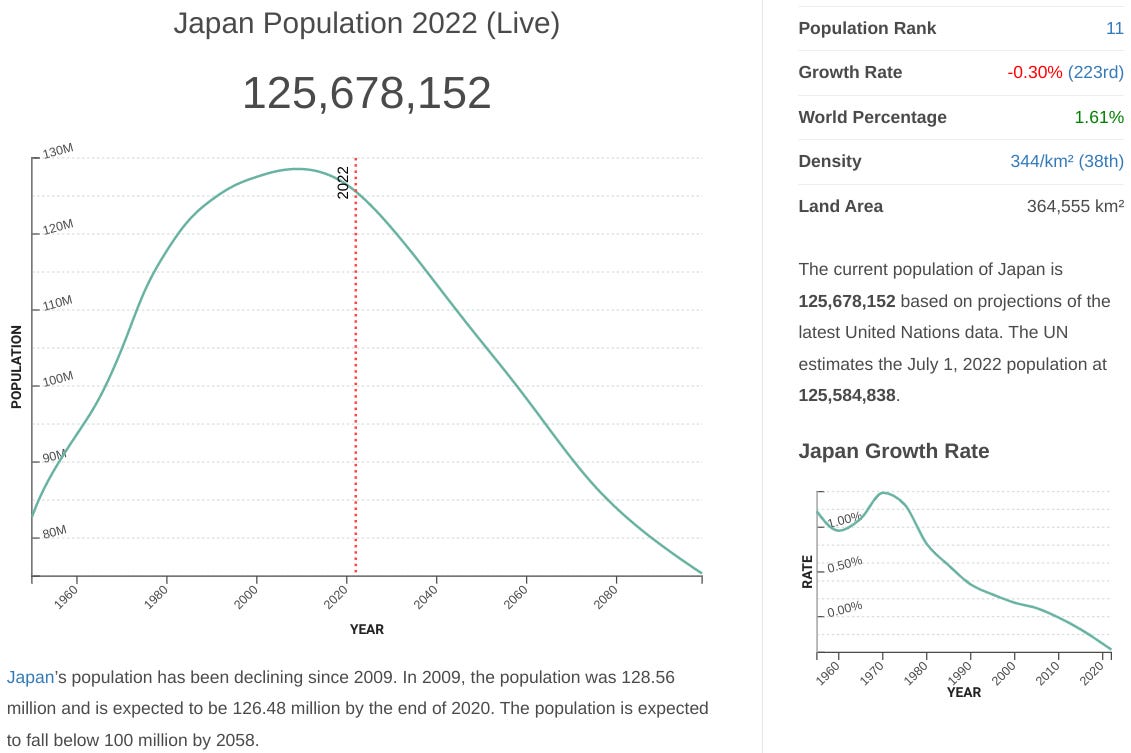

Japan’s population has peaked in 2009. Its population is aging and rapidly declining. This means that the workforce will become significantly smaller over the years ahead. This has two implications:

A substantially higher tax burden to pay for the massive debt burden.

Less ability to support the elder generation and finance the rising social security expenditures (which is already the largest component in the budget).

The energy crisis also puts tremendous pressure on Japan:

The country is a major energy net importer and therefore one of the countries that suffer the most from rising prices.

It is the 5th largest net oil importer.

It has no pipelines and relies totally on LNG carriers to deliver natural gas. Due to Europe’s recent endeavor, to reduce gas dependency from Russia, they are now competing for the same LNG supplies.

The working culture: The working culture of Japan is very hierarchical and has failed to adjust over time to a new environment of international markets. According to Globis Insights:

”Japanese working culture is notorious for rigidity, lack of transparency, and slow decision-making. This is partly a reflection of traditional Japanese culture and its many unspoken rules. But globalization makes things even tougher.”

This has implications for Japanese business performance. It is not anymore the vibrant and innovative economy that it used to be in the 80s and 90s.Finally, Japan has seen a comparatively weak recovery from the Covid pandemic, which puts further pressure on it and makes it more difficult to deal with all the other above mentioned issues:

Conclusion

For most people, it is hard to imagine that one of the major economies could witness a hyperinflation. The majority thinks that it can only happen in banana republics and mismanaged countries. I believe that all countries are heavily mismanaged. I further believe that our financial system is fundamentally flawed — just as the Terra & Luna pegging — and that it is very erroneous to trust central banks to ‘manage’ the economy. Looking at historic evidence (all centrally controlled forms of money have failed), should at least trigger people to contemplate the idea that maybe the money supply should not be managed by authorities.

From a financial perspective, Japan is definitely in a very precarious situation. And as we have seen with the Luna & Terra collapse, once the trust is lost and panic sets in, things can rapidly spin out of control. In this scenario, there will be enormous pressure on the yields to shoot up, as the currency further declines. If the JCB wants to defend the yield curve and purchase an unlimited amount of bonds, then we might see a LUNA event.

How likely is such a scenario? Well, it depends on many factors and there are many things that could happen around the world that could impact these developments.

But I wouldn’t rule it out.

For my part, I try my best to adhere to my understanding of economic principles. And the economist, who I admire the most for his work in building a coherent economic framework, is Ludwig von Mises. In his book ‘Human Action’ he makes the following assessment:

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.

— Ludwig von Mises (Human Action)

What this quote suggests with regards to Japan’s monetary policy, is that the ONLY way to prevent a prolonged very high inflation — or hyperinflation — is to stop the credit expansion. This would mean to abstain from the yield curve control and let the rates rise to whatever level the market will put them.

Of course, this would lead to a severe economic collapse, with bankruptcies and suffering. But it would probably be the better solution in the long run.

The Oil Price as Economic Indicator

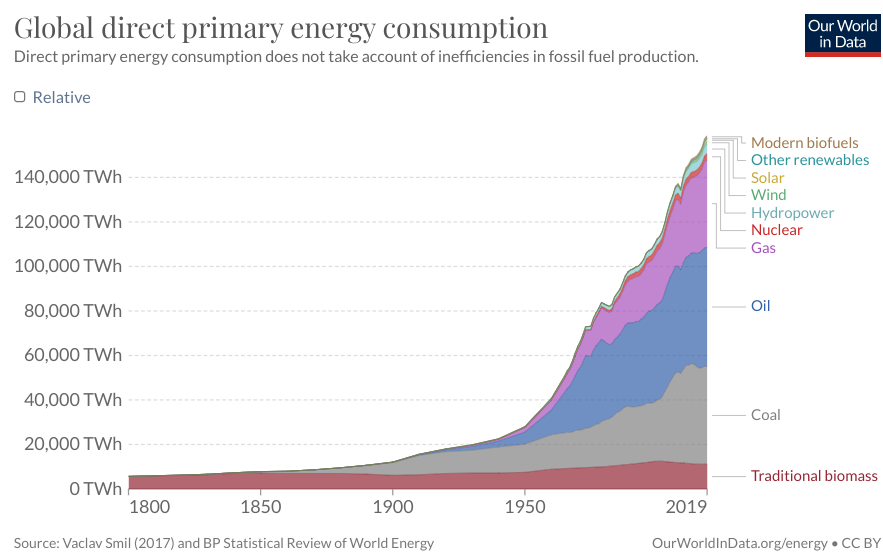

Oil, sometimes referred to as ‘black gold’, is unquestionably the worlds most crucial energy source. Since the 1950s, it started to quickly become the primary energy source, that underpins our modern society. Like blood vessels of the body, it is crucial for the economy to function, it can be moved around to wherever the energy is needed and it is the essential input required to move goods and people around the globe to their desired destination. Foremost, it is our largest energy source and currently accounts for roughly 1/3 of our energy consumption.

The following chart provides a good indication of our energy composition:

Over the last decades, oil has gotten a lot of bad press and there is a general attempt to reduce its usage in the future. Many people, who demonize the use of oil as an energy source, have spent little time doing proper research about the matter. Therefore I want to emphasize here — and it is hard to overstate — how important this energy source has been (and still is!), for economic development and human flourishing.

Most people think of oil mainly as an energy source, that is used to power machines, heat our homes and predominantly it is thought-about, as the key resource to move around vehicles. This is not wrong, about 2/3 of the oil is used as fuel in the transportation sector, to move cars, trucks, trains, ships and airplanes across the planet. However, oil is also a crucial component of most chemical products. About 1/3 of oil is used for industrial purposes, such as:

Cosmetics (oils, waxes, perfumes, shampoos, conditioners, and hair dye).

Lubricants

Synthetic Rubber (e.g. sport articles, shoes, and tires).

petrochemicals (almost all plastics are made from petrochemicals).

Synthetic fertilizers and pesticides to produce food and keep it fresh longer.

Asphalt

Synthetic Fibers

Since oil is such an important ingredient in so many aspects of our daily lives, it follows, that its price has a tremendous effect on economic activity. Falling oil prices make it cheaper to produce products and ship them around the globe. Hence, sinking oil prices literally ‘fuel’ economic growth. For the same reason, a rising oil price is a major contributor for economic slowdown and inflation.

Further, since oil is so important, but reserves are limited and located in certain regions, it has always been a source for geopolitical considerations and tensions.

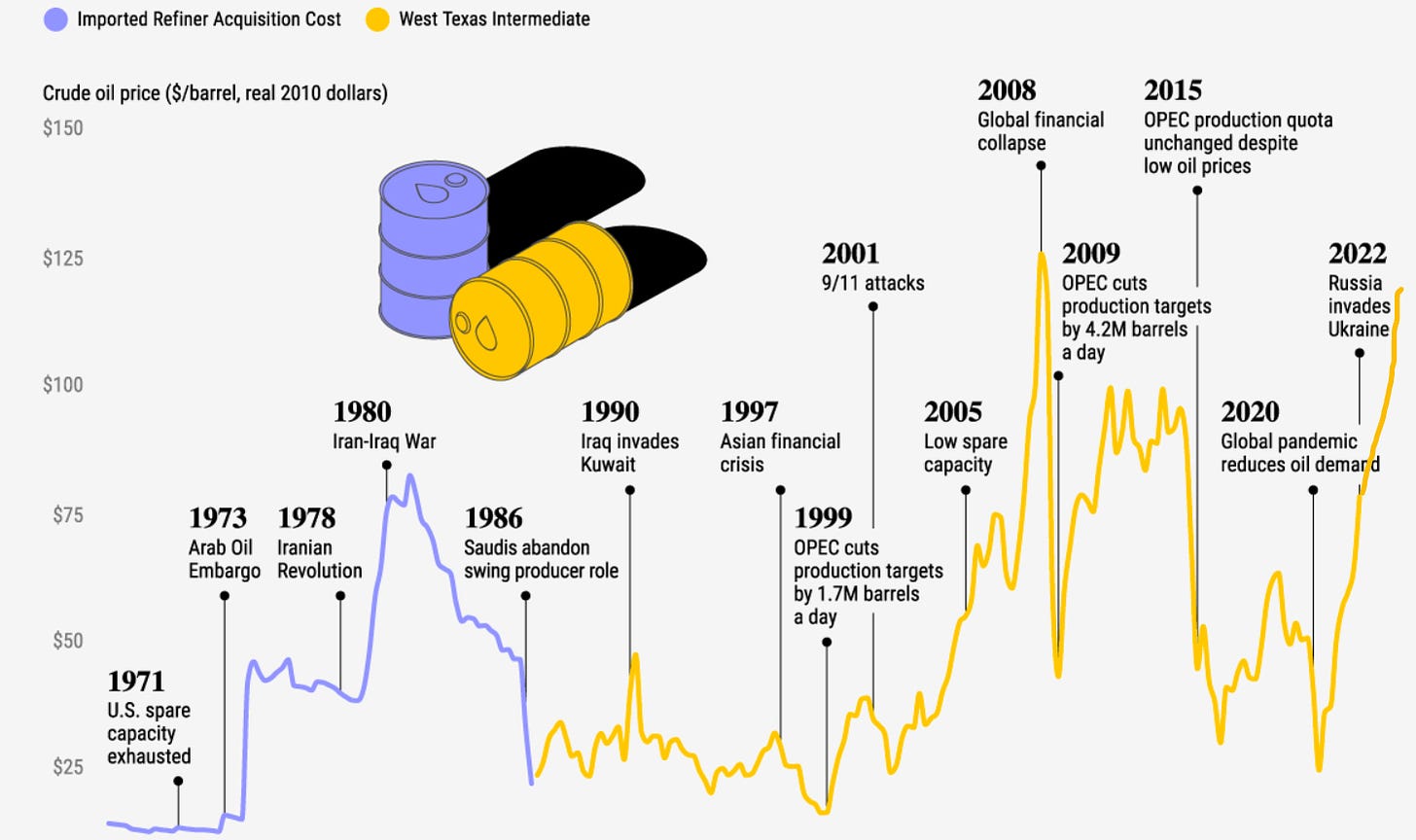

The following chart provides a nice historical perspective on the oil price and how it reacted to economic and geopolitical events:

Notably, oil saw a huge price increase, triggered by the Arab oil embargo in 1973. During the 70s, which was a period of high inflation, there were a lot of tensions between the Organization of the Petroleum Exporting Countries (OPEC) and the U.S. In the 80s, the price came down and remained fairly low for the following 15 years. Throughout this time, the oil market was essentially dominated by state-owned companies of the OPEC countries. In the 2000s, the oil price started its massive rise, culminating in the 2008 financial crisis and was followed by a crash. Thereafter, the price started to move up again until it collapsed in late 2014. This was influenced by the availability of cheap capital, accompanied with new technological advancements, which enabled the access to new sources. This so termed ‘Shale Revolution’ enabled the U.S. to massively increase their production and become the largest oil producer.

After the pandemic shock (in which oil futures even briefly traded at a negative price), we saw a continuous rise in the oil price and this rise was magnified by the invasion of the Ukraine and the subsequent sanctions against Russia.

It can also be observed, that oil is volatile and the price-swings are quite substantial. This is partly due to the fact, that it is not only driven by markets, but is rather heavily influenced by political decisions.

There are some things that are important to comprehend, when thinking about the market structure. Fundamentally, the oil market is set by supply and demand.

The process of exploring and ramping up drilling wells is a quite complex and time intensive process which requires a lot of capital expenditure.

The demand is also relatively stable since it is often difficult or imposes high friction costs of changing from oil products to alternatives. But the demand is not as stable as the supply:

A downturn in economic activity can reduce the demand substantially.

High price increases will lead consumers to rely on substitutes wherever it is possible.

This is why the price swings are so extreme. The continuous supply that is drilled out of the wells remains constant in the short and medium term — unless there is direct political meddling, such as OPEC restrictions or import embargoes. Hence, the oil price is predominantly driven by the general economic and political outlook.

To get a better understanding of the geopolitical implications, it is important to have some idea about where it is produced and where it is demanded.

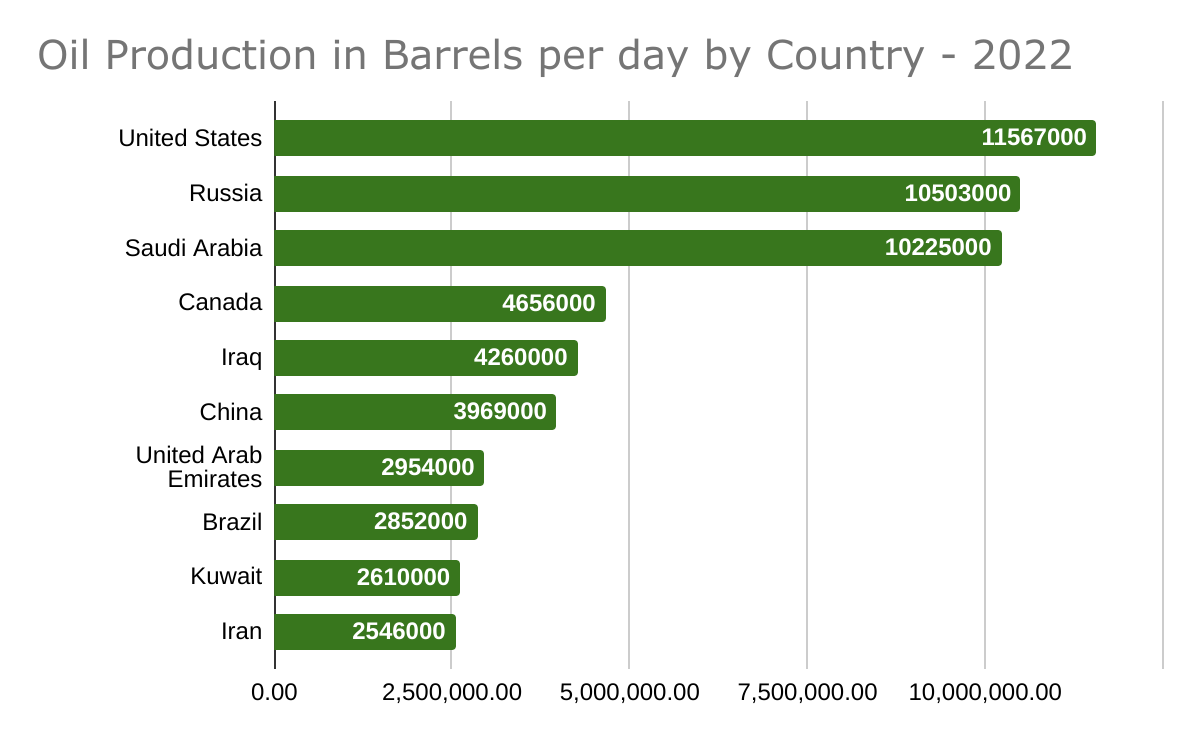

The United States, Russia and Saudi Arabia are by far the largest oil producers. However, it doesn’t follow, that these countries are necessarily also the beneficiaries of rising oil prices. For instance, even though the United States is the largest producer of oil, it has such a high consumption, that it is a net-importer of oil. Hence, while American oil producers benefit from rising oil prices, America as a whole is negatively affected.

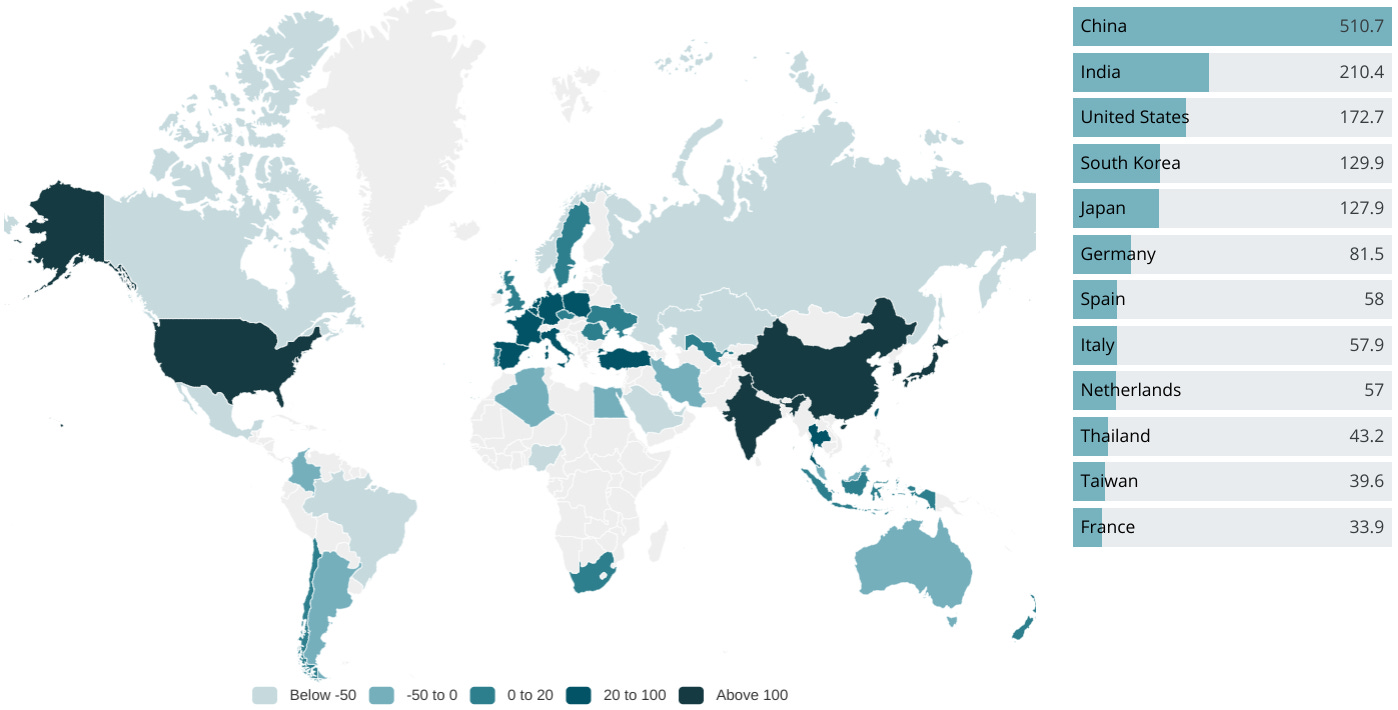

The following chart shows the net imports of oil (the darker, the more oil is imported):

The major net importers are Asian countries and their oil requirements are also rapidly growing, especially China and India. This is also one aspect, why these two specific countries are very reluctant, to follow the Western nations, in holding back from Russian oil imports. From China’s and India's perspective:

They already require a lot of oil imports and given the already painfully high prices, they rather take the discount that Russia provides.

If they also put forward embargoes on Russia, the oil prices would tremendously skyrocket, since 12% of supply would totally disappear from the market and all importers would be bidding for the remaining supply.

They are also not able to simply give out additional money to their huge populations, to compensate for the rising costs, as Western countries currently do. (Actually, Western countries are also not really in a position to do that, but they do it anyway).

They are aware that if they want to keep growing and enjoy the same standard of life as OECD countries do, it will require a massive increase in oil consumption.

Meanwhile, western countries have been in a quest to drastically reduce oil consumption, by meddling in the energy market with political measures and mandates, to discourage investment in this sector. On the other hand, they have heavily subsidized and encouraged the development of renewable energy sources.

As a result, there has been very little capital expenditure towards oil exploration and production over the past decade. Thus, it is likely to see rising demand, facing an inadequate ability to increase the supply.

Moreover, the recent rise in energy prices is met with populist hostility against oil companies ‘benefiting’ from the war by making profits. Many countries consider (or already did impose) windfall taxes on energy companies. These companies massively underperformed over the last decades and now that they are profitable, they get penalized for it. In other words, investors who took the risk of investing in these companies and got little returns, while almost everyone else made massive profits, are now asked to pay additional taxes. This should have another discouraging impact on investment in the oil sector.

Lastly, recessions have been periods, in which the oil price tends to substantially decline. This is due to the largely reduced economic activity bringing down the demand, while the production doesn’t just halt. However, given all the factors stated above, I am doubtful that this will be the case if we should really enter a major recession.

Part ll - What is a Bear Market? And how to Define a Recession?

‘Bear market’ and ‘recession’ are two terms, which are recently thrown around a lot.

So let’s take a look on what these terms really mean and how they are different.

Definition of a Bear Market

Here is Investopedia’s definition:

A bear market is when a market experiences prolonged price declines. It typically describes a condition in which securities prices fall 20% or more from recent highs amid widespread pessimism and negative investor sentiment.

Other assets, such as commodities, individual securities or real estate can also be considered to be in bear markets when they decline a certain amount. However, the 20% is a very arbitrary and loose number. Assets with high volatility might experience such movements quite frequently. Therefore, it does not really make sense to call it a bear market every time.

For instance, in my master thesis I analyzed Bitcoin cycle periods. Since 20% price drops in Bitcoin are quite frequent, I used 40% as the criterion to define the bear market territory. In the same way, it would be erroneous, to call bear markets for particular technology companies, or other volatile stocks, every time when they decline by 20%.

Thus, the 20% benchmark is generally applied to broad indices, such as the S&P 500, to determine whether the stock market is in a bear market.

With the closing of the S&P 500 more than 20% down since the start of the year, we are in bear market territory now.

Definition of a Recession

A recession is a more severe phenomenon than a bear market, because it describes not only the decline in assets, but it is a prolonged downturn of the whole economy.

There are different definitions on what criteria to judge whether we are in a recession. In the US, the National Bureau of Economic Research “NBER” determines, when an official recession has occurred. Their traditional definition is:

“A significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

To determine whether a period should be called a recession, a committee evaluates several indicators with regards to three criteria: depth, diffusion, and duration. However, many of the indicators that they look at, are lagging datasets that are adjusted over time and only confirmed after some time has passed. That means that the NBER always declares a recession in hindsight, after it already occurred.

The general understanding is, that two consecutive quarters of negative real GDP growth determine a recession. This is the ‘technical’ (as compared to the ‘official’) definition of a recession.

Are We in a Recession Right Now?

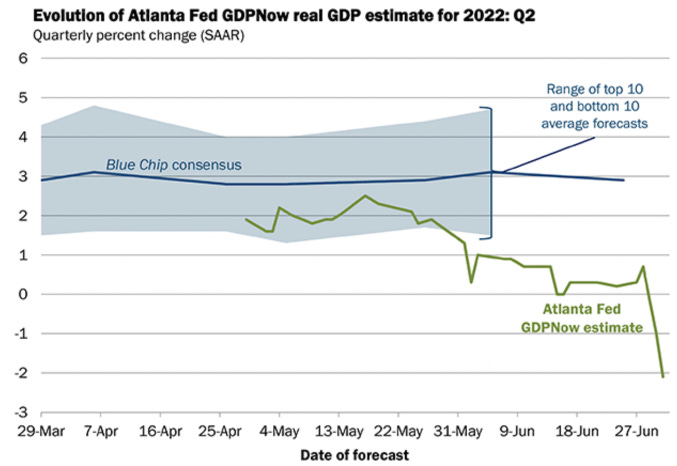

So far, the first quarter of 2022 saw a negative GDP growth of -1.6%. (It fist came out at -1.4% but has since then been adjusted to -1.6%).

If we look at the forecast for the second quarter, the outlook is dire:

The Atlanta Fed currently sees Quarter 2 GDP down 2.1%. If that is true, that would mean that according to the 2-quarter negative GDP growth definition, we are likely in a recession.

Based on the feeling of most people, we are probably in a recession now.

Another way to look at it, is not to look at past economic numbers, but instead focus on current sentiments that people and businesses have about the economy.

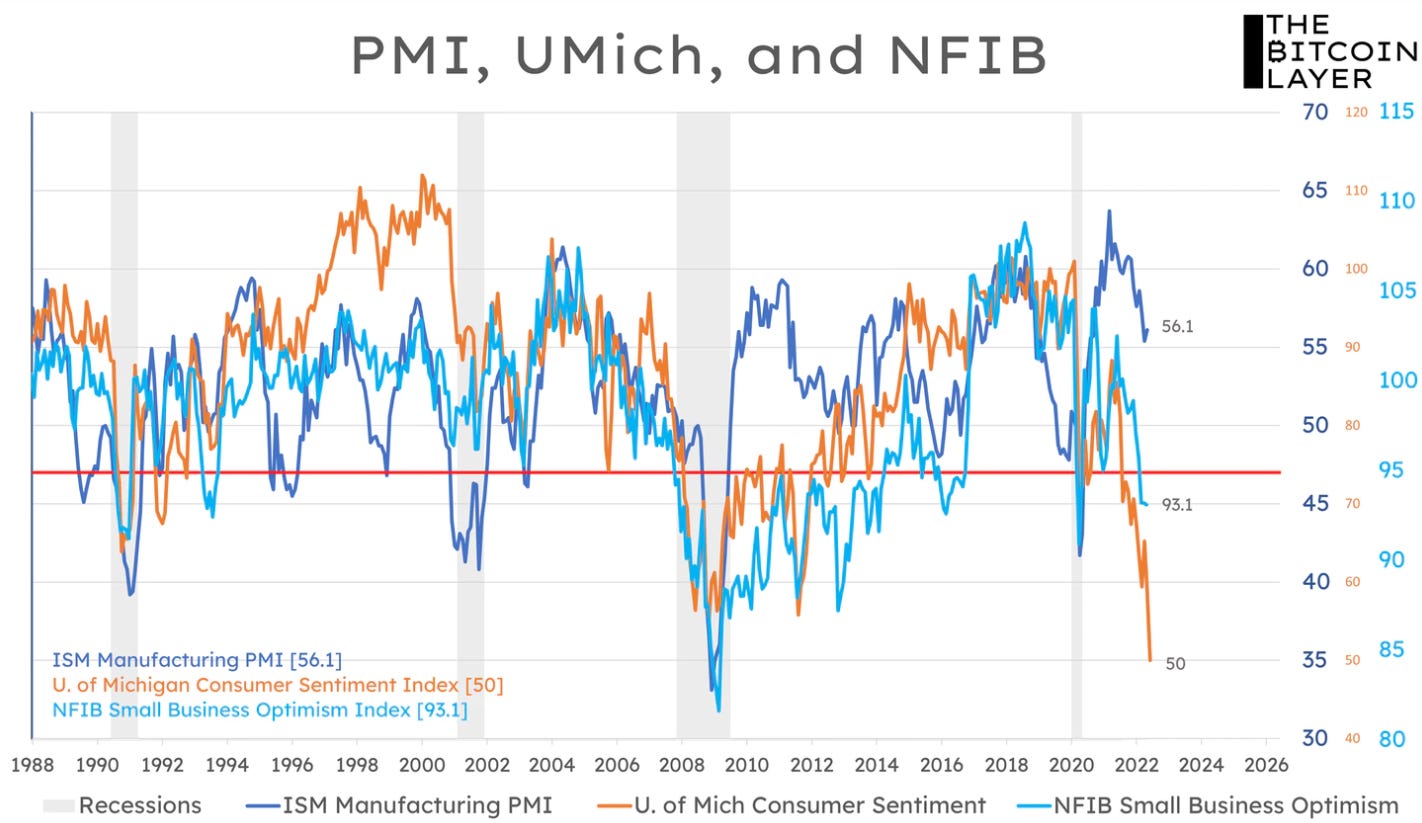

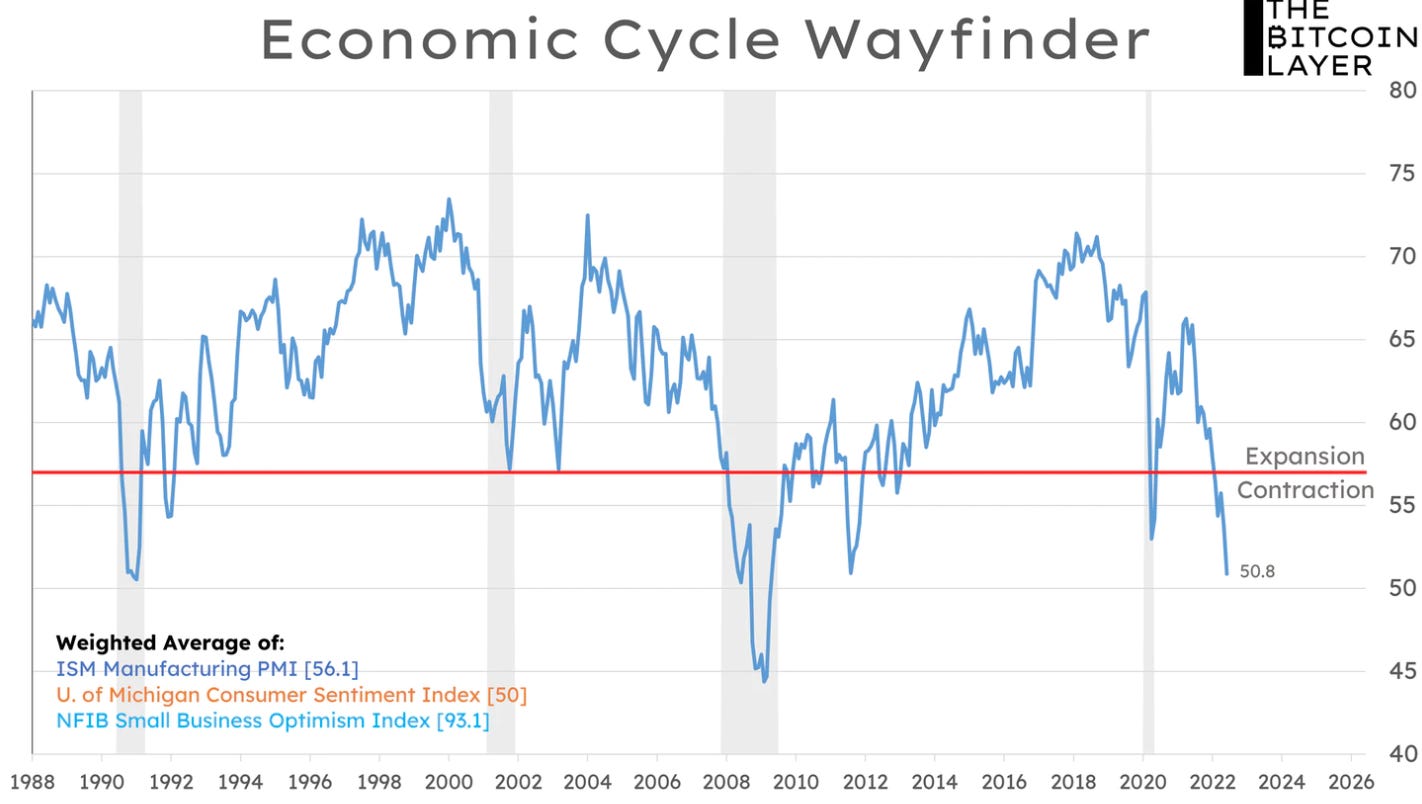

Nik Bhatia and Joe Consorti at the Bitcoin Layer, argue that there are three main indicators to look at, when it comes to determining the Likelihood of entering into a recession:

Purchasing Managers' Index (PMI): This is a survey conducted by asking managers from 300 manufacturing companies about the state of their business.

PMI → Broad manufacturing supply chain healthConsumer Sentiment Index (UNMich): This index is conducted by the University of Michigan through household phone calls and it tries to gauge the consumer confidence in the current state of the economy.

UMich → Consumer healthNational Federation of Independent Business’ small business optimism survey (NFIB): This is a survey focused on gauging the economic outlook of small businesses.

NFIB→Small business health

The chart shows that these three indicators are quite correlated, which makes sense. While they look at it from different angles, all of them capture the sentiments of individuals who experience and need to operate in the same economy.

Moreover, what sticks out of the chart is that the consumer confidence is at an all-time low (the above chart starts at 1988, but the UMich is also at its all-time low since its inception in 1952). This means that the general consumer feels worse about the state of the economy than ever in the past 70 years. That’s quite bad!

The grey areas in the chart show the recessions and it is obvious that all three indicators tend to have substantial downwards swings, before and during the recession periods.

Putting these three indicators together, they come out with the following chart, which they call the “Economic Cycle Wayfinder”:

They use the red line (set at 57) as the benchmark to determine whether we are in an economic expansion, or an economic contraction. According to this indicator, it seems quite likely that the economy is contracting and has entered into a recession.

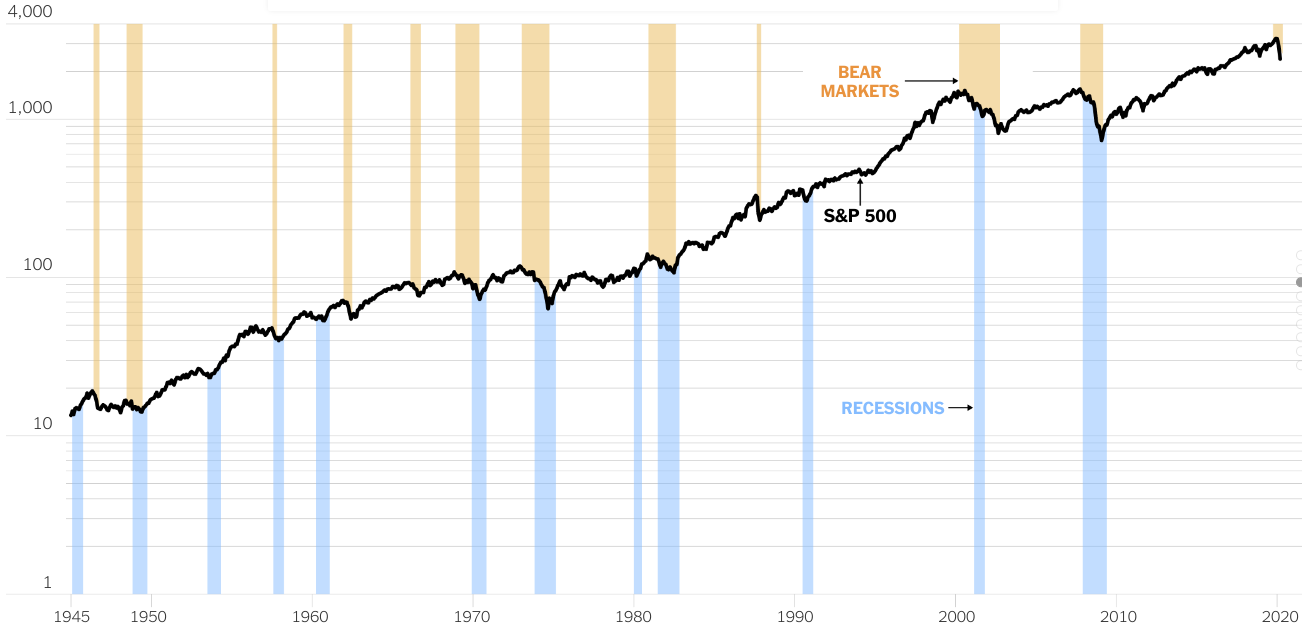

Are Bear Markets and Recessions Related?

The short answer is yes.

While they are not exactly the same thing, a huge downturn in stock markets is usually a sign of troubles in the economy.

The following chart shows how intertwined they are:

As can be seen, bear markets and recession tend to occur in tandems. In many instances, the bear market occurs first.

In general it can be said, that the stock market is a good indicator to gauge what is happening in the economy. However, it does not necessarily predict economic activity. For instance, the Black Monday in 1987 saw stock markets tumble more than 20% within just one day. It happened in an environment of high inflation, rising interest rates and fear of tensions in the Middle East. Nevertheless, the American economy was fine and continued to grow.

Since world war ll, the S&P 500 has had drops of more than 20% from its peak 13 times (including right now). And we also have had 13 recessions during that time (the short recession of 2020 is not shown in the chart). If we are in a recession now, this would be number 14.

Even though we might have a difficult time ahead, recessions are also the time in which things tend to get improved, malinvestments get exposed and more prudent businesses prevail. Investments based on stable fundamentals and a coherent value proposition will survive and strive once the market gets back on track.

Lastly, for investors — at least those who are not exposed swimming naked — it offers many opportunities to scoop up valuable assets at a cheap price.

So cheer up, all you stock speculators and Bitcoin HODLers out there! 😁

I hope you enjoyed reading this newspaper. Likes, comments and shares are highly appreciated. I put a lot of work into it and if you think the content is worth your time, please consider to subscribe, so you can receive it on a monthly basis. Its free and without commercials.

Best regards,

Disclaimer: The content of this newsletter is for informational and educational purposes only. It contains my personal views and opinions, which are not to be taken as direct investment advise. All investments have risks and you should do your own due diligence before making any investment decision. If you require individualized advice, to review your unique situation and make a tailored advice for you, then contact a certified financial planner or other dedicated professionals.