“One of the underrated features of the free market is that it so readily separates fools from their money. In government, fools separate everyone else from his money.”

—Bill Bonner

Bangkok, June 15th,

The meltdown of Terra and the Luna Network has offered a spectacular example of how fools can be quickly separated from their money, while we get daily examples of the government separating everyone else from their money.

My apologies for the late publication. I usually try to send the newsletter out early in the month, to give the analysis of the important things, which happened throughout the previous month in close proximity. My last weeks have been quite busy and I still couldn’t finish writing the coverage of the topics that I wanted to address in this month’s newsletter.

Now we are already halfway through June and the closing prices of the markets in May already appear to be far away in the past.

The inflation rate has surged up yet again to a new all-time high

The stock market has officially entered a bear market

Bond prices are falling like stones, while rates have been shooting up

Oil and gas prices keep climbing and thereby putting additional pressure on everyone.

And while I am sitting in Suvarnabhumi Airport, waiting to board my flight to Phuket, Bitcoin seems to be testing the $20,000 line and if it does, it might also test its high from the previous cycle, back in late 2017.

Later today, Jerome Powell is scheduled to announce the fed-funds rate. Due to the unexpected inflation number, there are rising guesses of whether it will be another 50 bps hike (like the fed indicated in their latest press conference), or whether the hike could be 75 bps, as was apparently leaked out, or even 100.

This could totally shake up the markets once again.

Therefore, this month’s newsletter will be kept short and just focus on providing the basics.

Market Analysis

Key Indicator Rundown

The 10-Year Treasury Rate declined slightly throughout May, finishing the month at 2.84%. However, at the time of writing, it has spiked up again to over 3% in response to the new record inflation rate, which came out last Friday and the expectation that this might trigger the Fed to be even more aggressive in its forthcoming rate hikes.

At time of writing, the rate sits at 3.48% and the yield curve has inverted, as the 5-Year Treasury Yield sits at 3.57%.The inflation rate for April came out at 8.3% and provided some confidence that the hawkish stance of the fed seems to be working.

However, the inflation rate of May, which came out on Friday 10th, has spiked up to a new record again, at 8.6%. Most commentators on the news came out last month, assuring the world that the inflation cycle had probably peaked in April and would be heading lower for the rest of the year.

These inflation numbers are not restrained to America. The Eurozone CPI has also crossed the 8% line and came out at 8.1%.

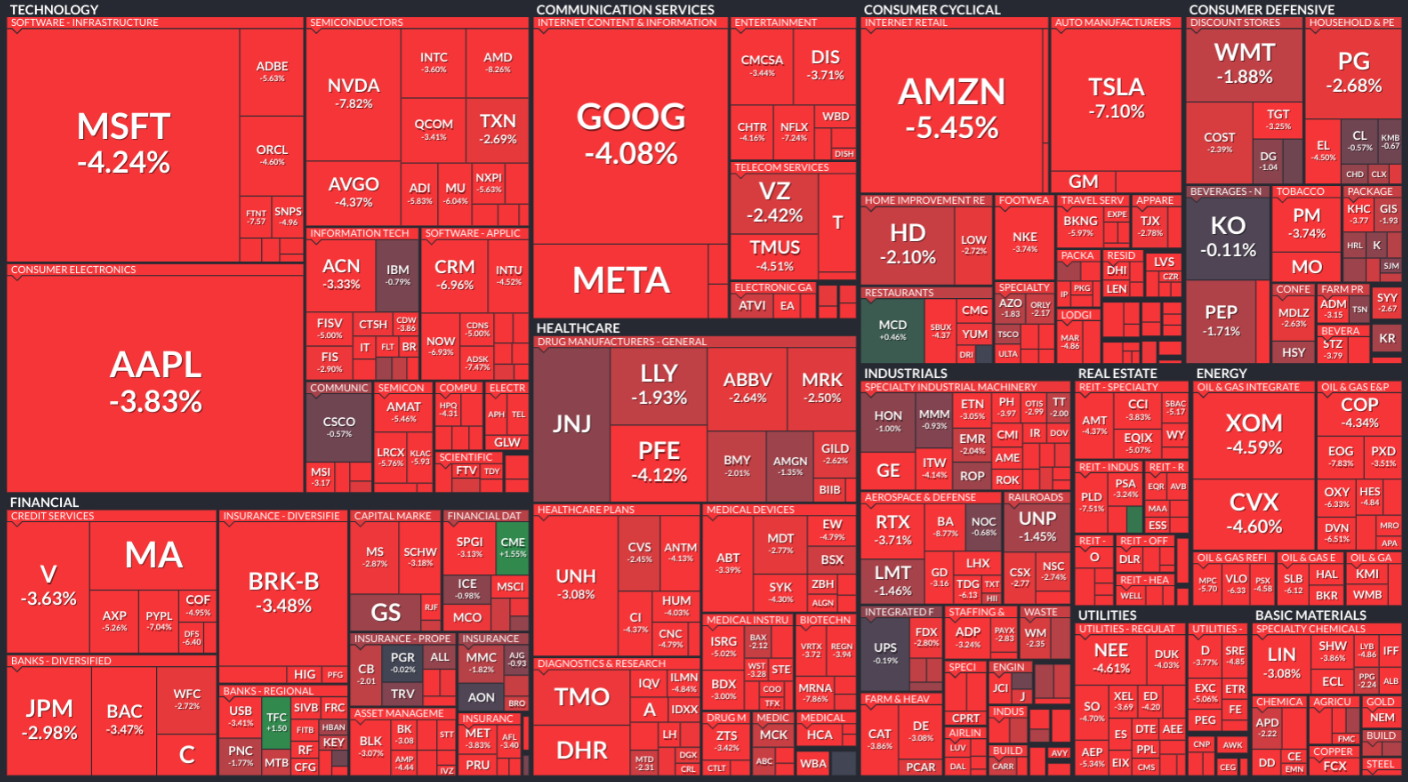

At the same time the stock markets around the globe have been crashing over the previous days. On Monday, some commentators even made comparisons to the “Black Monday” as the stocks got clobbered. Of course, it is not really an accurate comparison, but nonetheless it was quite a bad day for investors, as all indexes lost billions of valuations and almost all stocks saw substantial declines:

Heat Map Source: FINVIZ The heat map of the S&P 500 provides an impression of how bad it was and the index is now officially in bear market territory. Hence, while being flat in May, both, the S&P 500 and MSCI ACWI have been substantially declining throughout the last days.

In May, the Carpe Ratio, as well as the Buffet Indicator saw a slight decline, due to the stock markets trading sideways, while the earnings and GDP outputs are in decline. Due to the stock market declines, these ratios have further declined over the last few days. Historically, they are however still at a very high level, which indicates that we could not yet be close to bottoming out and potentially see further stock market declines. Overall, it becomes more and more likely, that the U.S. has already entered into a recession. It still remains to be seen, how the numbers develop over the coming weeks, but if the second quarter again shows a decline in GDP, then it is officially in a recession.

Furthermore, if the U.S. is in a recession, then it is likely that most economies will also be in a bad economic situation and have difficulties to avoid a recession.

The situation in China is also alarming: According to Seeking Alpha, the decline of economic output data that China is witnessing as a result of the zero-Covid policy is also not providing any positive outlook: “Fresh figures out of China show how its zero-COVID policy is weighing on the country as coronavirus controls continue to bite its economy. Retail sales fell 11.1% on year in April, manufacturing slid by 4.6%, industrial output dropped 2.9%, while fixed-asset investment rose 6.8% in the January-April period (slowing from a 9.3% pace in the prior quarter). Meanwhile, the unemployment rate across China's 31 largest cities climbed to a new high of 6.7% in April as hundreds of millions of people remained under full or partial lockdowns.”

The volatility index VIX is staying at elevated levels, it closed May slightly below 25 and is currently at 32.23, which is not surprising, considering everything going on.

Commodities are still seeing rising prices. Various analysts are worried about potential food shortages on a global scale, which might lead to hunger, especially in developing countries. Ukraine, also known as the “bread basket of the Europe”, has failed to implement all of the sawing due to the ongoing war, which will lead to a substantial decline in crops for the season, while large quantities of the already produced wheat cannot be exported, because a) the harbors are blocked and b) European bureaucracy complications prevent it from being transported to EU member states by train. Meanwhile, India, another major wheat producer, has halted its wheat exports as a protectionist measure to secure the supply for its own population.

Oil and gas prices keep increasing at substantial rates. This might be partially due to the EU member states, which have been pushing to implement further sanctions against Russia.

Rory Johnston from Commodity Context points out that due to the lack of capital expenditures over the last decades and the down-scaling after the Covid shock, there is just not enough crude production capacity at the moment, to quickly get higher outputs. In his recent newsletter post, he shows that the current production is still below the production amount before Covid:

Chart Source: Commodity Context For most folks, it is difficult to comprehend that these things are not coming out of nowhere, but are a direct result of the government meddling into the free market. Unfortunately, there is little general knowledge about how markets function and therefore many look at the wrong potential solutions.

These energy price increases are a direct result of the increasing sanctions, which are levied against Russian energy supply, in combination with the ongoing political pressure to divert investments from fossil fuels to renewable energies. The result of ESG mandates has mainly been, that there has been very little capital expenditure in new exploration and production facilities of oil, gas and nuclear energy. We pay the price for that now.

There are now also increasing uproars against energy companies, who are accused to be taking unfair advantages out of the elevated energy prices. Some governments are considering — or have already implemented — special taxes on profits for energy companies. Policies like that will most likely again lead to wrong incentive structures.

The gold price has also declined throughout May and is at $1833 at time of writing.

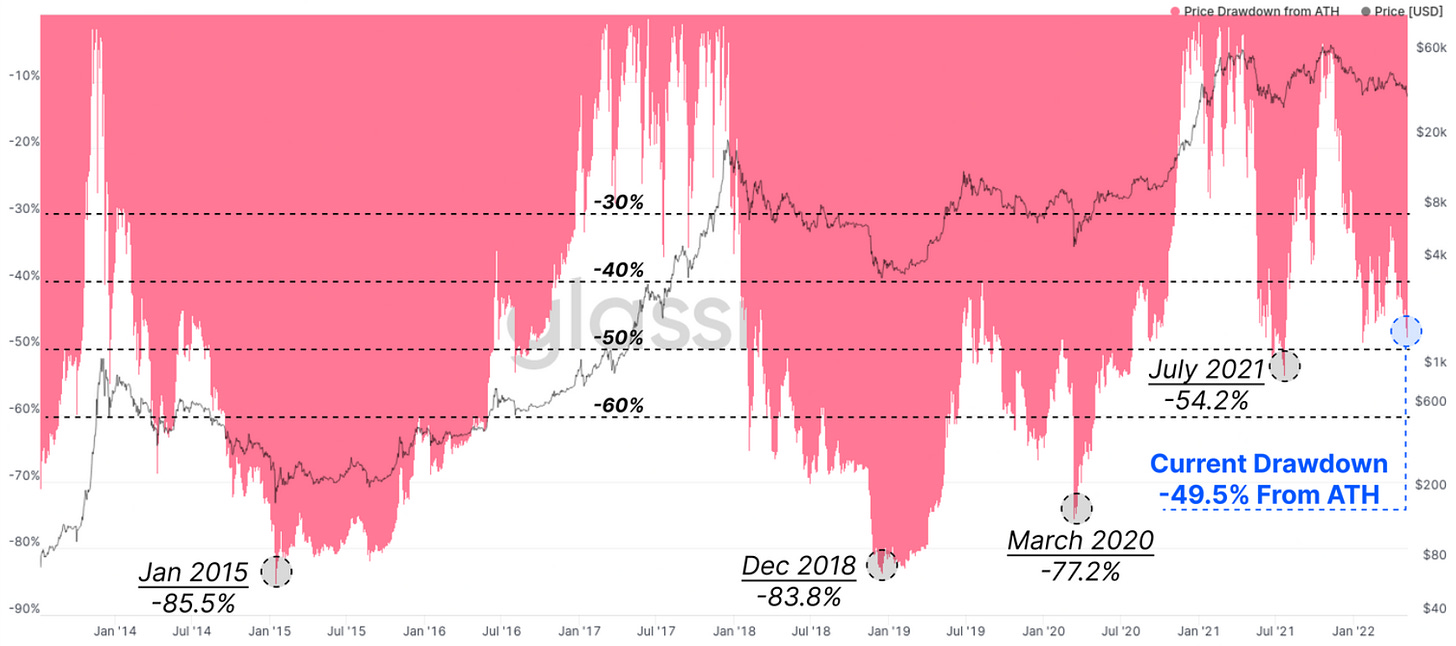

Bitcoin is in a bad state from many perspectives: It was substantially down in May and beginning of June:

Bar Chart Source: ARK Invest As you can see, it has been trending downward for 9 weeks in a row. It took out the lows of July 2021 and is now hovering slightly above the $20,000 mark. If it falls below this mark, it will be quite interesting how whales and “HODLers” hold up and whether there are any buyers coming in at some point. Especially interesting to watch will be what leveraged institutions who hold large positions will do. With Celsius, there is already one crypto-lending company that seems to be under water, as it stopped all withdrawals from its platform.

But I am mainly thinking about MicroStrategy, which is the largest institutional bitcoin holder and might provide more bitcoin as collateral for its leveraged loans. But also exchanges and some other lending platforms, which are engaged in trades that involve leverage of crypto-assets.

Nonetheless, from a long-term perspective, not much has changed, since all the main fundamentals, such as the network growth, second layer adaption (especially lightning network) and the mining industry are doing well and even the hash-rate (to secure the network) has not seen much deterioration so far.Moreover, long-term holders have experienced such bitcoin bear markets in the past. The following chart shows the price draw-downs from Bitcoin’s all-time highs:

Chart Source: glassnode It is not totally actualized, so we are actually down almost 70% at the time of writing, but it can be seen that there have been more severe downturns that Bitcoin experienced in its 14 year history (actually the chart does not show the most severe decline, which happened in 2011 and brought bitcoin down more than 90%).

The world is in difficult times and investors in all asset classes can feel it, but it remains interesting how it all is gonna play out.

Here is a good quote from Seeking Alpha’s Wall Street Breakfast newsletter:

Twelve FOMC policymakers walk into a central bank and order a pint of rate hikes. Behind the bar are three kegs with percentages of 50 bps, 75 bps and 100 bps. "How strong would you like it?" asks the Fed Chair. "Not sure," they reply, "but we'll decide soon." The meetup drags on way longer than expected, but the policymakers grow tired and soon begin to leave. "Don't forget your pint," says the Fed Chair as they near the door. "Scratch the order," they exclaim, "it was just transitory!"

My bet is that Powell will not dare too much and just ‘dovishly’ grab for another 50 bps pint.

But we will see. The numbers should be out in about an hour… 🙂

I will be back next month with a more thorough report to connect the dots and provide some thoughts and information.

That is all for this month. I hope you enjoyed reading this newspaper. Likes, comments and shares are highly appreciated. I put a lot of work into it and if you think the content is worth your time, please consider to subscribe, so you can receive it on a monthly basis. Its free and without commercials.

Best regards,

Disclaimer: The content of this newsletter is for informational and educational purposes only. It contains my personal views and opinions, which are not to be taken as direct investment advise. All investments have risks and you should do your own due diligence before making any investment decision. If you require individualized advice, to review your unique situation and make a tailored advice for you, then contact a certified financial planner or other dedicated professionals.