Ataraxia Financial Newsletter - March 2022

War in Ukraine, Canada on its Way to Tyranny, Further Increasing Debt Levels While Inflation Keeps Rising - the World Craziness Level Reaches Another All-Time High!

If you spend more than you earn… borrow too much… loaf… squander your resources… falsify your prices… counterfeit money… pay people to do nothing… start wars… block trade… and overregulate, bad things will happen.

Always have. Always will.

— Bill Bonner

March 7th, Sofia, Bulgaria.

Last week was a special week in Bulgaria.

On March 3rd is the Liberation Day, where Bulgarians celebrate the day when the country gained its independence from the Ottoman Empire back in 1878.

But in my opinion the even more interesting event took place two days earlier.

Each year on March 1st, Bulgarians exchange Martenitsas. They are cute little presents, which come in different shapes and forms. However, they all display the combination of red and white. These colors are associated with the wish for health and fertility for a new cycle which starts with every spring.

It stands in a sharp contrast to what’s going on 500km northeast.

Maybe sparking some hope against the otherwise dark and cloudy sky.

Martenitsa Image Source: Getty Images

The last few weeks have been all about the building war rhetoric that finally culminated in the invasion of the Ukraine.

I personally have a very strong anti-war stance. In my opinion, the only way in which war can ever be justified is when people try to overthrow their rulers who aggress against their freedom and rights.

Wars between groups or nations, in which one side tries to conquer territory, tries to impose its rules, or tries to force its values upon other people, are clearly not satisfying this criteria. Thus, I believe that all wars that have been waged by governments over the last century have clearly been unjustifiable — in my opinion there is really no exception.

It is sad and depressing, to see people desperate and in fear, buildings destroyed by missile attacks and masses trying to leave their cherished homes and being separated from their loved ones. And all the people who are loosing their life as a consequence of this act of war.

And it is all caused by shameless politicians playing their geopolitical chess game.

Most Ukrainians and Russians have nothing against each other, they have a very similar culture, have a shared history and are usually engaging in trade were both parties benefit.

In the same way, most people around the world have no real personal interest to wish blessings or harm for anyone in the Ukraine, or in Russia. But once the political machinery goes nuts, the whole attitude changes all at once.

All of a sudden everyone — apparently — has to choose a side to be on and cheer for.

Instantly, the whole human psychic attitude changes towards a “we” and “they” thinking. It is an instantaneous change, totally illogical to me, but it happens just like that.

And in the spirit of this group-think phenomenon, people start to feel proud, to not import “their” oil, or, “their” wheat anymore, or, block “their” ability to engage in any financial transaction — not withstanding the fact that there are actual real individuals on both sides, on whom these sanctions are imposed on and who have nothing to do with the war aggression.

As far as I can tell from the Russians I have met, they are decent — maybe sometimes a bit brusque — but generally nice, always good to hang out with and have a captivating conversation.

So I don’t know why I should stop transacting with them all at once, just because “they” are now in the enemy group and some politicians decide so.

And likewise, Russian solders who have been told that their mission is to protect “their” country, are suddenly told to march over to conquer and shoot “them”.

A glimpse of hope is that apparently there are many Russians protesting against their government, as well as some Russian troops deciding to drop their weapons and go back home. From any government’s point of view, they are committing treason. From my point of view, this is where the rational human spirit comes out and the choice of liberty wins over government imposed rule.

It’s heroic and I am definitely cheering for any individual who decides to do so.

While the main news were all about the political tensions related to Russia’s invasion of the Ukraine and its buildup, there was another crucial event in Canada. As a retaliation of the Freedom Convoy, which has been protesting against the continuation of Covid restrictions, Canada’s Prime Minister Trudeau invoked the “Emergencies Act” and froze the bank accounts of all participants and supporters.

It was obviously sidelined by the events in the Ukraine and therefore almost not covered at all by European media. But nonetheless, this is a huge act by a constitutional democracy in which people — allegedly — have the freedom to express their opinion and a right to protest against government rules.

Thus, before going in the market analysis, I feel I should first cover these two topics.

The Invasion of the Ukraine

There are no winners in war.

At least no winners that decent people should be favoring. The winners are the state apparatus and the politicians who gain control and power, as well as the war industry and companies that, in one way or another, benefit from either the war itself, or the outcome.

I was totally surprised that the attack actually happened. I thought that Putin was bluffing in order to achieve some concessions regarding Russian’s security concerns of a eastwards extending NATO and a westward leaning regime in the Ukraine.

Unfortunately the media coverage on both sides has been totally one-sided throughout all of this and it is therefore quite difficult to get a real understanding of the situation.

The western media brainwashes its citizens to believe that Putin is some sort of tyrannical moron, who refused to sit down and negotiate. Further, he can’t be trusted, is unpredictable and only in power by suppressing his opposition.

The Russian media propaganda on the other hand, accuses the West of totally ignoring Russia’s national security interests, spreading misinformation and being ignorant of historical circumstances, while supporting a regime that suppresses Russian minorities in the country.

As so often, it is not a totally black and white story. There is something to both sides and the truth probably lies somewhere in between.

It is sad though, that most western politicians and media do not even try to understand the Russian perspective, but seem to be caught in their anti-Russian narrative now. The historic perspective and political objectives of each side are important to understand, in order to hopefully engage in actual real diplomacy, instead of conflict escalation.

So why did Putin decide to invade the Ukraine? I am certainly no expert, but nonetheless, here are some bullet points trying to look at it from the Russian perspective:

Historically, Russia has been invaded many times from western countries over the last century, thus there is some fundamental concern towards the western border engraved in the culture.

Putin seems to be very aware of history, he describes the fall of the Soviet Union as the "greatest geopolitical catastrophe" and the separation of the member countries as “a major humanitarian tragedy”.

There is a long shared history and there are strong ethnic and economic ties with today’s Ukraine.

A large portion of the population are native Russians, or “pro-Russian” and many (in some areas more than 50%) speak Russian as their native language.

He further believes that Russia should be one of the leading nations, which can be observed throughout all of his public appearances and the way he phrases his words.

His historic view is that “We turned into a completely different country. And what had been built up over 1,000 years was largely lost” , thus he likely sees it as his obligation to lead Russia back to the position of a strong leading nation.

Since the Revolution of Dignity in 2014 (significantly influenced and supported by the West), the Ukrainian regime has a very pro-European stance and has engaged in activities such as:

stating the objective to become a member of the NATO

stating the wish to join the European Union

threatening to build nuclear weapons

building up the military, making it more capable and threatening

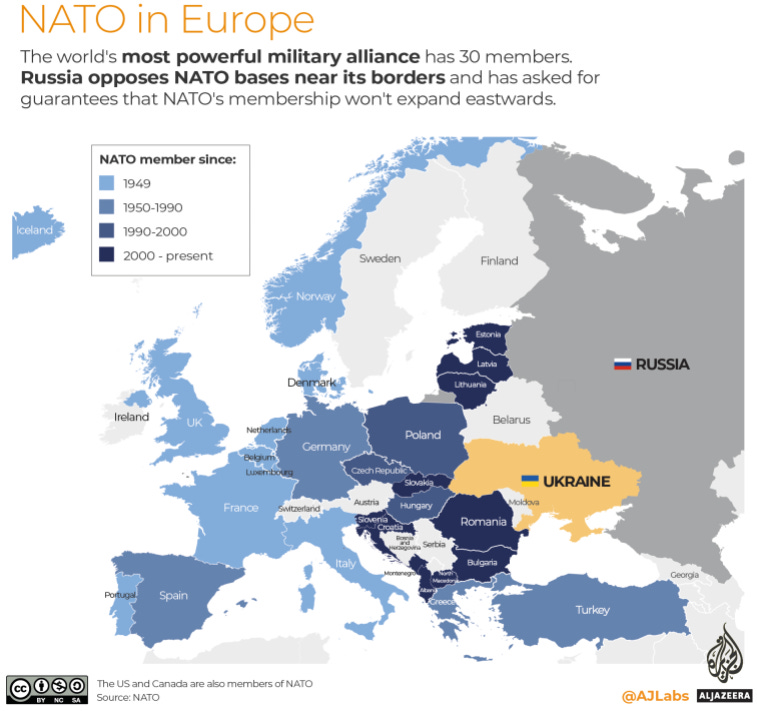

This is combined with a paranoia to be encircled and constantly kept pushed down by “the West”. The following map gives an overview of how the NATO has been expanding eastwards over the last decades.

Map Source: Al Jazeera

From a geopolitical standpoint, the Ukraine definitely is an important country. Especially taking the point of view that the NATO and Russia are in a hostile relationship. It marks not only a big puffer territory between Russia’s border and the NATO states, but also closes a “protection belt” given that it is bordered with its ally Belarus in the north and the black ocean in the south. Moreover, the western part of the Ukraine is market by mountains and therefore offers a more defendable territory as compared to the plain landscape between Russia and the Ukraine.

I think considering the above mentioned points makes it quite clear why Putin has such an interest for the Ukraine. Before the invasion he also clearly stated that he doesn’t want a war, but that he will only negotiate if he gets some concessions out of it.

But why did he push for it and make the invasion now?

Russia is faced with many problems for its future:

An expanding NATO towards the Russian borders

A very low fertility rate and a declining population

A dysfunktional economy

At the same time the West is in a weak spot at the moment:

A weak economy due to disastrous Covid policies

Troubled by high inflation

An energy crisis in Europe, energy that is mainly supplied by Russia

It is winter, exacerbating the importance of energy supply

Putin’s perception might be that right now is the moment of the best shot that he ever gonna have to push and achieve something.

The end-game for Putin is probably to install a puppet regime in Kiev

All of this of course doesn’t justify to any extend to launch a murderous attack on innocent people.

In my opinion Russia is the aggressor and therefore most guilty for starting this disastrous war. However, it is not that the EU and America are innocent (as western media tries to frame it now). They are definitely also to blame for the escalation of this conflict.

During the buildup the narrative was that Russia was the bad actor, because it did not want to negotiate. But Russia actually was clearly stating the concerns, mainly the Ukraine joining the NATO. However, the EU and American leaders totally ignored that concern and declared that this is not negotiable.

Well, if Russia’s concerns are not even to be heard and discussed by the other side, then why would they expect that Russia would have any interests to sit on the negotiation table.

Diplomacy and negotiation are about putting all concerns between the involved parties on the table and then working out compromises to find a solution. A solution, that is best suited to accommodate the different interests and make the best out of it.

We witnessed a total failure of political diplomacy from both sides, culminating in a terrible and unnecessary war.

So far, other nations have not directly intervened in this conflict on a military basis. There is Belarus in the north, supporting Russia and Turkey has blocked the entry point of the Black Sea against Russia. But that’s all.

The West has so far used sanctions to intervene in this war.

Sanctions

Sanctions are a terrible way of intervening.

It is crucial to remember that most people in Russia did not choose to invade the Ukraine. It was their autocratic government who did it.

Now Russians are being penalized for it as a collective, which is a horrible thing to do.

Most sanctions don’t really hurt the politicians against whom they are intended, but they have far greater impact on the daily life of the citizens of the sanctioned country.

And not only people of the targeted country, all people who would normally engage in trade, are being penalized by these sanctions.

One example of this is the Nord Stream pipeline that is supposed to deliver natural gas from Russia to supply Europe. As a response to the invasion, Germany has halted the project. I wrote lengthily about Germany’s wrongheaded energy policy in the January issue. This is just another mindless aspect of it:

At the moment Germany imports about 55% of its natural gas from Russia.

It also imports 35% of its oil from Russia

And in addition, it gets 50% of its coal from Russia

Blocking trade-ties with Russia and closing the Nord Stream pipeline is like jabbing a dagger in your own arteries.

And finally, when the blood is running out of the veins, it’s not Putin who suffers from it the most. It is the ordinary citizen who doesn’t even understand why exactly the prices of everything are spiking and it gets harder and harder to financially survive.

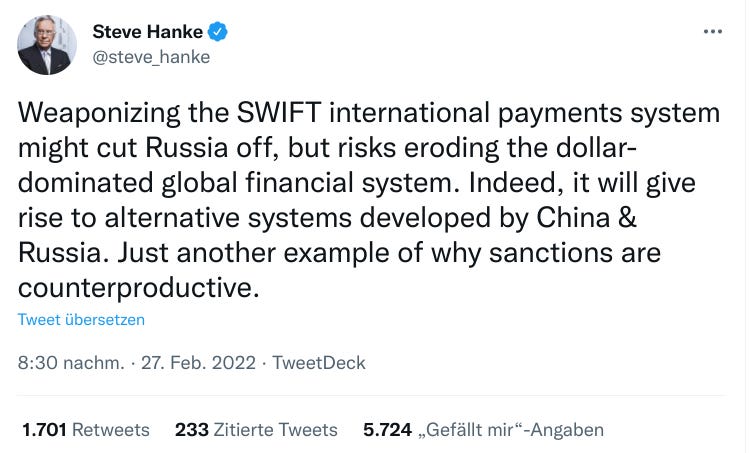

Furthermore, banning Russian banks from the SWIFT system is a very dangerous step, which not only has massive negative impacts on international trade, but also makes it clear to every other country that the current reserve currency cannot be trusted as a secure payment system:

And this was even exacerbated by freezing the foreign exchange reserves of the central bank held outside of Russia, which amounts to about 2/3 of their reserves.

It is like making a showcase to the world that whatever reserves you hold in the banking system, they are not save and they can be frozen or taken away at any second.

As a result of all these sanctions, we saw Russians lining up in front of ATMs to withdraw their savings.

In consequence, the ruble has declined more than 20% in just a week. The Russian stock market has tumbled, trading has been halted and the exchange remains closed. Investors around the world have already lost billions.

The War Outcome

It seems that the Ukrainians are giving more resistance to the Russian army than expected. Putin might have imagined that the Ukraine would surrender quickly, but so far there is no sign of it and Ukraine’s president Zelenskyy seems to be all-in on defending Kiev, not willing to give up.

The defender in such a war has one very crucial advantage: motivation.

Defending your home is a far greater motivational power than being send to destroy, kill and conquer.

Moreover, the war logistics are not easy, so keeping up this kind of military operation, is difficult over a long time.

On paper, Russia’s military is of course way more powerful though.

I am not sure how it will all turn out, but I hope that it will end soon and politicians will find some common sense again. So far, the outcome remains unclear.

The Global Perspective

Apart from the sanctions, there has been a lot of backlash against Russia in all sorts of forms.

The corporate world has taken some critical measures:

Western companies pull their investments out of Russia

Companies have also halted their investment projects in the country

Many companies have even stopped supplying their products

Boeing and Airbus suspended the maintenance of planes from Russian airlines

The media outlets RT and Sputnik have been deplatformed by Google and Spotify

Russian stocks have been delisted from some main widely-tracked indices of FTSE Russell and MSCI

I am honestly not quite sure what to think of all these measures on a corporate level, I get that it is done to put indirect pressure on the government, but in general, I maintain that the focus should be directed at the Kremlin and shouldn’t be waged against 144 million Russians.

Furthermore, it is not only on a corporate level: Russians are also banned from participating in various sport events. Even the committee of the Paralympics has banned Russian and Belarusian athletes from participating. These athletes have nothing to do with this invasion and shouldn’t be penalized.

They are the poor victims of nationalistic group thinking.

However, there are also some very positive aspects emerging that show the empathy that people have with the Ukrainian people, who are in the most unpleasant position in all of these tragic events.

People around the world are sending their blessings and donations towards Ukrainian people. It is also warming to see how citizens of neighbor countries are willing to provide living space for refugees.

Many are saying that the way in which the world has reacted to the invasion, Russia is politically in a very bad position and will not be able to sustain this for a long time.

I hope so, but I am not sure. Putin is known as one of the most skillful political strategists and I would think that he has thought about the potential backlashes and his options quite clearly, before launching the attack.

From a global perspective, I think that Russia is just too important to the energy market, to be easily defeated (12% of the global oil production, 40% of the EU’s natural gas supply). Most people underestimate how crucial the energy market is for everything in the global economy, especially right now where the supplies are already strained. In other words, as long as Russia can keep up its energy production — and Putin stays in power — they have a lot of cards to play.

In addition, China and Russia are in many ways tied together in this, and I think that Xi Jinping is watching quite closely at what is happening.

The Future Outlook

What makes me most concerned is the way that the West is dealing with the situation. It almost seems like they want to push their morality no matter what and are not even willing to think about the long term consequences of their actions.

It is also the same phenomenon that recently becomes more and more obvious in every event of public life: You have to choose a side and then you need to go all in on it.

The problem here is that whether people like it or not, Putin is the current head of Russia, which not only has the control of a magnificent amount of the global energy supply and lots of other important commodities, but it is also the country with the most nuclear weapons, with the potential of causing horrifying mass destruction.

What’s happening now is concerning. Germany and other European states ramping up their war machinery is definitely not a good sign for the future. It seems almost that as the narrative to make “war” against Covid looses its public support, the state welcomes this conflict in Ukraine as a new opportunity to increase their power over the population.

It is very worrisome.

Canada’s Financial War Against the "Freedom Convoy" Movement

The sanctions against Russia have shown the world how risky and unreliable savings are in the existing financial system.

In a similar way, the Canadian Freedom Convoy has revealed the dangers of relying on public financial institutions on a more individual level — in a G7 country!

For everyone who didn’t follow up on it, here is how the movement and its purpose was described in the WSJ:

Protest organizers operate under the banner Freedom Convoy 2022. According to a statement posted to their Facebook page, a small team of western Canadian truckers, family members and friends decided in mid-January to launch the protest, with truckers and supporters converging in the capital in a peaceful protest. The group said the number of trucks headed to Ottawa was around 50,000. Police said on Feb. 10 that the number of vehicles in the area in front of Canada’s Parliament Hill was about 400.

The group’s goal is to compel all levels of government in Canada to repeal vaccine mandates—including one that applied to truckers as of Jan. 15—and other social restrictions, such as a ban on unvaccinated people from going to restaurants, bars and gyms. “Freedom is constantly at war with those who want to limit it, and it must be defended,” the statement said.

Most of the demonstration was done peacefully and there were almost no incidents of violent behavior. The problem was that they were blocking some roads and caused some disruptions in the supply chain.

The convoy was supported through crowdfunding, which was first facilitated through traditional (centralized) platforms such as GoFundMe or GiveSendGo. However, due to government pressure, the money was seized and instead of being forwarded to the truckers, it was either sent back to the donors (only upon filling out a request), or send to another donation cause determined by GoFundMe. You can read more about the story here.

In order to support the cause, people turned to Bitcoin as a means of making donations to the Convoy. Bitcoin has the advantage that there is no centralized party in the middle that can stop or seize the transactions. You can read more about it here.

It all escalated, when the Canadian government enacted “Emergency Measures” and instructed banks to lock the private and/or business accounts of individuals involved in the convoy.

These protesters were not charged or convicted by any crimes.

The supporters didn’t even participate, but merely wanted to support the cause of fighting for freedom rights.

And yet, all of them were financially deplatformed just like that. A simple government decision is enough, so that people who are not in line with the government’s opinion are not allowed to participate in commerce anymore.

Even worse, it happened after the fact. Someone who donated didn’t even know that the government would later deem this as some form of “criminal action”.

Throughout the whole Covid pandemic, we have seen governments not caring for basic human rights and freedoms have been diminished in exchange for more government control, this is a new climax of it. And it is happening before the world’s eyes, in a supposedly free democratic G7 country!

This is not only a measure against some demonstrators and their supporters, it is a direct attack against the principles of a constitutional democracy!

Everyone who knows me well knows about my general stance on the political hemisphere and that I find it impossible to justify any form of government.

But even I concede, that a government which is restraint by a constitution that protects basic human rights, is superior to a government that can impose whatever it wants.

And for everyone who doubts that freedom of financial transaction is the cornerstone of all constitutional freedoms, I highly encourage to click on the following Twitter Thread by 6529 — and read it!

Market Overview

Markets & Indicators Rundown:

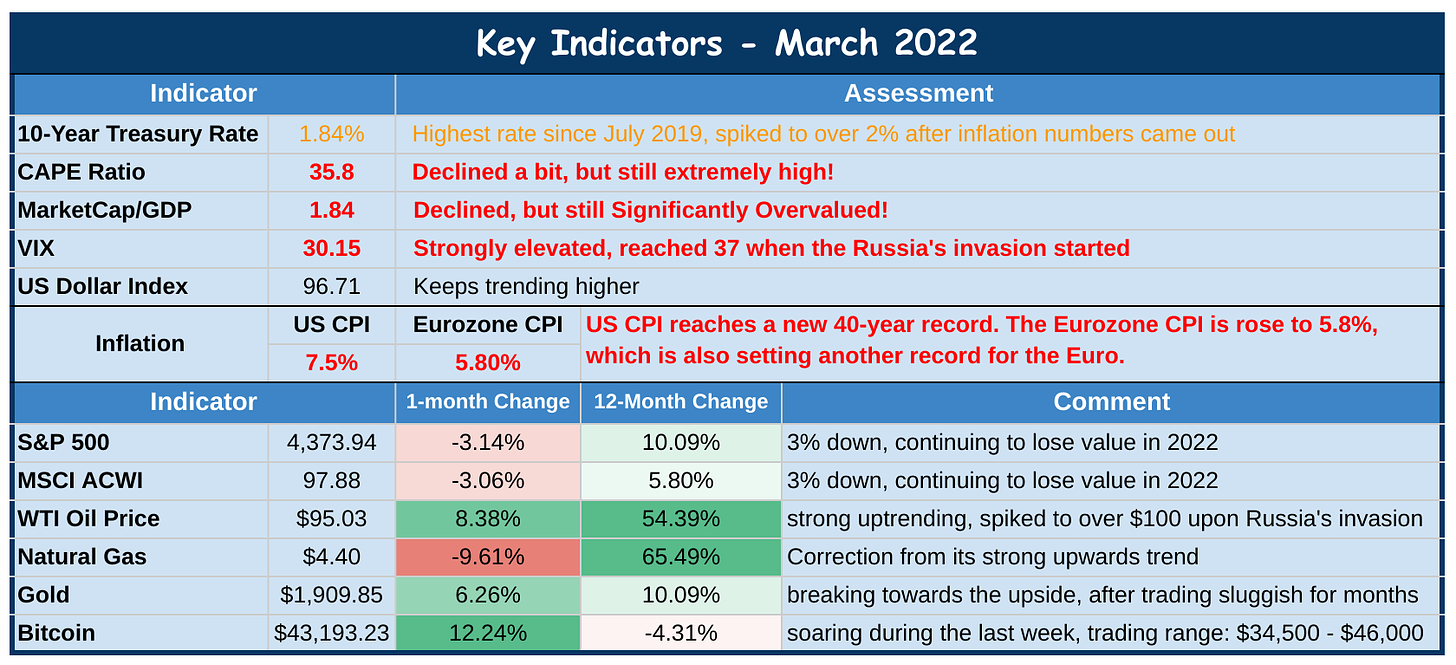

Inflation keeps increasing with the US CPI at 7.5%, which is the highest official inflation in 40 years. The Eurozone CPI climbing all the way up to 5.8%, which was 40 basis points above the expected 5.4% consensus number and marks another record since the Euro was inaugurated. Now, due to the conflict and the effects it likely has on energy prices, as well as prices for other commodities, it is to be expected that the inflation rate might continue to trend upwards in the near future.

Last week, we focused on the interest rate and I explained how strong the interrelationship between the 10-year Treasury Rate and the inflation rate is. The following chart shows how the yield jumped up as the CPI number came out higher than expected:

Chart Source: Blockware Market Intelligence

The 10-Year Treasury Rate climbs, reaching the highest monthly close since July 2019. It has also seen volatility, as it spiked to over 2% upon Russia’s invasion, before retreating a bit to about 1.85%. There are many factors contributing to the upward pressure on the yield, as inflation rates remain rising. There have been many analysts suggesting that the Fed might raise the federal funds rate by 50 basis points in March and might have up to 9 times in total for 2022. Due to the conflict in Europe, those hawkish forecasts have been drawn back a bit, so that most see 4-5 rate hikes more plausible now, which would bring the federal funds rate to 1.25%-1.5% at the end of the year. But it remains unclear, how the Fed might react to the events. Generally, markets are concerned about rising rates in the current environment, especially since global debt levels are still increasing and higher rates would require higher interest payments to service those debt levels.

However, due to the rising inflation rates, the spread between the 10-year yield and inflation has increased even more, suggesting even more upward pressure on interest rates in the coming months.

Meanwhile, the US national debt has crossed the $30 trillion mark.Both, the CAPE Ratio and the Buffet indicator have slightly declined due to the retreat of the stock valuations. The overall stock markets saw high volatility across the globe. Most stock markets are down and due to Russia’s invasion the Russian stock market has lost more than 50% and was halted from trading. Some Russian stocks and ETFs, which are still trading on other stock markets have seen devastating declines.

Both, the S&P 500 as well as the MSCI All Country World Index have lost more than 3% of stock valuation in February.

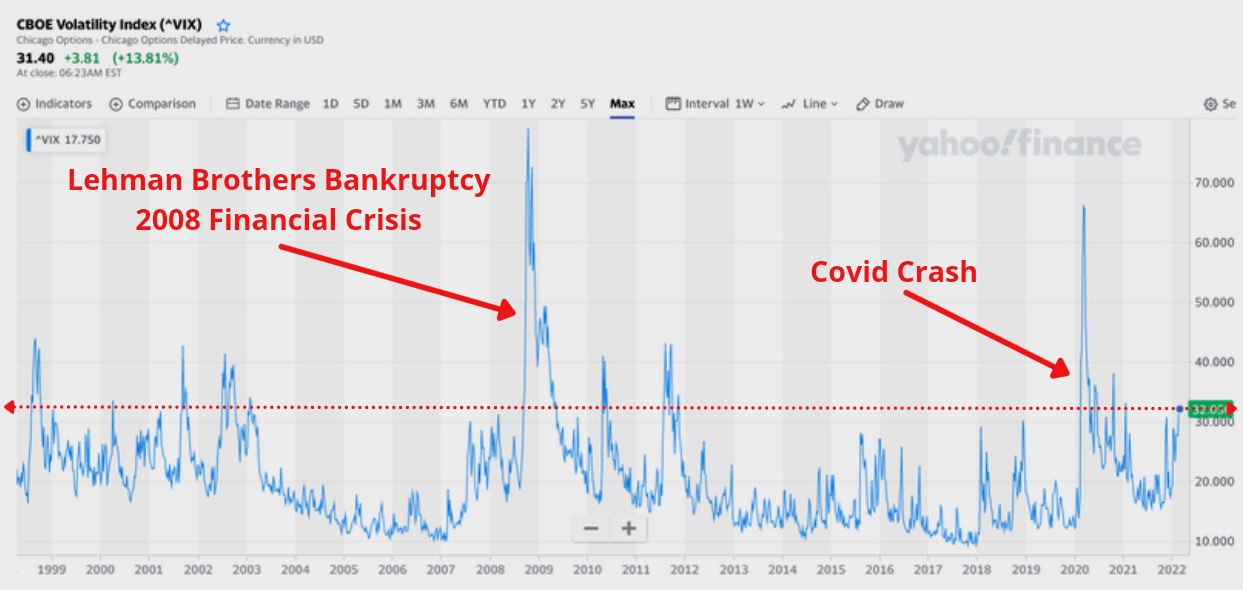

Notably, Facebook had a one-day loss of $232 billion in value (in market cap), which was the largest one-day loss in the history of American capitalism.The VIX has reached strongly evaluated areas of above 30. When Russia’s invasion happened, it spiked up to 37 before retreating slightly. These high readings indicate a lot of concern and forward going uncertainty.

I will explain more about the VIX below.The US Dollar is historically one of the traditional safe haven assets to go to during uncertain times. Hence, it comes as no surprise, that it continues its upward trend.

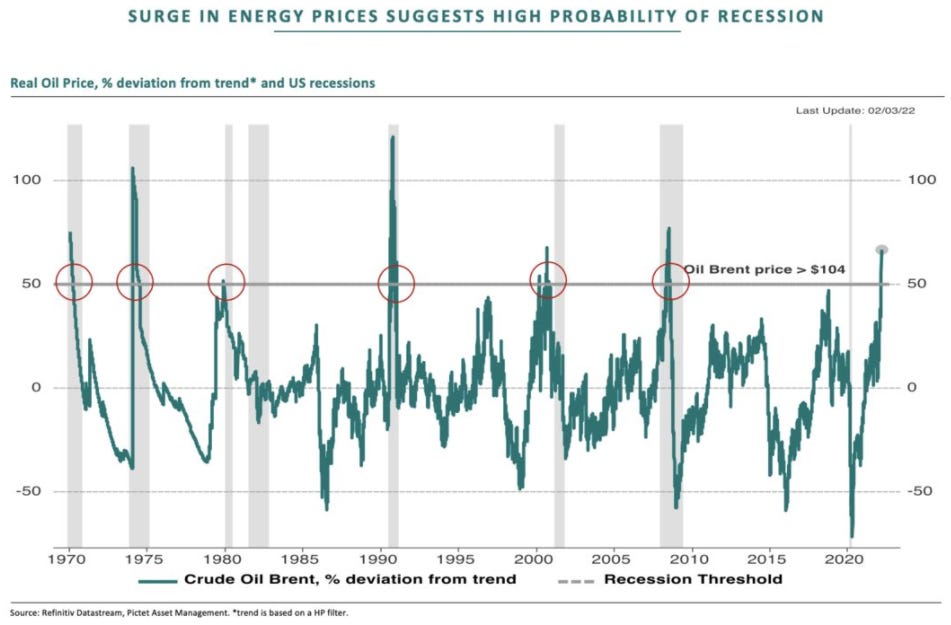

On the day of Russia’s invasion, the crude oil price sparked to over $100 for the first time since 2014. It retreated a bit and closed the month at $95, but since then has risen and crossed the $100 benchmark again and at time of writing is trading at $110. The volatility is enormous.

Luca Paolini from Pictet from Pictet Asset Management shows that, over the past 50 years, every price-spike of oil that deviated by more than 50% from the trend, has resulted in a recession (recessions are marked as grey area):Chart Source: Refinitiv Datastream; Pictet Asset Management

In general this makes sense, since oil is an important input factor for the production of many essential products. A huge price increase therefore results in higher production costs.

As readers of this newsletter already know, I think that the oil price is likely going to appreciate due to a number of reasons and could be one of the best bets over the coming years. Russia produces around 11-12% of the global oil supply. The sanctions imposed against Russia are putting further upward-pressure on the price in the near to medium term.Commodities have generally seen huge gains, with the commodity index reaching levels that we haven’t seen since 2014:

Chart Source: TradingEconomics.com

Especially those commodities, which have a high production amount in Russia and the Ukraine, have risen a lot. Apart from being a crucial exporter in the energy market, Russia and Ukraine are also main suppliers of agricultural commodities:

Russia and Ukraine account for 30% of wheat exports

They also account for 15% of global corn exports

And they produce about 75% of sunflower seed oil.

And export about 24% of barley

Therefore, the conflict also imposes substantial risk on the global food supply chains. In addition they also produce other important commodities, such as Uranium, Aluminium and titanium, which are affected by whatever is happening in this conflict.

Gold: After trading sideways for several months, even though the inflationary environment would have suggested that more people might flock into gold as an inflation hedge, it seems like gold is now finally breaking out of the $1,800 range. Gold is known as a safe haven asset and it has historically been the unique best asset to hold during war times. Upon the invasion, gold spiked to almost $2,000 before giving up some of its gains and it closed the month at $1,909.

After its sharp decline in January, Bitcoin has recovered some of the losses

Here are a few main notable points that have happened in February:Bitcoin’s correlation with NASDAQ has significantly declined.

The hash-rate has hit a new all-time high, making the system more secure than it has ever been.

Blockfi made a $100,000,000 settlement with the SEC (highest settlement for a crypto company so far). They are now officially allowed to engage in providing interest-bearing lending products to US citizens.

KPMG (one of the biggest accounting companies) is the next large institutional company (there are about 40 now), to publicly put Bitcoin (and Ethereum) on its balance sheet. (Read more here).

Bitcoin and the Big Picture of Current Events

Over the last days an article titled If Russian Currency Reserves Aren’t Really Money, the World Is in for a Shock, published by The Wall Street Journal got a lot of attention.

The article explains, why the recent events should worry all countries — especially China — about holding foreign reserves in the USD (the reserve currency). It sheds light on the fact that these reserves are just a liability and that the issuer — obviously — cannot be trusted to always honor them.

The gist of the article is in the following excerpt:

Many economists have long equated this money to savings in a piggy bank, which in turn correspond to investments made abroad in the real economy.

Recent events highlight the error in this thinking: Barring gold, these assets are someone else’s liability—someone who can just decide they are worth nothing. Last year, the IMF suspended Taliban-controlled Afghanistan’s access to funds and SDR. Sanctions on Iran have confirmed that holding reserves offshore doesn’t stop the U.S. Treasury from taking action. As New England Law Professor Christine Abely points out, the 2017 settlement with Singapore’s CSE TransTel shows that the mere use of the dollar abroad can violate sanctions on the premise that some payment clearing ultimately happens on U.S. soil.

There is the saying of all roads leading to Rome. Well, in my view the roads of all current global events are leading to Bitcoin.

Here are just a few of them:

Russia’s foreign reserves are frozen → this is not possible for Bitcoin held in self custody

Same goes for Afghanistan and Iran → Bitcoin

For Russian citizens (due to sanctions):

The ruble is tumbling

the banking system doesn’t work properly

There are withdrawal limits

There are capital controls

→ Holding Bitcoin provides a solution to all of these risks

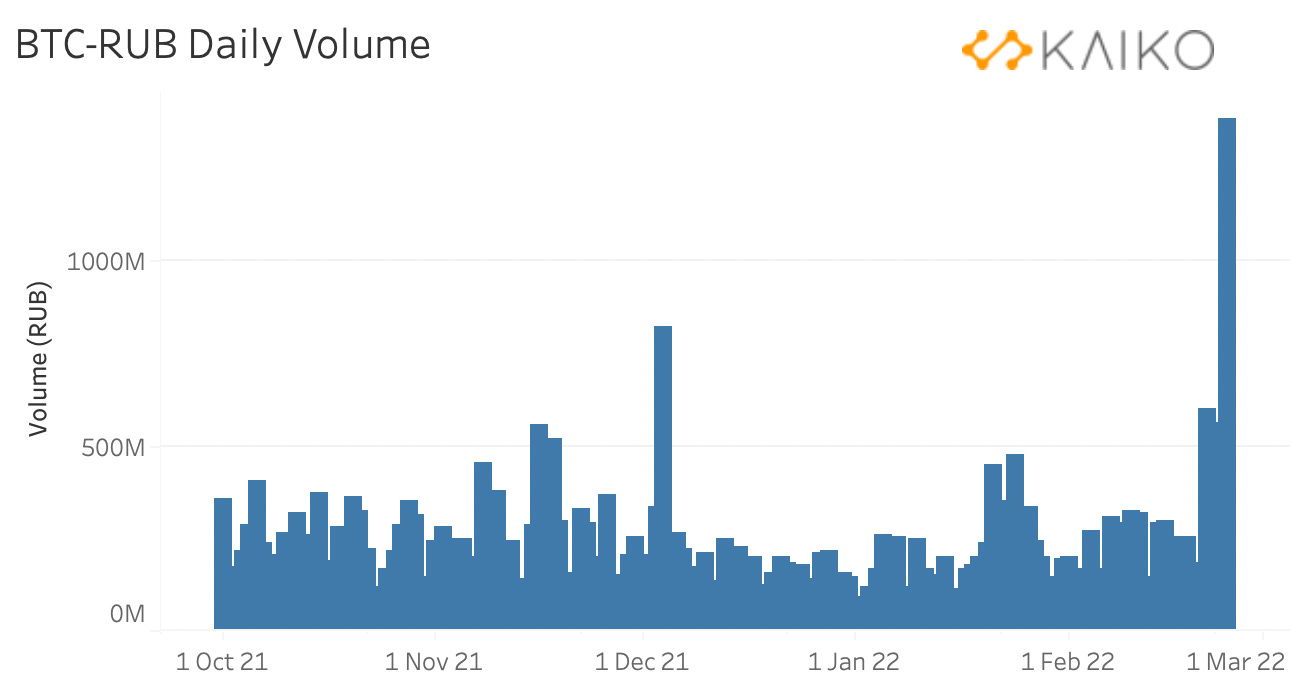

No wonder that the Bitcoin hit an all-time high accounted in rubel and the daily BTC-RUB trading volume is also as high as it has never been before:Chart Source: Kaiko.com

Similarly, Ukrainians were lining up in front of ATMs not being able to make withdrawals → Bitcoin

Ukraine needs funding → Bitcoin enables frictionless donations from all across the world

Ukrainians suddenly are in a position, where they quickly need to flee their country. The value they have in houses, Ukrainian hryvnia or other physical assets, are difficult to move or get access to when needed→Bitcoin provides the possibility of storing wealth and quickly relocating anywhere in the world

In Canada it was impossible to make donations to the Freedom Convoy via the traditional institutions → Bitcoin made it possible

Canadians who supported the Convoy saw their bank accounts being frozen → Bitcoin held in self-custody can’t be frozen

Turkey, Argentine and Venezuela are currently witnessing crazy levels of inflation → holding their assets in Bitcoin allows citizens the long-term preservation of their wealth

The general trend of money expansion and inflation poses great danger on accumulated savings→ Bitcoin provides a powerful hedge

Most people still see Bitcoin just as a “risky speculative asset”. I honestly think of it as the most secure and least risky asset to hold (I will elaborate a bit on this in the educational part). Moreover, I actually see it as the best form of protection against all the other financial risks that we are facing.

As I explained in my January issue, I think it is time to get “off zero” and have at least a small allocation in Bitcoin.

In my view, Bitcoin is not only the most promising investment for the next decade, but it is also the best tool we have to fight for peace and freedom!

The CBOE Volatility Index (VIX)

Last month I was introducing the 10-year Treasury rate as a main indicator.

Given the high uncertainty in the markets, lets take a look at the The CBOE Volatility Index, or, as it is usually referred to, “the VIX” this month.

The VIX measures the expected volatility in the S&P 500 over the next 30 days.

Volatility can be measured by either looking at past data and using historical prices to calculate the volatility, or by looking at options expiring in the future. Technically, the VIX takes the prices of S&P 500 index options as its derivative. Therefore, it calculates the volatility based on future market movement expectations and is not based on any historical sets of data.

Investors use this indicator to determine the level of risk, fear, or stress in the market. Therefore it is often also referred to as the fear gauge.

Essentially, a high reading in the index means that it is expected that the market will experience large price swings. Theoretically, price swings can be either to the upside or to the downside, but historically very high readings (especially short-term spikes) are usually a sign of stock market downturns — or crashes.

The following chart shows the reaction of the index as it became known that Russia had started the invasion:

Chart Source: Yahoo Finance, added annotations

As can be seen in the chart, the VIX jumped up to 37 within a few minutes. A trader tracking the chart could have immediately started to buy or (more likely) sell his investment positions accordingly (even without actually knowing what exactly is going on).

It is important to note that it is a real time index. This means that it is actually better in predicting short-term developments. For that reason, a lot of traders who focus on options and other derivatives make use of this indicator, or even use it for pricing.

However, it is a 30-day forecast, hence, using it as a general monthly indicator still makes sense, since it also provides a gauge at the general uncertainty sentiment in the market.

Here is a long-term VIX chart:

Chart Source: Yahoo Finance, added annotations

The above chart provides a longer term view of the VIX and shows that at 31, we are well above the average. This indicates that market participants are quite worried about the current developments and there is a lot of fear in the market.

This implies that the investment environment will be market by volatility and risk.

I think given all the things happening right now, it is a good time too take a look at the conception of risk and how to think about risk when it comes to investing.

Risk

Living on planet earth is a risky endeavor and the future is always uncertain.

What exactly is risk? What is uncertainty? How can we measure it? And if we can, then how should we deal with it? Can we apply probabilities to particular events? What could be done to lower risk? Is it possible to eliminate it? Or, should we maybe be willing to take more risk?

In this month’s educational part of the newsletter, I try to dive into these questions and what is in my opinion the best way to think about them. I’ll first lay out some general thoughts, then explain how it applies to finance, and finally provide some ideas how investment strategies might be derived from it.

Risk as a Part of Life

Being alive means taking certain risks!

— Nassim Nicholas Taleb (Skin in the Game)

From the moment we wake up in the morning, we are facing a world with numerous risks. (actually even that is not totally true, since most people die while sleeping).

Whatever decision we make, every action we undertake, will entail some risk. Of course, most of these risks are small and have negligible importance in the process of our decision making. But nonetheless, I think it is important to conceptualize this idea as a starting point for thinking about risk.

Over the past two years, Covid has been the main topic on everyone’s head when it comes to risk. Fueled by tons of fear mongering from the media, many have taken it as a huge general risk to humanity.

Here in the Balkans most people are quite relaxed about it by now, but in other parts of the world the fear level is still quite substantial.

For instance, some Taiwanese friends have asked me whether I feel save being in Bulgaria (at the time of writing, Bulgaria notoriously has the second highest Covid-death rate per capita).

Well… lets give it a thought…

I am still feeling kind of young, I regard my lifestyle as somewhat healthy, I am vaccinated and I already had the bug (Covid) just a few months ago. Based on statistical probability and my personal risk assessment, my risk of dying from it, should be less than 0.01%. Hence, I can probably find numerous risk factors that are more likely to kill me — even in Bulgaria.

Probability is paramount when assessing risk.

And the combination of probability and the potential impact is the key framework, to conceptualize risk and get an understanding of it.

Risks can also be categorized in immediate risks, long-term risks and accumulative long-term risks.

Jumping from a very high wall has some immediate risk (breaking the leg), but once we safely landed on the ground, there are no future consequences.

Choosing the right country to settle down might involve little immediate risks, but if we pick the wrong country, the long-term consequences could be enormous (e.g. moving to the Ukraine a few years ago).

Other risks are more accumulative in their nature. For instance, eating a cake involves little risk to our overall health. However, eating a cake everyday over many years will substantially increase the risk of getting various negative long-term effects. Same goes for smoking, or other activities with an accumulative risk-structure.

Last month, we were exploring the topic of time preference. This concept also plays a crucial role when thinking about risk. People with high time preference are generally more inclined to engage in short-term seemingly low-risk satisfactions, such as eating a cake, while people with a low time preference are concerned more about their future well-being and therefore will more likely forgo the immediate satisfaction of eating the cake.

Another aspect is how much immediate risk we are willing to take, to receive a potential reward.

Assume a collection of people play Russian roulette a single time for a million dollars [...]. About 5 out of 6 will make money. If someone used a standard cost-benefit analysis, he would have claimed that one has an 83.33 percent chance of gains, for an “expected” average return per shot of $833,333. But if you keep playing Russian roulette, you will end up in the cemetery. Your expected return is… not computable.

— Nassim Nicholas Taleb (Skin in the Game, p. 225)

Whatever risk each of us takes when going through our day is an individual decision.

Financial Risk and Uncertainty

All of the basic ideas that I tried to point out so far, can in some form or another also be applied to finance.

When it comes to finance, risk is always to be considered with regards to the potential influence on the expected return. To analyze financial risk, it is therefore important to get an idea about the probability and the potential magnitude of any risk factors.

One aspect, that sets financial markets apart from some other things (e.g. a dice game where the probabilities are certain), is that markets are subject to human action, which means that it will always have a certain amount of uncertainty, that cannot be quantified.

Every investment must always face the inevitable uncertainty of the future.

Volatility to Measure Risk

In modern finance, volatility is the main subject when the topic is about risk.

Above, we have already looked at the VIX, which looks at the volatility of S&P 500 options, to gauge the general level of fear in the market.

Likewise, most risk models that are taught in finance classes, take the volatility as the number that presents the amount of risk.

Here is the description from the textbook that I used in my corporate finance class:

There is no universally agreed-upon definition of risk. One way to think about the risk of returns on common stock is in terms of how spread out the frequency distribution is. The spread, or dispersion, of a distribution is a measure of how much a particular return can deviate from the mean return. If the distribution is very spread out, the returns that will occur are very uncertain. By contrast, a distribution whose returns are all within a few percentage points of each other is tight, and the returns are less uncertain. The measures of risk we will discuss are variance and standard deviation.

Ross, S. A., Westerfield, R. W., Jaffe, J., & Jordan, B. D. (2017). Corporate finance: Core principles and applications (5th ed.). McGraw-Hill Education.

Interestingly, it is quickly stated that there is no agreed definition.

However, then risk is quickly defined as the variance (or standard deviation). Measuring the standard deviation over a certain period of time gives a volatility number, which is then used to ascribe risk to an investment.

The rest of the 70+ pages risk-section in the textbook then deals with how it can be calculated, what time spans can or should be used, how it can be applied to models etc.

Unfortunately, these textbooks usually don’t really go into the discussion of the flaws, problems — and risks — that someone relying on variance as the main (or only) risk metric for evaluating investment decisions might incur.

The reason for this is probably that it is all about quantitative data and math. The resulting numbers can be used in numerous ways to create (seemingly complicated) models and produce nice looking charts showing the “risk” profile of various investments. It offers itself nicely to write academic papers, corporate reports, make student projects, or to present to clients. It’s all just about numbers and doesn’t require the qualitative thought process to determine other potential risks outside of these numbers.

I think that looking at volatility is helpful, but in my opinion it is a bad conception for the overall risk of an investment.

Here is a quick example:

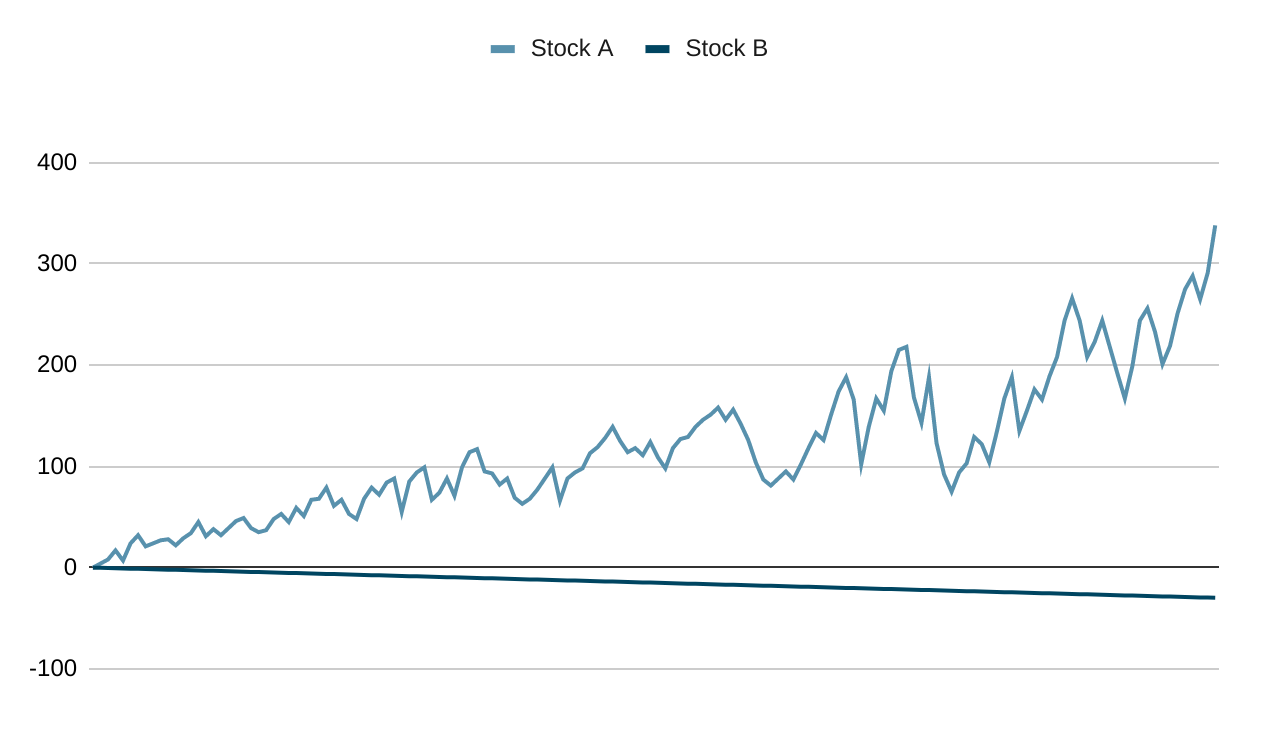

Stock A has obviously a very high volatility with some huge drawbacks. But over the long term, it is constantly trending upwards. According to its volatility, it is a very risky stock. Only crazy risk-freaks would invest in it.

Stock B in comparison has a volatility of zero. In other words, it is a super duper safe investment.

So, which of the two stocks would you rather put your money in?

The problem is, of course, that stock B constantly looses value, while stock A makes huge profits. So, if you would define risk as the probability to lose money — instead of volatility — then stock B’s risk profile suddenly changes from “super duper safe”, to “100% risky”.

As a quick side note: The example-chart that I made to illustrate the problem of merely focusing on volatility as a risk factor, is actually quite accurately describing how I look at the risk structure of Bitcoin (stock A) versus long-term government bonds (stock B).

Bitcoin is often described as risky, due to its high volatility, while government bonds are regarded as super safe. Yes, Bitcoin is super volatile. It can have drawbacks of more than 30%, 50%, or even 80% within a short period of time. However, it has proven that it tends to massively increase over longer time-frames. Nobody investing in Bitcoin and holding on to it for more than 3 years, has ever lost money (and there are many good reasons to believe that this trend is likely to continue). On the other side, at current inflation rates and the low coupons that bonds are paying, investors are practically guaranteed to lose value over time. Hence, I would regard the bond investment as far more “risky”.

From a risk perspective, volatility can be quite important in cases where there are short-term investment considerations, but for a long-term investment thesis, it shouldn’t play such an important role.

Here is a quote from one of the most renowned investors:

This great emphasis on volatility in corporate finance we regard as nonsense. Let me put it this way; as long as the odds are in our favor and we're not risking the whole company on one throw of the dice or anything close to it, we don't mind volatility in results.

— Charlie Munger

He would actually not agree with my evaluation of Bitcoin, which he famously described as “probably rat poison squared” and making statements like: “the whole damn development is disgusting and contrary to the interests of civilization”

Well, opinions can differ. We agree about volatility, but we look at Bitcoin from a 180°-degree different angle.

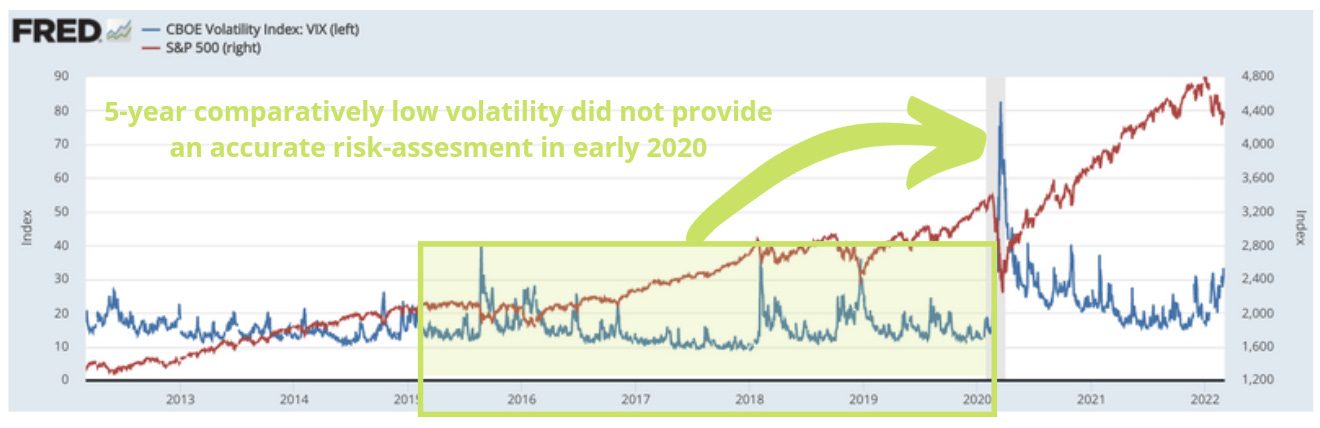

Another problem of relying on volatility as a risk measure is that it mostly relies on historic price datasets. In reality, as I explained above, investments are always prone to future uncertainties. Looking at the price movements in the past does not guarantee that investments will behave like that in the future. For instance, taking the variance of the past 5 years, does not necessarily show the accurate amount of risk that is inherent in the investment.

Chart Source: St. Louis Fed, added annotations

This brings us to the next important risk component to consider.

Black Swan Events

The effect of Covid-19 on the stock market in March 2020, is one example of a Black Swan Event.

Investopedia.com defines it as follows:

A black swan is an unpredictable event that is beyond what is normally expected of a situation and has potentially severe consequences.

In other words, they are these events that nobody expects to happen. While it was certainly known that at some point there will be another viral pandemic, the time and severity of the Covid pandemic were basically unpredictable and nobody expected it.

In contrast, Russia’s invasion in the Ukraine was by most people (including myself) considered very unlikely, but it was not unpredictable.

The key difference from an investment perspective is that an investor can protect her portfolio from a predictable event (for instance by buying pull options for Russian stocks as Russia is moving troops to the border), while protecting a portfolio against unpredictable events is quite more tricky.

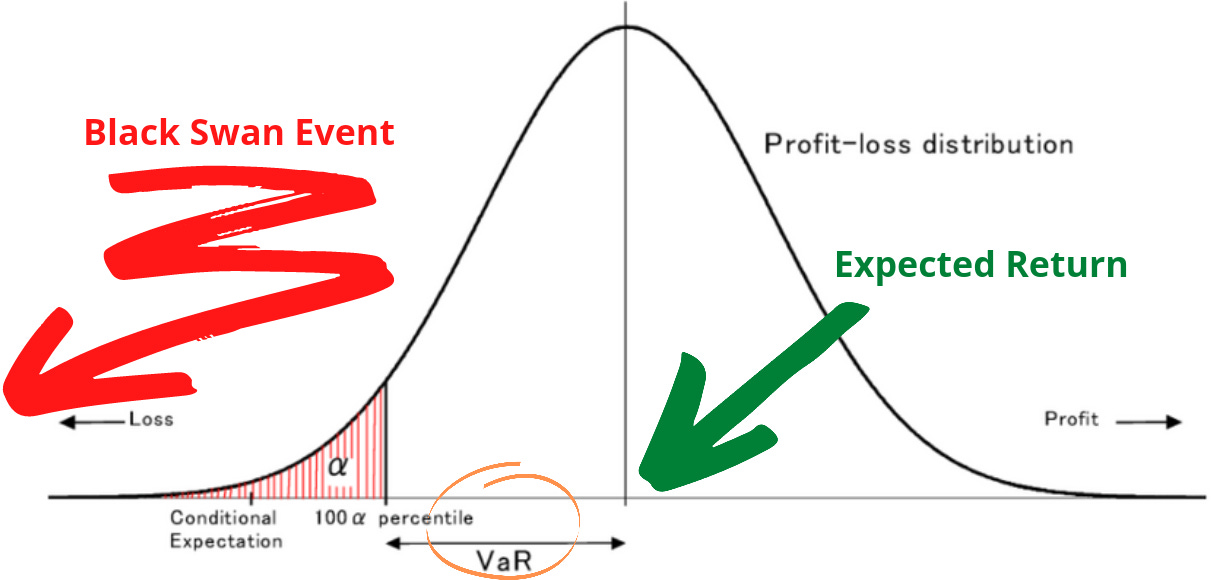

To asses their risk, many fund managers use a metric called Value-at-Risk (VaR). This statistical metric estimates the potential loss that a portfolio could suffer in a defined period of time.

This is a good technique to estimate known risks and get a sense of what could happen if the investments don’t perform as desired. Usually VaR is set at a >95% (2 standard deviations away from the expected outcome), or sometimes a >99% (3 standard deviations) confidence level. This means that the fund expects that with a confidence of 95%, or 99% respectively, the maximum loss is limited to the VaR.

Nevertheless, this does not protect the portfolio from a black swan event, an event that causes a loss which lies more than 3 standard deviations away from the expected return and might have detrimental effects for the fund.

Figure Source: Yamai, Y., & Yoshiba, T. (2002). On the Validity of Value-at-Risk: Comparative Analyses with Expected Shortfall. Monetary and and Economic Studies, 20, 57-85., own annotations

A notorious example is the Long-Term Capital Management (LTCM) hedge fund, which collapsed in 1998 and was finally bailed out by a consortium of banks for $3.6 billion (at that time a way more significant number than now).

The fund was led by Nobel Prize-winning economists and well known wall street traders. It used high leverage and was betting on arbitrage trades on wrongly priced interest rate spreads. It used complex econometric models based on previous price data and they stated that this tactic was basically risk-free. The fund was highly successful between 1994 and 1998, but in August 1998, it suddenly all turned south.

In early August the calculated daily "VaR” stood at $35 million. But just a few days later, it dropped $550 million on a single day.

Essentially, the problem was that their investments were way more correlated than their models predicted. In addition, they were betting on a decline in the spread of risky bonds, but when Russia defaulted on its debt — which was at the time a very likely risk, but a risk that cannot be detected by econometric models based on historic variances — the risk premiums shot up and their previously profitable leverage suddenly turned fatally against them. (The whole story can be read here).

In the end, it needs to be said, that these events were quite predictable and therefore don’t fall under the black swan event category. It rather puts a spotlight on the blindness of academics relying on financial modeling, and being convinced that their variance-based risk models, which purely rely on historic price data, can capture the actual risk inherent to the portfolio.

Again, markets are determined by human action and not by static factors. Hence, they are always prone to changes with uncertain outcomes.

I’ll conclude this section with a great risk description by Morgan Housel:

There are three distinct sides of risk:

The odds you will get hit.

The average consequences of getting hit.

The tail-end consequences of getting hit.

The first two are easy to grasp. It’s the third that’s hardest to learn, and can often only be learned through experience.

[...] the tail-end consequences – the low-probability, high-impact events – are all that matter.

In investing, the average consequences of risk make up most of the daily news headlines. But the tail-end consequences of risk – like pandemics, and depressions – are what make the pages of history books. They’re all that matter. They’re all you should focus on. We spent the last decade debating whether economic risk meant the Federal Reserve set interest rates at 0.25% or 0.5%. Then 36 million people lost their jobs in two months because of a virus. It’s absurd.

Tail-end events are all that matter.

— Morgan Housel

Diversification

The remaining question is how investors can protect their portfolio in general, and especially from such tail events.

When it comes to investment, diversification is the essential weapon to protect against any risk.

The basic idea is quite simple: When you put all of your eggs in one basket, your risk exposure to any event breaking the basket is at 100%.

So essentially what you want, is to find several baskets that will protect you as good as possible from the various risk factors.

The challenge is to identify assets that will trade differently if any specific risk event occurs. Correlation is a good starting point to look at, when choosing different assets:

A correlation of 1 means that the asset will trade exactly in the same direction.

A correlation of -1 means that an event will cause the exact opposite reactions in the assets.

A correlation of 0 means that both assets are totally uncorrelated and the movement in one asset offers no predictive information about the reaction of the other.

Generally, a correlation of 0 is the most desiderable, however, if an investor wants to protect her portfolio against some specific risk, a negative correlation can also be advantageous.

For example, a portfolio that is exposed to Russian stocks, can be protected against the event of Putin going nuts and invading the Ukraine, by also buying an oil ETF. It is to be expected, that these two investments are negatively correlated if event “X” happens (which was unfortunately the case).

There are different opinions about the amount of different investments that should be made to reach a good diversification. It depends on many factors and is therefore not so easy to say.

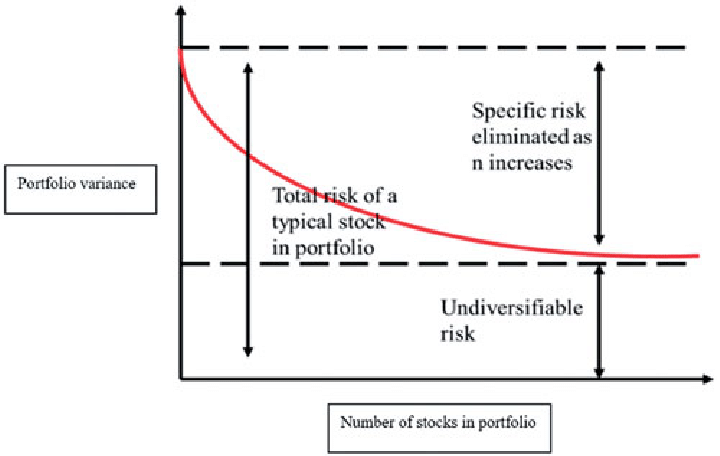

In essence, more securities lead to greater diversification, but with every added investment, the additional diversification affect gets diminished:

Figure Source: Hundal, Shab & Eskola, Anne & Doan, Tuan. (2019). Risk–return relationship in the Finnish stock market in the light of Capital Asset Pricing Model (CAPM). Journal of Transnational Management. 24. 1-18.

However, there is also a case to be made, that investors shouldn’t overdo their amount of different investments, in the pursuit of diversification.

Stanley Druckenmiller, one of the most renown hedge fund managers, famously said:

I like putting all my eggs in one basket and then watching the basket very carefully.

Druckenmiller, of course, invests in more than one asset, but the point of the statement is, that when the diversification is overdone, it becomes difficult to follow all of the investments. It might result in missing important developments and leads to a portfolio which incurs even more risk.

Moreover, as can be seen in the above graph, the majority of the diversification happens by adding the first few investment items. Thus, most of the diversification benefits can already be reaped, just by investing in 8-10 well chosen assets.

One crucial aspect to keep in mind is that correlation is not a constant. For instance, Bitcoin had a high correlation with the NASDAQ over the past months, but recently the correlation diminished a lot. It even got to negative levels for some time.

And most importantly, especially in times of stress, when diversification is needed the most, correlation levels tend to rise towards 1, stocks that were perceived to be uncorrelated, suddenly become very correlated — as LTCM experienced.

Risk Management Applied to Portfolio Construction

When constructing a portfolio, one way to look at diversification, is to separate them into different layers:

1st layer: Asset Classes (stocks, bonds, real estate, commodities, bitcoin etc.)

2nd layer: Regions (USA, Europe, Asia, Africa etc.)

3rd layer: Sectors (technology, energy, utilities, financials etc.)

4th layer: Individual securities (Google, Apple, Nvidea etc.)

In general I would say that the first layer is the most crucial to get right.

The second layer is also important. Imagine an investor putting all savings in Russian securities. Anyway, there are also asset classes which are equally traded globally, making them a good hedge against regional risks (e.g commodities, gold and Bitcoin).

Further, layer 3 and 4 are mostly relevant for stocks, not so much for other assets. The diversification in these layers can also be handled conveniently by investing in ETFs.

And then it really depends on a lot of different factors that determine what allocation makes sense for a given person at a given time.

For instance, the risk profile of a 65 year old, who has saved a meaningful amount and is about to retire, is very different from a 25 year old, who just graduated college.

Moreover, personal goals, time preference and risk appetite also play a crucial role in determining an adequate portfolio.

Lastly, markets are obviously facing different risks in different times. At the moment, I would put a lot of consideration into strategies to protect the portfolio against ongoing high inflation, a stock market collapse, as well as potential capital controls and wealth confiscations by governments.

Anyway, as stated repeatedly, the future is always uncertain and risk management can only protect to a certain extend.

Conclusion

Risk is what’s left over after you think you’ve thought of everything.

— Carl Richards

This quote basically answers the question of whether risk can be eliminated. The answer is obviously “no”. In investment, as well as in real life, there will always be some risks that we just cannot anticipate and therefore also cannot eliminate.

The greatest risk in finance is how individual risks have, over the last decades, been transformed into massive systemic risks (bailouts, Covid measures, low interest rates, growing debt levels etc.).

What a good investor can do, is structuring his or her portfolio in such a way that all of the known risks are negated and it is aligned with the goals that the individual wants to achieve.

And the same goes for real life.

I hope you enjoyed reading this newspaper. I put a lot of work into it and if you think the content is worth your time, please consider to subscribe, so you can receive it on a monthly basis. Its free and without commercials.

My blessings go especially out to all those who are affected by the recent geopolitical developments. I hope this stupid war ends soon.

Best regards,

Disclaimer: The content of this newsletter is for informational and educational purposes only. It contains my personal views and opinions, which are not to be taken as direct investment advise. All investments have risks and you should do your own due diligence before making any investment decision. If you require individualized advice, to review your unique situation and make a tailored advice for you, then contact a certified financial planner or other dedicated professionals.